Other parts of this series:

The number of older persons—those aged 60 years or over—is expected to more than double by 2050, reaching 25 percent or more of the population in all regions except Africa. The impact on state systems and the economy will be significant. For insurers, there is opportunity—if they can deliver solutions that seniors want and need.

Better medicines and healthier lifestyles means longer lives. The growing segment of the elderly is putting huge pressure on social, health and government systems. Responses are coming from all directions, with clear guidelines emerging in terms of what the elderly want and need. How are insurers responding?

The UK’s Industrial Strategy sets out Grand Challenges, tying artificial intelligence (AI) and data closely to the country’s Aging Society challenge. More data means better and more customised risk management. The UK believes that within 15 years, better use of AI and data could result in over 50,000 more people each year having their cancers diagnosed at an early rather than late stage. This would reduce by approximately 20,000 the number of people dying within five years of their diagnosis, compared to today. The benefits for individuals and the support systems they depend on are clear, and insurers are already incentivising wellness.

The wellness revolution

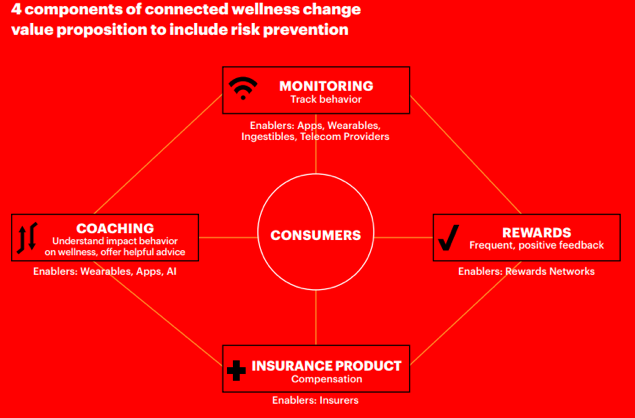

The wellness revolution has evolved the concept of health and life insurance. While the focus used to be on medical and hospital cover, and payouts at death or disability, today it is increasingly on protection and prevention—improving the quality of lives and helping people live healthier, longer, more independent and fulfilled lives.

From wrist bands and heart monitors that measure steps, record activity and prompt healthy actions, the applications for wearables have exploded. For seniors and their loved ones, there’s a boom in devices that can guide, remind, help protect, locate, improve hearing and even provide companionship.

Source: The Connected Wellness Revolution, Accenture

Leading insurers are already leveraging the opportunity this presents.

Examples:

- Noé, Groupama’s digital tele-assistance system and social network for elderly people connects customers with their relatives. It includes a connected tablet to link users via phone / video / messaging to relatives and key services, a fall detection wristband with an alert push-button linked to a 24-hour helpline, and a mobile app that allows relatives to interact with the tablet and stay in touch with their beloved parent.

- Europ Assistance Group and SeniorAdom offer Connect et Moi, a solution designed for taking care of people who are alone at home. It uses the IoT and an intelligent algorithm to learn the habits of the person and generate alerts for fall detection, denutrition, dehydration or a decrease in activity. Client caregivers and a 24/7 assistance call centre receive and resolve alerts.

- Allianz was one of the first insurance companies to propose offers and services dedicated to long term care. In 2014, Allianz created the Allianz Téléassistance offering with partner Mondial Assistance to help seniors live independently longer. By pressing a bracelet or locket button users can issue an alert from anywhere in their home—e.g., in the case of a fall. An advisor from Allianz Téléassistance will evaluate the situation and notify relatives or emergency services.

- An Accenture solution takes in-home care and connectivity with family to another level. The pilot program, completed in 2017, helps older people manage their care delivery and well-being. The AI-powered platform can learn the behaviours and preferences of elderly people and, via a portal, suggest activities to support their overall physical and mental health. Leveraging the AWS cloud and delivered via Amazon Echo Show, the platform’s ‘Family and Carer’ portal lets relatives and caregivers check on the individual’s daily activities, such as whether they have taken their medication or made new requests for caregivers. It can also spot abnormalities in behaviour and alert family or friends, based on user-defined permissions.

These technology-supported offerings will evolve, bringing more changes to insurance business models and value proposition.

What do seniors want from assistive tech?

With more data and a means to influence and monitor behaviour, insurers will be able to create risk models capable of individual risk modelling and dynamic pricing. At a broader level, it also opens new avenues for ongoing revenue for insurers, which can now offer value models aligned with every stage of life.

But, to gain a foothold in the silver economy, what technologies and solutions will appeal to older insurance customers? What do the elderly look for?

Technology has become both a fashion and functional item. To be relevant it needs to be easy to wear or access, and preferably non-invasive. It needs to be always-on and trackable in an emergency. It needs to be easy to use. And the ethical use of data and privacy need to be guaranteed. In addition, where ecosystems are involved, payments, data exchanges and other interactions need to be effective and secure.

Ethics, fraud, lower premiums

Companies such as Vayyar Imaging, which uses radar rather than cameras to build 3D images, are paying attention to the need for privacy. But the HiNounou solution offered by AXA and its partners in China stands out for a number of reasons.

HiNounou is a holistic and innovative home wellness solution for seniors that is powered by AI, the IoT, blockchain, and genomics. Its partners include Bayer, AXA, Ping An, ZTE AngelCare, Walimai and L’Atelier BNP Paribas. The HiNounou platform and ecosystem offer China’s seniors “the first dedicated insurance-as-a-service product”, regardless of their medical history. It enables regular biomarker monitoring, a 24/7 tele-consultation hotline, and an intelligent health data platform that securely stores and shares data via blockchain.

The blockchain architecture can help combat insurance fraud through the adoption of smart contracts, whilst ensuring a vast increase in the efficiency of information flow and payments between insurers and reinsurers. It will also enable insurance companies to calculate risks and build customised health insurance pricing models based on genuine health records and real-time wellness data provided through the HiNounou ecosystem.

I hope you have enjoyed this series. Insurers are just beginning to explore the opportunities that the silver economy offers and there are many exciting solutions on the horizon. Feel free to contact me or my team to discuss your ideas.

- This video expands on the Elderly Care pilot solution Accenture has delivered, while this video looks at Accenture’s AI for the Elderly solutions, presented at CogX .

- For more on the wellness revolution, read Accenture’s Connected Wellness Revolution.

- For a closer look at how technology is improving the way people work and live—and the implications for the insurance sector—click through to Accenture’s Technology Vision For Insurance 2018.