Other parts of this series:

- Forget COVID-19, it’s time to start insuring the new normal

- A new normal for consumers and businesses – and for their insurers

- Personal lines post-COVID: New table stakes and wildcard prospects

- Wildcard insurance opportunities, from home cyber to e-scooters

- Can business insurers fulfil their customer mission in a post-pandemic world?

- Commercial lines post-COVID: Growing SMB cover and defending the back book

Beyond obvious restrictions on everyday life, the most pervasive impact of the coronavirus pandemic has been the shutdown, total or partial, of wide swathes of the UK and global economy. The nature of doing business has radically changed, and so too has business insurance.

In our earlier entry on personal lines, we pointed out that the decline in economic activity – especially commuting and travel – has lowered claims and put pressure on top lines. For commercial insurance, lockdowns have in many ways had the opposite effect, triggering a spate of large claims and price corrections, especially in lines like events, trade credit and business interruption (BI).

We explore the implications for the sector over today’s and next week’s posts, including new opportunities in the SMB market – from pandemic insurance and cybersecurity to digital distribution and parametric products.

Killing the soft market

Last year’s major event cancellations included Euro 2020, the Tokyo Olympics and nearly all business conferences. As supply chains ground to a halt, with whispers of insolvencies, the threat of a trade-credit crunch loomed large. Many small businesses – with no means to continue trading – turned for support, in their hour of need, to their insurers.

Even though governments have ultimately borne the brunt – via business loans, furloughs, grants and trade-credit guarantees – the impact has still pushed many insurers out of affected lines.

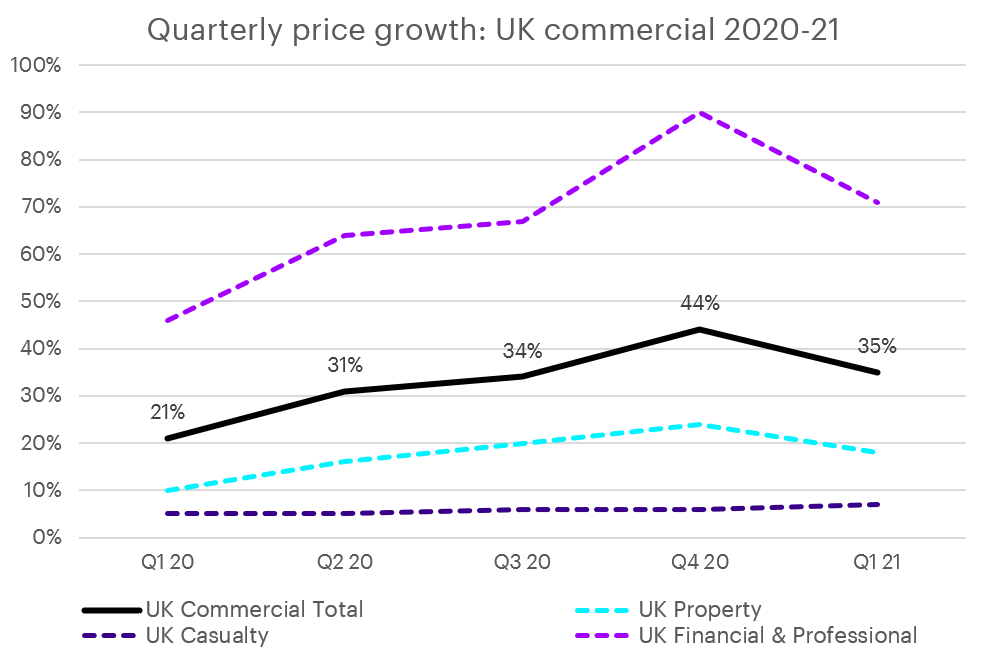

This has delivered the coup de grâce to what had been a twenty-year soft market. UK commercial rates rose 44 percent in Q4 of 2020, and a further 35 percent in Q1 of 2021 – and growth was even higher in financial/professional lines (90 percent and 71 percent in Q4 2020 and Q1 2021 respectively).

Source: Marsh Global Insurance Market Index

The new normal can benefit commercial carriers – but what about customers?

What does the hardening market mean for commercial insurance? Well, COVID-19 has clearly had its winners and its losers. Firms who have been burnt by losses will need some time to rebuild their balance sheets. Meanwhile, those with outstanding capacity can cherry-pick high-margin opportunities without straying far from their well-trodden lines.

Ultimately, if key players either have bigger fish to fry or no oil in the first place, this may end up detracting from innovation on unresolved customer pain points. Insurance as profit, yes. Insurance as mission, no.

Unresolved pain points are indeed many. Especially for smaller businesses, there is a string of challenges old and new, such as low penetration levels for many types of cover and enlarged cyber exposures – to be explored in next week’s instalment. The biggest question mark of all – certainly for today’s post – is whether private insurers can cover business interruption (BI) for pandemics.

All these areas are opportunities not just for premium growth but also for social good, given the role that small businesses play in society as a whole, providing the majority of UK employment for instance. What remains to be seen, on a theoretical level, is how far these problems can be overcome. And, on a practical level, whether carriers have the appetite and innovation capacity.

Guide insurance customers to safety and well-being – Insurance Consumer Study 2021

Learn moreSMBs hardest hit by lockdowns

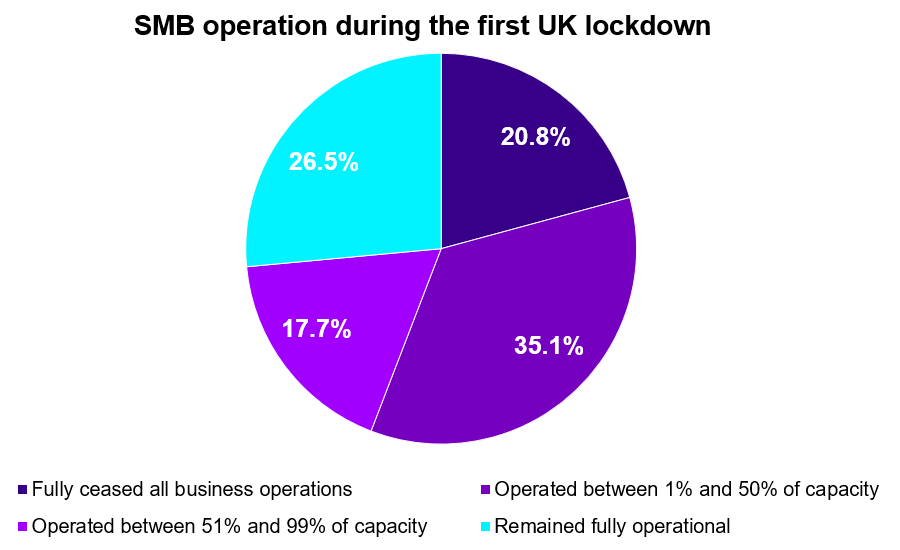

Out of all the impact groups, it is perhaps small and medium-sized businesses (SMBs) that have suffered the worst during the pandemic, with only a minority remaining fully operational during the first UK lockdown.

Source: GlobalData (SMB defined as a firm having less than 250 employees)

Often largely reliant on physical channels, with limited financial cushions and minimal provision for staff to work from home, SMBs have been harder pressed to keep the lights on this year than their larger corporate cousins. And, if they expected insurance to form a substantial part of the solution, then they have been disappointed.

From a technical perspective, today’s BI policies are simply not designed to deal with events like COVID-19. Cue a long-running contention over policy wordings – with many business insurers favouring a narrow interpretation of “disease” and “prevention of access” clauses.

A recent ruling by the UK’s Supreme Court has clarified the situation somewhat, expanding the scope for businesses to claim. However, since last spring, insurers have been adding explicit COVID-19 exclusions in their newly written BI policies – so, welcome as the Supreme Court’s ruling is to those affected, it does not fundamentally solve the problem of pandemic (re)insurance.

Pandemic cover and the limits of what’s insurable

Pandemic cover may in fact prove a bridge too far for the industry. For a start, for private insurers to fully cover the BI impacts of an event like COVID-19 would require a capital base several times larger than the entire global P&C industry, according to research from the Geneva Association, who put the global economic losses of 2020 at some $4.5tr.

This is not just about the size of individual BI losses – which are substantial when closures are mandated not for hours or days but for months – it is also due to the difficulty insurers face diversifying this risk. While hurricane premiums from the Gulf of Mexico might pay for Bengal typhoons, and vice versa, global pandemics strike policyholders across geographies simultaneously.

Insurers would also have to balance their books with decades of pandemic-free premium collection. This is why pandemic cover is probably best left in the hands of governments, who can spread out the cost across the literal lifetime of citizens, not just the figurative lifetime of customers.

In its broadest definition, the SMB protection gap looks like a hard one for insurers to fill. But this doesn’t mean they can’t solve aspects of it. They can. Sometimes many small nets can be as good as one big one.

In our next and final instalment, we look at how insurers can take an incremental approach to SMB cover, turning specific customer pain points into opportunities, all the while keeping on top of their existing book of exposures. Stay tuned for parametric products, cyber criminals’ pivot towards small businesses, exotic distribution channels and trouble in the back book.