Natural language processing, one of the AI tools, can help insurers tap into their unstructured data and improve customer experiences.

Insurers rely on data for the insights they need to develop the products and services their customers need, as well as to make their business more efficient and agile, able to pivot quickly and adapt to changing technologies and evolving business expectations. But what if the data insurers need to analyze is unstructured?

Nearly 80 percent of enterprise data is unstructured, coming in the form of emails, text documents, research, legal reports, voice recordings, videos, social media posts and more. For insurers looking for answers, this unstructured data is a goldmine. However, compared to structured data, it’s much more difficult to analyze.

Fortunately, evolving technologies, such as natural language processing, can enable insurers to unlock the value. Natural language processing, a component of artificial intelligence (AI) that can understand human language as it is spoken, has evolved to a point where it can be used to understand a user’s questions (text or speech) and mine insights from vast amounts of unstructured data.

Here are a few ways insurers could use natural language processing applications to help them glean the insights they need to make changes to products and services or for strategic decision-making:

- Intelligent document analysis. Uses AI techniques including natural language processing, entity extraction, semantic understanding and machine learning to analyze content, extract meaning and reliably aid process automation and decision-making.

- Data storage optimization analytics. Lets IT departments, CIOs and content owners identify content eligible for deletion or migration to lower-cost storage, improving data quality and reducing costs.

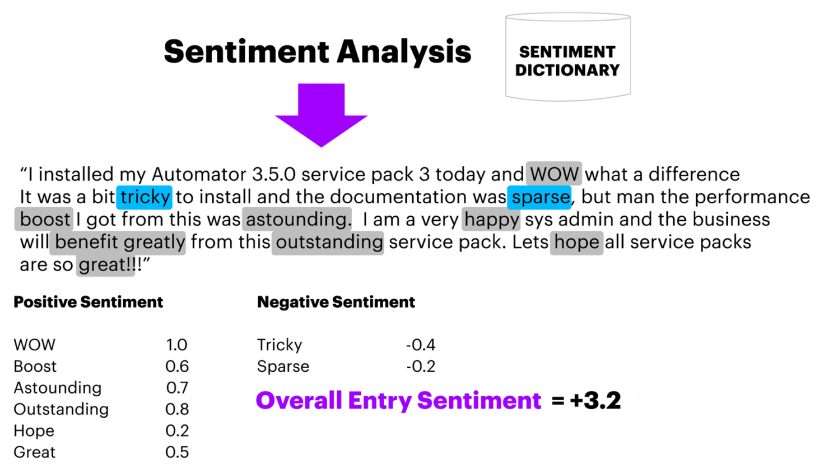

- Sentiment analysis. Also known as opinion mining, uses AI to automate the process of identifying opinions about a specific subject from a piece of content. In its simplest form, it categorizes a sentiment as positive or negative.

As well as helping with the analysis of unstructured data, natural language processing applications can lower the friction in customer interactions via chatbots and virtual assistants. Gartner research suggests that by 2021 (in just a year’s time!) 15 percent of customer service interactions will be completely handled by AI—that’s an increase of 400 percent since 2017.

With a well-implemented natural language processing solution in place, insurers can gain a deeper understanding of unstructured content, and develop enhanced business intelligence and analytics. If you’re looking to get ahead of the competition, it’s worth considering the insights waiting to be discovered in your unstructured data.

To learn more about the benefits of natural language processing and to read about how the technology is being applied, check out the report: Top Natural Language Processing Applications in Business