Authors: John Koepke, Raghav Nayak, Anil Kar

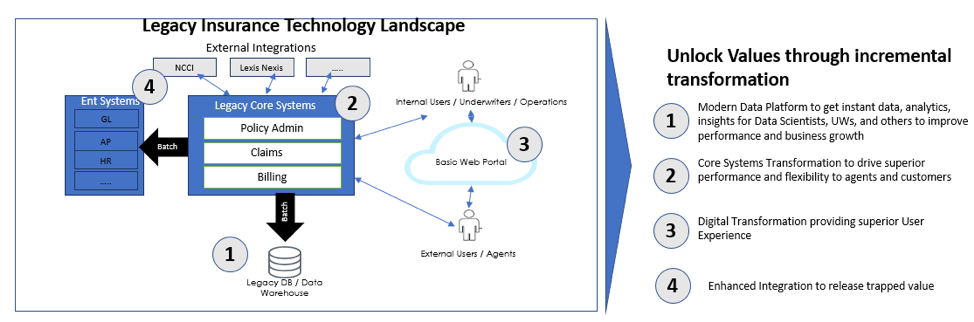

Status Quo for the small insurance carriers is over. There is a significant pressure to grow the business while protecting itself from the non-traditional competition. The available channels for growth are limited and need to be achieved through product differentiation, new markets, scalability and improved customer experience. Since many regional small carriers are reliant on independent agent network to sell their products, the agent experience through superior service and systems play a significant role to be the preferred insurer over the competition.

The CIOs are increasingly interested in a longer-term solution that meets some key criteria. There is pressure to deliver something tangible to the business faster. If the product differentiation is less, the transformation falls into the technical upgrade trap and there is pressure to deliver cheaper sticking to the basics. It is becoming imperative to look at the full suite consisting of key systems. There is an expectation of increasing value from each of these business components.

- Policy Administration: Faster launch of new products, Seamless integration to provide faster Underwriting decisions, introduction of new services to compete with insuretechs, ease of adaptability to ever changing insurance rules and laws……

Key business functions include but not limited to Rating, Underwriting, Quote & Bind, Issue, Endorsement, Renewal, Forms. - Claims: Better Claims experience for the customers through automated claims assessment and processing. Move towards a touchless claims experience utilizing newer technologies for automated claims assessment, integration with geo location to preferred service shops (Removal of manual efforts)..

Key Business Functions include but not limited to FNOL, Claims Assignment, Investigation, Evaluation, Settlement, Recovery, Customer Service - Billing: Support for various billing types, easy and seamless billing processing. Key business functions include but not limited to support for flexible pay plans, latest payment processing channels, invoicing, non-pay cancellations,

- Data & Analytics: Move towards a modern data platform enabling usage of analytics and predictive insights to enable business growth. Develop automated fraud detection, model based underwriting, product innovation, customer retention strategy using organizations data over cloud based analytics services.

- User Experience: Personalized and rich user interface for Agents, Customers, Underwriters, Service Operation agents. Responsive design enabled UI to serve multiple channels from agents to end clients, AI enabled assistant, Digital Id’s, easy to use UX.

- Ancillary Capabilities and Services: These are critical capabilities to ensure effective business operations. In the absence of enterprise systems for these, the organization should look at including these in the transformation roadmap.

- CRM

- Distribution Management / Producer Life Cycle Management

- Document Management

- Communication

There are many available options, but the choice of the future ecosystem should be carefully analyzed and decided.

There are a few considerations for everyone before making the decision regarding the transformation approach –

1. Where to start: The big bang large transformation would need a significant commitment from the board and top leadership of a small regional insurer to invest over several years of implementation. It would need a meticulously planned business case with defined outcomes and measurements. Given the smaller scale of any regional carrier, the incremental transformation of key capabilities can prove to be seamless, less daunting, and measured. The capability transformation can be sequential or in parallel.

2. Configuration Vs Coding approach: There is always a debate between the amount of configuration Vs. Coding while choosing the technologies, tools, and platforms for the transformation. The cumulative experience over the years makes one believe that coding provides a richer capability but makes it difficult to maintain and upgrade in the future. However, with the advent of low-code and no-code platforms, Cloud-native technologies, it is essential for smaller insurers to evaluate the right mix of packaged software and custom build for the journey.

a. Make or choose the technology which is modular and extensible for future needs

b. Make sure the new product launch, change in business rules are easily configurable. These capabilities should be available to businesses as self-service.

3. Evaluate the holistic Total Cost of Ownership

a. Software License

b. Infrastructure Cost

c. Implementation – Understand the upgrade needs to evaluate the future costs

d. Support – the newer technology and customized code would increase the support cost

There are several options available to small insurers – they have the flexibility of the smaller scale and yet, lack the resources to embark on multi-year investments to achieve the transformation goals. So, a careful fit-for-purpose selection of components is necessary which aligns with the business strategy and technology roadmap.

- Package Solutions – Duck Creek, Guidewire, Majesco, Insurity, etc. Most of these provide the full suite and can enable full transformation. They embed a lot of out of box integrations to optimize the cost of developments. The amount of configuration vs. coding varies between the products. The scale of operations, product set, future growth plans, and total cost of implementation should be considered while choosing the right solution. The partner ecosystem and skilled SI Partners are the critical evaluation partners for any insurer. SI partner with implementation expertise with insurance industry knowledge is best suited for such large scale programs.

- Custom Development

- Refactor the whole and build from scratch

- Digital Decoupling – keep the core and decouple the most inefficient and critical business capabilities required for customer experience and business growth

- Hybrid – this seems to gain traction in the marketplace – choose the best of breed where it makes the most sense. It has to be a conscious decision around the surrounding ecosystem keeping the business needs in mind. The best of the breed architecture will need to focus on customer experience, seamless processing, and a modern data platform powering the business with insights.

- Core Platform: Choosing the core platform is essential as the first step.

- Customer Experience Layer: Headless implementation with a nimble and future-ready front end should provide the Option to build rich UI later. Modern web development techniques like ReactJS, AngularJs, and Node.js are pretty useful to build modern UI with rich functionality. Several low code platforms like Appian, Outsystems. Or Unqork can help rapid application development and help to decouple some business functionality out of the core to the front end.

- Data and Analytics Layer: Replatforming the data layer on a low cost, scalable and modern data platform can enable the business to move faster while the core systems transformation is in progress. Several new database technologies are available to evaluate in addition to the rich data platforms available on the cloud platforms. The customers have the choice to choose between AWS Redshift, Azure CosmosDB, Snowflake, MongoDB, Splice Machine, and host of other data appliances. Careful evaluation and fit for purpose selection of data platform(s) would be a critical step in the transformation journey. Please read more on how Accenture is helping clients in the Data Transformations at https://www.accenture.com/us-en/services/technology/data-strategy

Read more on how Accenture is helping insurers in their transformation at https://www.accenture.com/us-en/industries/insurance-index