Other parts of this series:

Exploring Future Systems and why they are the key to unlocking value and innovation success for insurance.

Since 2015, insurance executives have made significant investments in new technologies, but they’re not all seeing the value they’d hoped to achieve. This has created the innovation achievement gap: the difference between potential and realized value. How leadership manages technology investment and adoption in the 2020s will make or break your financial future—particularly with uncertainties like the COVID-19 pandemic or other business threats.

Accenture recently conducted its largest-ever enterprise survey to look at a Future Systems approach the average company should be taking to keep pace with industry leaders. The sample included C-level IT and business executives from 515 insurance companies, and gathered key data on IT system adoption and dissemination, as well as the effects on organization and culture.

Survey results identified Leaders (the top 10 percent), Laggards (the bottom 25 percent) and the Middlers that round out the group. But you might be wondering, “What are Future Systems?” and that’s what I’m going to talk about today.

Future Systems are boundaryless, adaptable and radically human enterprise systems capable of repeatedly scaling innovations and creating strategically agile organizations.

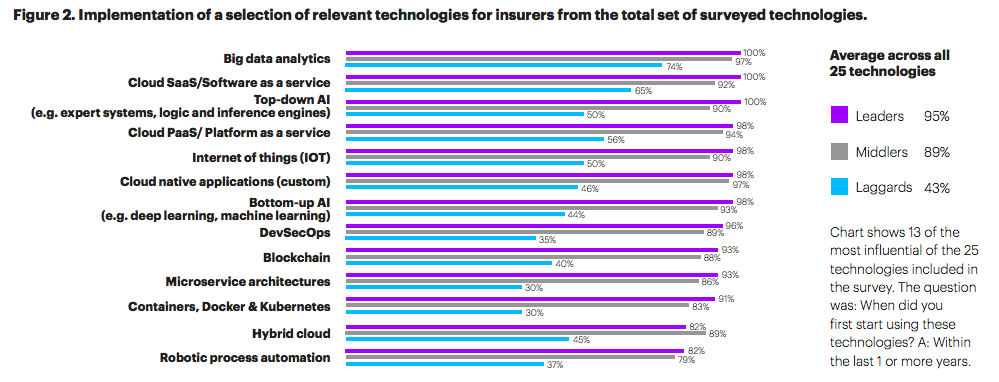

Ninety-five percent of insurance Leaders have invested in relevant tech like big data analytics, artificial intelligence (AI), cloud, software-as-a-service (SaaS) and blockchain to name a few. These are boundaryless, adaptable and radically human systems that break down barriers—within the IT stack, between humans and machines, and throughout the partner-client ecosystem. An especially important relationship and culture shift that Future Systems brings is that of business-IT alignment.

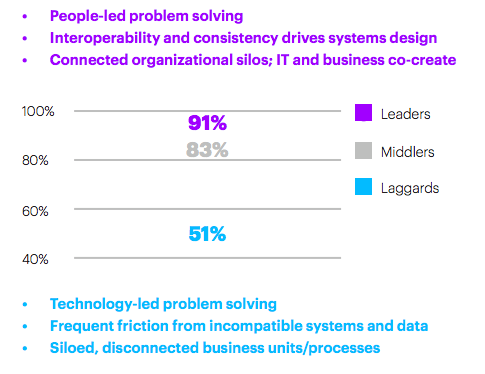

Future Systems enable better business-IT alignment without boundaries

In Accenture’s study, 93 percent of insurance Leaders surveyed agreed that business-IT alignment is integral to effectively scaling innovation. This is how the Canadian carrier Wawanesa operates its Insurance Hub—innovations need to fit within the overall goals of the organization.

In Accenture’s study, 93 percent of insurance Leaders surveyed agreed that business-IT alignment is integral to effectively scaling innovation. This is how the Canadian carrier Wawanesa operates its Insurance Hub—innovations need to fit within the overall goals of the organization.

But while Leaders are outpacing Laggards in their adoption of technology, investment on its own is not enough to keep up. Leaders are building and investing in boundaryless technology that enables data, architecture and applications to work together securely—which allows for seamless innovation, partnerships and adaptability.

Future Systems are adaptable.

Future Systems learn, improve and scale by themselves, eliminating the friction that hinders business growth and helping humans make better decisions faster. Eighty-three percent of executives across industries want systems that allow them to pivot in new directions—this is a key strength of Future Systems. Decoupling the IT stack, using automation and AI across the enterprise, and maintaining a continuous data supply chain in the cloud are traits of adaptable organizations whose technologies nurture and encourage business growth.

Future Systems are radically human.

Radically human systems communicate the same way people do: they listen, talk, see and understand each other. Examples include:

- Natural language processing

- Computer vision

- Voice recognition

- Machine learning

- Data enrichment

These systems have become more intelligent, making them more efficient and easier to interact with. Ant Financial’s use of cloud computing and AI enables customers in car accidents to simultaneously submit a claim for assessment and source quotes for repair while on-site—all they need to do is take a photo on their smartphone.

Why are Future Systems important for insurance?

Much of the insurance industry finds itself struggling to remain relevant at a time when legacy systems have a hard time keeping up with the pace of digital disruption. Connected systems allow an enterprise to be an adaptable living business—an attribute that many insurers continue to strive for.

With innovation and forward thinking, strategic adoption of new technologies can lead to increased revenue, relevance and loyalty, as well as the following key benefits for insurance companies:

- Business-IT alignment

- Faster claims processing

- Less fraud

- More efficient underwriting

- The ability to scale innovation across the enterprise

- The agility to pivot at times of disruption

- A competitive edge

The sky is the limit when insurers adopt technologies with a deliberate and strategic stance.

In my next post, I’ll delve into the mindset of Future Systems Leaders by looking at companies creating a future-ready foundation with strategic tech investment. In the meantime, for more insight into Future Systems for insurance, download Future Ready Systems and Full Value. Full Stop., or get in touch with me here.