Other parts of this series:

In only months, even just weeks, the COVID-19 pandemic forever changed how all industries operate. Insurance has felt the impact across the board and much quicker than past economic or health crises. How carriers move forward with business and future systems in these uncertain times will be crucial to overall business continuity.

COVID-19 insurance industry business impacts

The business impacts of the COVID-19 crisis have surpassed what anyone could have thought. In March, the average insurer lost 35 percent of its market capitalization and those in North America and Europe lost 41 percent. Along with market volatility, other impacts include:

- Operational costs went up due to crisis management

- Premiums have decreased in many lines of business

- Changing claims landscape

- The need to go digital now

On the customer level, millions around the world are facing financial hardship due to unemployment. This reality will affect millions more in the coming months, continuing to alter consumer spending.

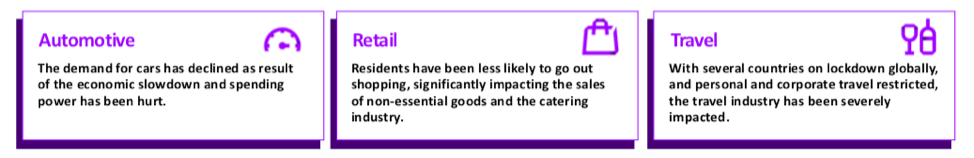

The COVID-19 impact to related industries has also affected insurance.

The hit on related industries such as automotive, retail and travel has had a domino effect. For example, new business in motor insurance has declined as people have been driving less due to social distancing. This has been especially prevalent in China but will be felt globally. Digital capabilities for both customers and employees will be imperative for business continuity.

Digital or bust during in 2020

If insurers weren’t already shifting to digital and remote work capabilities, the COVID-19 pandemic ripped that bandage off in a hurry. Digital tech and strategic communications to ensure business continuity and safety have enabled remote work for employees. But as the pandemic evolves, systems resilience is being stretched thin for some. I will deep dive into this topic in the last post of this series.

As insurers progress forward over the next three to six months, they will want to take a close look at:

Digital employee and customer journeys

- Mobilize the internal HR COVID-19 query response to support physical and mental wellness

- Refocus workforce and processes on customer value management, agility, and workforce automation/optimization with a Human + Machine mindset

- Grow employee and customer trust

- Strengthen digital communications with customers

- Digitize claims eligibility and processing

Digitally enabled go-to-market models

- Stand-up digitally enabled go-to-market models to leverage new market receptivity

Cost reductions to focus on recovery and the “new normal”

- Analyze, prioritize and adjust internal and third-party spend

Cloud-based workforce analytics

- Improve productivity and skills development by increasing the use of workforce analytics

The Band-Aid is off and strategic use of digital will be the path forward for insurers. It will also aid in building or rebuilding trust with customers during these uncertain times.

In my next post, I’ll take a look at insurance companies that have digitally stepped up to the plate for their customers through strategic partnerships. In the meantime, find out more about digital capabilities for insurance by connecting with me here or visit the Accenture COVID-19 resource hub for further information and strategic insights.