Other parts of this series:

My earlier posts in this series about Accenture’s Future-ready insurance systems study showed how and why insurance Leaders and Laggards differ in terms of their technology investments. In this blog, I’ll tackle the question of what’s next. What do market-leading insurance systems look like and how can you realize them?

Getting over the BAR

Our research indicates there are three characteristics that differentiate effective Future Systems from the rest: they are boundaryless, adaptable and radically human (BAR). What do these things mean in practice?

- Boundaryless systems don’t heed the traditional IT stack’s boundaries between data, infrastructure and applications. They break through barriers between humans and machines, and even between humans and other humans. They bring IT and non-IT talent together by shifting culture. They break down divisional and industry silos to create connected ecosystems that stimulate revenue.

- Adaptable systems leverage those connected ecosystems to enable scalability and agility. They learn, improve and scale by themselves, and enable insurance leaders to respond to business change based on data-driven insights. Adaptable systems can scale up and down in data storage and computing ability, or quickly adjust to meet a new market demand.

- Radically human systems allow people to interact with machines on their own terms instead of having to learn specialized technical skills. They talk, listen, see and understand like humans do—the secret to simplicity in human-machine interaction.

How do I get over the BAR?

There are three practical ways to get over the BAR and maximize benefits from Future Systems in the insurance industry:

Pay attention to key non-IT-related areas. Cultural change is non-negotiable. That means embarking on change management to overcome the divisions between IT and non-IT employees. Among Leaders, 91 percent are extremely effective at enabling business-IT crossover teams. Among Laggards, the figure is 44 percent.

Destroy the silos that separate your data, infrastructure and applications. But don’t stop there—extend that internal technology ecosystem to key partners and to your clients, so that you can adjust quickly and effectively to changing market demands.

Modernize your aging technology. According to our data, insurance Leaders are first adopters of innovative IT. Among companies we polled, just five percent of Leaders opted against early technology adoption while 57 percent of Laggards did so. In the last five years, 93 percent of Leaders increased their spending on innovative technologies and solutions, compared to 64 percent of Laggards.

Getting over the BAR is easier said than done. It demands consistent, high-quality decision-making. The most immediately enticing decision is often the wrong one in the long term. Conversely, the most difficult short-term choices can bring greater longer-term rewards. We’ve created a cheat sheet that identifies five areas where the right decisions are vital to your success.

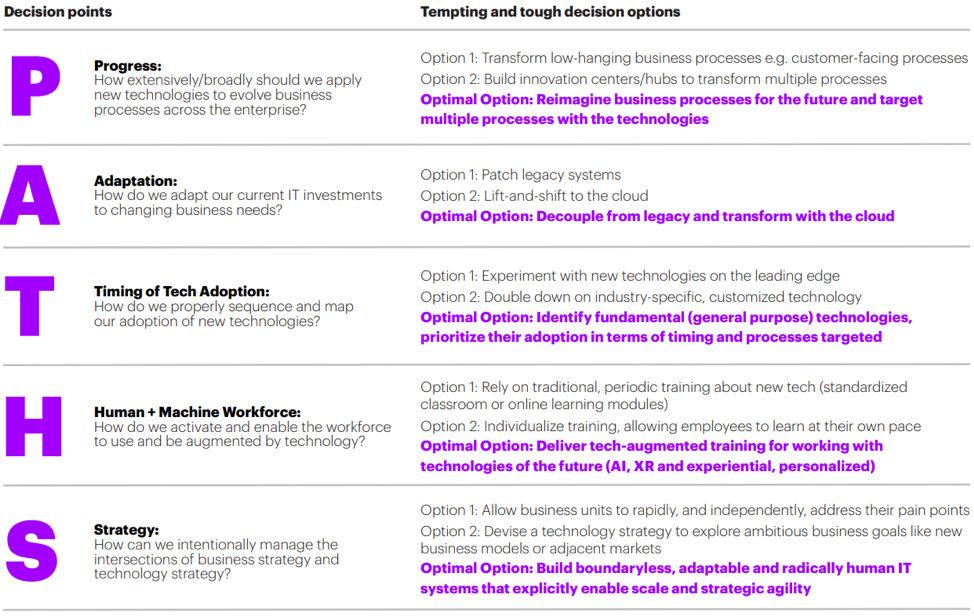

We call this approach PATHS—Progress, Adaptation, Timing, Human + Machine Workforce, and Strategy. When looking at each of the five dimensions, the first two options are the ones Laggards or Middlers typically make while the third, though more difficult, is the preferred choice of Leaders. In other words, the third option is the choice every insurer should seriously consider.

Investing in technology: Five decision points, three options, one optimal choice

The woes of Middlers and Laggards are mostly unrelated to low levels of technology investment. The research confirms that Leaders use a boundaryless and culturally integrated organizational structure and IT ecosystem to leverage the benefits of IT. This difference represents billions of dollars in additional revenue growth.

The main challenges that carriers face in optimizing IT investment are clear. The bad news is that overcoming them is neither quick nor easy. Insurers that want to act on these lessons should do so now. The innovation achievement gap is getting bigger and there is no time to lose for Laggards and Middlers who wish to close it.

Learn more about the future systems by downloading “Full Value. Full Stop” and “Future-Ready Systems: The leadership difference” Or, email me to discuss how Accenture can help prepare your organization for the future.