Highlights

- Small commercial is at an inflection point with digital.

- Four of the top five carriers now have a direct offering.

- From 2010 to 2018, insurtech spend in small commercial spanned 50 companies, 111 deals, with a total of $1.5 billion invested, showing a compound annual growth rate of 41 percent.

Introduction

Small commercial insurance is a highly desirable market, and one that is going through a digital transformation. In order to win big in small commercial, carriers need to create winning digital experiences, significantly improve the efficiency of core operations and create category killers by launching new direct channels.

This ultimate guide to small commercial insurance covers:

- The opportunities in small commercial

- The challenges in small commercial

- What small commercial customers want

- Our research, insights and stats

- How to win in small commercial, including key strategies

- The fundamental supporting capabilities

Opportunities in small commercial

Small commercial insurance is a highly desirable market for three main reasons: the market is fragmented, it’s underserved, and digital transformation has just begun.

- The market is fragmented, with even the largest carriers having only a small portion of total premium income;

- The market is underserved, in terms of the extent of coverage many small commercial businesses have as well as the number of micro & small businesses (MSBs) and gig economy workers who have no coverage at all;

- Digital transformation is at an early stage in this sector, and insurers are not yet having to wage the costly brand and advertising wars that accompanied the advent of direct online selling in the personal lines sector.

Challenges in small commercial

Just because small commercial is a desirable market it doesn’t mean that it is easy to unlock. There are several challenges that carriers face in small commercial insurance:

- The core business owners’ policy (BOP) is viewed by customers as a commodity with little differentiation;

- Underwriting and pricing can be very complex;

- Pricing pressure is strong, making profitability difficult;

- Expense pressure is constant, despite the high-servicing needs of customers.

What small commercial customers want

Small business owners explain why they don’t buy commercial coverage: Bad service. They want speed and ease; personalization; transparency and education; and a continuous relationship.

Reducing the time and administration burden on small business owners when they research policies and gather quotes should be a priority for commercial insurers.

What small business owners have to say:

“When I first started this process I was going at it alone and doing some research on my own and going online to look for information, which proved to be extremely unhelpful.”

To build trust and confidence, direct carriers must create transparency through clear and engaging educational content about what is and isn’t covered, how to reduce premiums, and how the claims process really works.

What small business owners have to say:

”It was time-consuming and just exhausting. And on top of everything else I do I really wasn’t thrilled with the process, but it was something I needed to do.”

By offering solutions that match the ups and downs of small businesses today, carriers can demonstrate an understanding of customers’ needs and create long-term relationships that evolve with the business.

How to win in small commercial

Small commercial is in the early stages of the same type of digital revolution we have seen in personal lines, and as in the personal lines revolution there will be winners and losers. Here are three things carriers can do to prepare for the small commercial revolution:

- Create winning experiences with digital: These are the compelling experiences that will help to differentiate carriers, enabling them to win and keep customers as the core product becomes increasingly commoditized.

- Relentlessly improve operations: This is the focus to provide increasingly better and faster services while reducing operational expenses and maintaining or improving underwriting results.

- Create category killers: Use partnerships to establish compelling channels, services, and offerings that let you win and own sections of the marketplace.

Creating winning digital experiences can help carriers throughout the sale, onboarding and service level agreement (SLA) phases of small commercial.

- The Sale

As small commercial becomes more digital, customers will expect and move to more compelling experiences around the buying process. Winning in small commercial insurance will require carriers to create compelling digital experiences for customers across the buying spectrum.

Most carriers have not yet developed the excellent websites and articles supporting recognition, research, reflection and support for potential small commercial customers that they have for their other lines of business.

What small business owners have to say:

”I don’t even know if it’s good coverage or have high confidence in what would happen if someone made a claim against me.”

In the digital future of small commercial, carriers will actively identify small business owners based on their digital activities. Analytics-based tools and advice will help the business understand the needs of this size and type of enterprise. Chat bots or active customer service will provide a warm transition to direct or agency channels to help the customer start the purchase. Online tools such as ratings, analytics and reviews will improve customers’ confidence in their decisions.

- Onboarding

One of the best ways to grow your small commercial business is to increase retention. This starts with what carriers do right after the sale. Winners in retention will be those that make customers feel great about their purchase from the moment they say, “Yes.”

- Service Level Agreements

An important part of creating winning experiences in small commercial insurance is creating great service. While many carriers are proud of the service that they offer and the service level agreements (SLAs) they comply with, they need to rethink the definition of the SLA: Solution, not Service; the Level should be the target set by market and customer expectations, not your own goals; and Achievement, not Agreement. It’s time for carriers to move from “service level agreements” to “solution level achievements.”

Our research, insights and stats

This guide is based on Accenture’s up-to-date, industry-leading research in small commercial including:

- Small commercial research study and workshop covering in-depth sessions with 20 small business leaders;

- 500-person quantitative study of small business insurance decision-makers;

- 36 in-depth small commercial video interviews;

- 17 in-person small commercial site visits and interviews;

- 42 market-competitive analyses of small commercial and adjacent competitor sites;

- Research report and more than a dozen blogs published, and presented at two conferences.

Key Insights:

- There is trust in carrier solutions, but there are also cracks that leave opportunity for disruption:

- 81 percent of small business owners are satisfied or very satisfied with their insurance provider

- 77 percent fully or partially purchased from a broker

- 38 percent have more than two providers, and 28 percent have more than two agents/brokers

- Yet, 24 percent are likely to shop around

- Small commercial insurance remains a complex purchase, with many people relying on other information to make decisions:

- 54 percent of customers consult with industry peers

- 40 percent relied on a recommendation to choose their insurance provider

- Digital channels offer opportunity, but only if they meet key needs:

- 40 percent of customers find industry-specific content helpful on a provider’s site

- 40 percent find customer reviews helpful in making the decision

Key strategies

To survive and thrive in the small commercial marketplace, carriers need to create more compelling experiences for both agents and customers while pursuing two key strategies:

- Brilliant basics: How to improve the core of underwriting

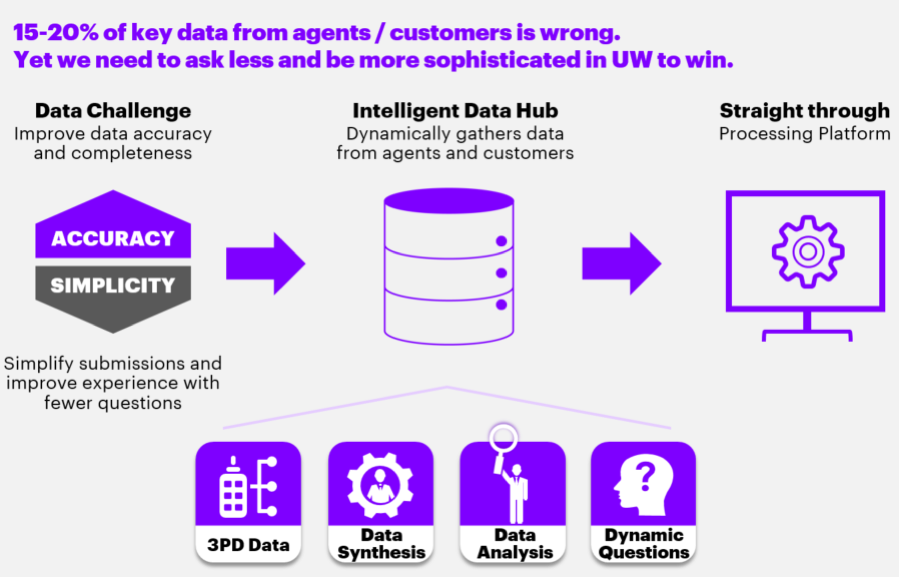

Improving the core of underwriting will be key for carriers looking to succeed in the future of small commercial insurance. The three basics to strengthening underwriting, while enhancing the quality of data, include making better use of third-party data, evolving straight-through processing (STP), and enabling underwriters with artificial intelligence and machine learning.

Just like agent-collected information, third-party data can be incomplete, out-of-date, or just plain incorrect. In order to make the most of third-party data, carriers will need a combination of solutions including multiple data vendors and the use of artificial intelligence (AI) to supplement the incoming third-party data. Continuous data evaluation will be critical to ensure underwriting quality.

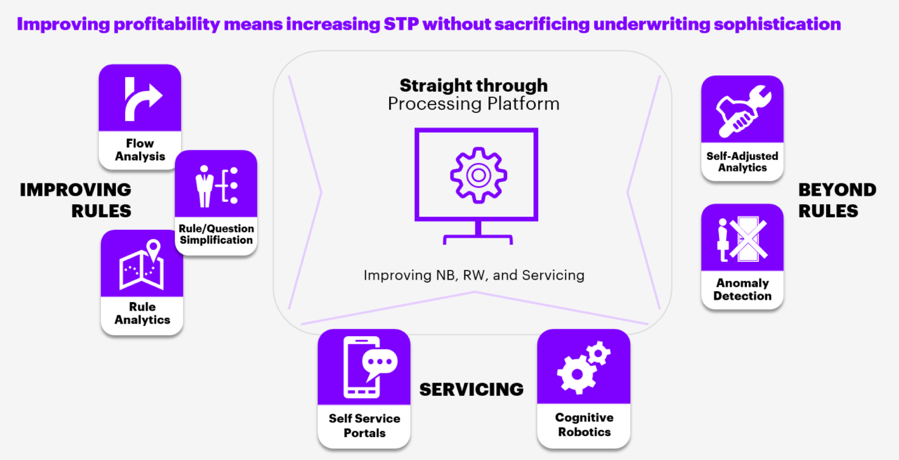

Evolving STP requires carriers to rethink rules. They need to simplify, adjust and change some of the rules. But some rules may no longer be needed at all. In small commercial underwriting there is life beyond rules, and it’s called self-adjusted analytics.

AI and machine learning can also bring sophistication to the underwriting process by directing underwriters to important data points to make immediate, insightful decisions on the curated content. Underwriters would also receive real-time updates to pricing analysis and would increase the scope of the analysis when needed. Access to the latest data would also enable underwriters to improve their risk appetite and pricing.

- Pivot to ‘the new’ with design, speed, partners

After improving the core of underwriting, carriers will need to drive higher-margin business by pursuing new growth opportunities in underserved markets through direct channels and with strategic alliances in the greater digital ecosystem.

What small business owners have to say:

”It was frustrating and challenging to find an agent who had a market for this type of business.”

There is an opportunity for insurers to offer similar, simple, end-to-end digital experiences for small business owners who prefer to do everything themselves – just as they do for their other customers. They could offer this in parallel to the agent model.

The “pivoting to the new” strategy has three key components: 1. Design, 2. Speed, 3. Partners.

Design to win: While channels bring in new opportunities, it’s the experience design that wins customers over. Insurers will have to define their digital objective, discover, hypothesize, experiment and launch.

Speed: Carriers wanting to succeed and thrive in a new digital environment will have to experiment quickly, develop, deploy and scale.

Partners: In the greater digital ecosystem, carriers will need the right partnerships and the right approach to forming alliances. Rather than having a pre-conceived notion of what the partnership should accomplish, they should adopt an open mind and keep at it. The fastest-growing area of insurance is the one where carriers are depending on the right alliances.

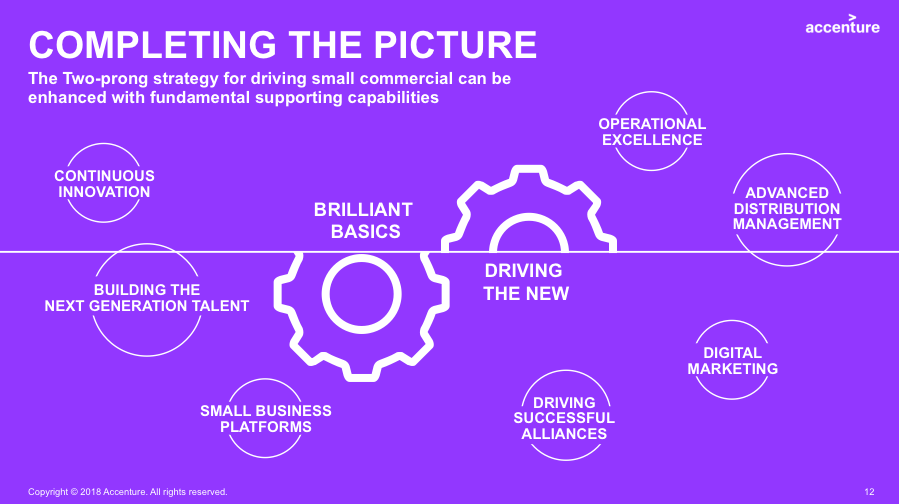

Fundamental supporting capabilities to drive small commercial insurance

As carriers develop their small commercial strategies, seven major capabilities will help enhance their efforts:

- Continuous innovation

- Building the next generation of talent

- Small business platforms

- Operational excellence

- Advanced distribution management

- Digital marketing

- Driving successful alliances

If you want to win big in small, choose the right partner

It is clear from our experience and research that there are opportunities for clear winners in small commercial as the market becomes disrupted. As we saw with personal lines, just showing up or having “me too” capabilities will be insufficient to differentiate and unlikely to win.

The winners will not necessarily be the organizations that are first to market or those with the simplest and fastest online quoting process. Instead, the victors will be those that create a transformative buying and service experience that addresses the fears, concerns and frustrations that trouble small business owners today when they buy direct or through agents. Key competitors are embarking on bold bets to rethink small commercial led by experiential research.

If you want to win in small commercial, you need to get the experience right, and you need to consider doing it with a leading partner.

Accenture stands ready to help from ideation through execution as the clear leader in small commercial today.

Read our Small Commercial Insurance research report to learn more or contact me to discuss your small commercial insurance journey.