Other parts of this series:

In my first blog in this series about Accenture’s Future-ready insurance systems study, I described how insurance Leaders and Laggards differ in terms of their technology investments. This time, I’ll look at why the cultural and structural differences between Leaders and Laggards are at least as important as technology itself.

As I showed in my previous post, investment in key systems isn’t enough on its own to ensure market leadership. Laggards invest in technology, but they don’t build future-ready systems, like the Leaders do. So, what must a carrier do to avoid an innovation achievement gap? I’ll cover two of the most important aspects: culture change and organizational structure.

Culture change: it takes more than technology to lead in insurance

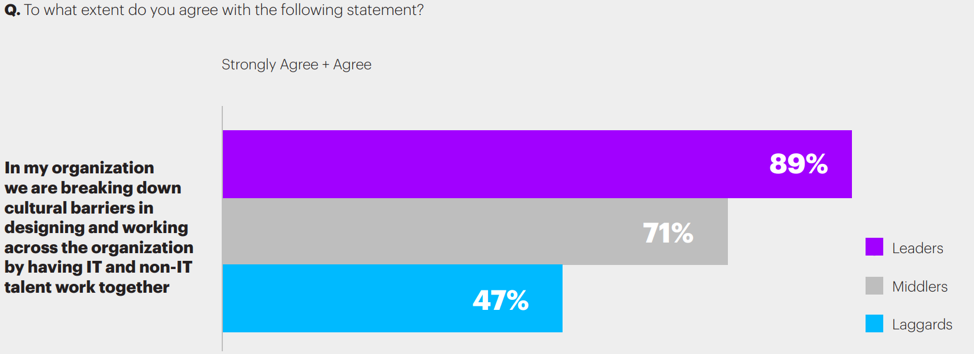

An integrated culture that breaks down the business-IT divide is key to success. In our study, 89 percent of Leaders reported that “at my organization we are breaking down culture barriers in designing and working across the organization by having IT and non-IT talent work together”. But only 47 percent of Laggards said the same.

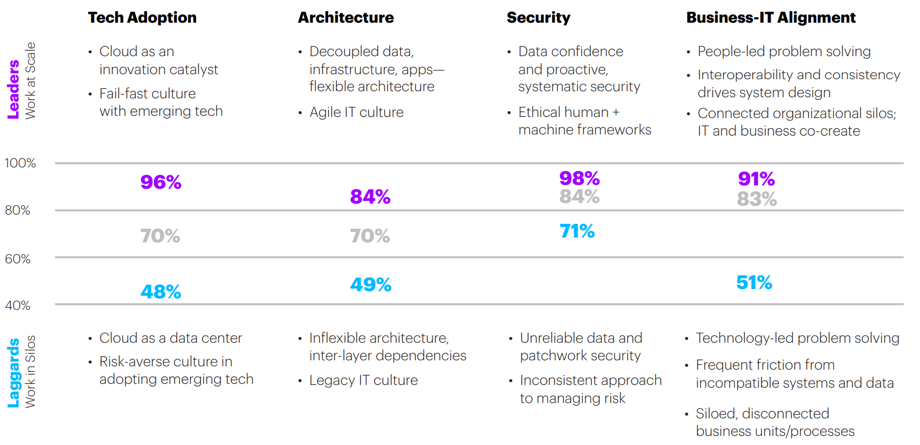

Leaders and Middlers (91 and 83 percent of them respectively), meanwhile, are building a culture of business-IT alignment. This involves people-led problem solving and systems design driven by connected silos where IT and business collaborate on problem solving.

But just 51 percent of Laggards exhibit these behaviors. Laggards’ culture tends towards technology-led problem solving. It experiences a lot more friction from incompatible systems and data with isolated, disconnected business units or processes.

Corporate structure: decouple data from business silos

Advances in cloud technology reveal more and more advantages to decoupling data from the IT stack. The Leaders in our study agree, with 76 percent saying that decoupling the entire IT stack is a key step towards adaptable systems. Implicit in this step is decoupling data from business silos, too.

Many insurance Laggards place business unit, product or geography heads in charge of their own technology investments. This isolated approach results in pockets of disparate technology, even though it delivers short-term incremental benefits within those silos. This is because decoupled data and organizational agility require holistic IT investment.

Consider the as-yet-untapped benefits available from cloud technology that leverage enterprise-wide data. While silos remain, promising pilot projects in areas such as artificial intelligence are destined for the shelf. Well-designed Future Systems can multiply value—but require a decisive departure from segmented legacy systems based on strongly delineated corporate structures.

This is where Middlers fall short

Middlers believe that Future Systems are the way to go but aren’t as ready to implement those technologies as Leaders are. Middlers fall behind when it comes to mastering technologies at scale and at speed—decoupling the IT stack and building architecture flexibility. Nor do they reinvest in new technologies or develop the same levels of expertise as Leaders do.

The gap between insurance Leaders, Middlers and Laggards is greatest regarding technology adoption and smallest for security. Questions: 1. How important is business-IT alignment for scaling new innovations in your industry? 2. How effective is your organization in achieving this alignment? 3. What are the key impediments you face?

Finding the most appropriate ways to bridge these shortcomings could be the difference between catching the Leaders—or remaining a follower. My concluding post in this series will detail how to close the gap by creating future-ready systems that are boundaryless, adaptable and radically human.

Learn more about the future systems by downloading “Full Value. Full Stop” and “Future-Ready Systems: The leadership difference” Or, email me to discuss how Accenture can help prepare your organization for the future.