Other parts of this series:

In the next three decades, the silver age (60+) will be a reality for almost a quarter of the globe’s population. New thinking is required to create a supportive environment for this rapidly growing segment. For insurers, the arrival of a silver economy—along with innovative, technology-driven solutions for the elderly—presents significant opportunity.

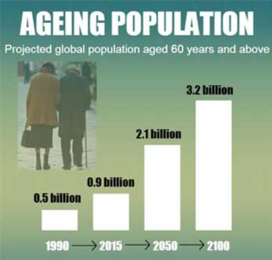

Right now, approximately 962 million people—13 percent of the global population—are aged 60 or over. United Nations (UN) research indicates that this number will more than double by 2050 and, at this point, people aged 60+ will make up 25 percent of populations in every region of the world, except Africa. The world is ill-prepared and economies are bracing for the impact. Can we mitigate some of the challenges? Better yet, can we turn this into an opportunity? For insurers, there’s potential to do exactly that.

Source: United Nations, www.un.org

First, let’s understand the challenges. Did I mention a slowing birth rate? The global fertility rate has halved over the last 50 years. Globally, the population aged 60+ is growing faster than all younger age groups. What this means is that a larger aging population is going to place a greater burden on the state in terms of pension and healthcare resources, and a shrinking base of economically productive people will need to fork over more income tax to pay for it.

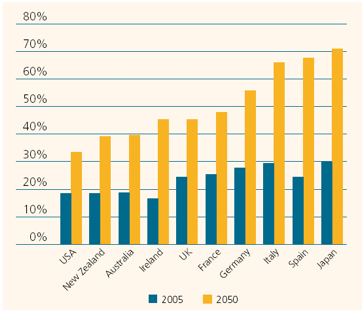

Worldwide dependency ratios

The ratio of the population aged 65 years or over, to the population aged 15 – 64.

Source: UK Department for Work and Pensions

Source: UK Department for Work and Pensions

With fewer people in the labour pool, productivity and innovation decline, and labour costs go up. And there’s more—as more people put a bigger percentage of their income away for a longer retirement, lower capital investment impacts economic growth. The net result: lower per capita income, productivity and economic growth.

Nataxis spells out the some of the key impacts in its 2018 Global Retirement Index.

What can be done?

The quick answers are: improve the general health of aging populations and help people stay independent and mobile for longer, encourage later retirement, find new ways to keep people productive and contributing to the economy for longer, and make better use of available talent in the labour market (especially women).

What is being done?

Governments, including Japan, Australia, Britain and the US, are reviewing tax, state support and other policies to address these issues. The UK notes “it’s time to radically rethink how we respond, at each stage in life, to the way that we support our families and communities, as well as the way that we approach work, finances, health and care, and housing.”

Infrastructure and economic shifts are necessary. And new connected technologies and solutions aimed at keeping people healthier (physically, mentally and emotionally) and their environments safer will be a vital part of these strategies.

The UK’s Centre for Policy on Aging’s updated strategy document, Transforming Later Lives, outlines four priority goals to help people enter later life “free from disability, financially secure, supported by friends and family and with a purpose”. These goals include helping more people aged 50-69 find fulfilling work, making the homes of the elderly more safe and accessible, increasing the ‘connectedness’ of communities, and supporting healthy aging. Similar policies and goals are being introduced elsewhere in the world.

The opportunities

For insurers, there is a growing opportunity to extend the connected wellness movement to the silver segment.

Connected wellness combines digital devices like wearables, mobile apps and web portals with analytics to create personalised daily interventions. Customers agree to provide their health data in exchange for monitoring, coaching, and rewards from ecosystem partners all designed to educate and encourage behaviours that improve physical and mental well-being.

The move to connected wellness goes beyond putting devices into customers’ hands. It is a revolution in customer interactions, products and services, and ecosystem partnerships that represents a profound shift in insurers’ value propositions.

The insurer’s silver opportunity

In the silver economy, insurers have an important role to play. Living longer means better planning is required by individuals and their families. Life and health insurance models will need to change to reflect society’s changing needs. However, there’s also a bigger opportunity to consider: as the silver segment grows, so does their economic spend.

For example, with an aging population that desires independent living, an increase in demand for home living services, as well as smart home devices and services, can be expected. These devices and services can make aging more comfortable and safe, reduce caregiver burden and enhance quality of life. Insurance companies can capture this market by collaborating with wearable tech and home automation companies as well as other providers (e.g., caregivers) to provide specialised solutions for the elderly care at affordable rates.

For insurers, understanding what seniors want and need and becoming part of the ecosystem of providers for this segment will position them well to personalise offerings, protect investments and assets, insure health needs adequately and provide a living service.

Join me next week as I look at the exciting new technology solutions that are emerging to meet the needs of the elderly, and how insurers are already taking advantage of these technologies to create innovative insurance solutions for older people.

- For more on the wellness revolution, read Accenture’s Connected Wellness Revolution.

- For a closer look at how technology is improving the way people work and live—and the implications for the insurance sector—click through to Accenture’s Technology Vision For Insurance 2018