Other parts of this series:

- Forget COVID-19, it’s time to start insuring the new normal

- A new normal for consumers and businesses – and for their insurers

- Personal lines post-COVID: New table stakes and wildcard prospects

- Wildcard insurance opportunities, from home cyber to e-scooters

- Can business insurers fulfil their customer mission in a post-pandemic world?

- Commercial lines post-COVID: Growing SMB cover and defending the back book

COVID-19 has placed insurers of all shapes and sizes before a host of unaccustomed challenges. But as vaccines are rolled out and we move beyond the acute phase of the pandemic, there are increasing opportunities on offer as well – where insurers can play a role in addressing the pain points that consumers and businesses face in the new normal.

As an insurer, the opportunities you can pursue – and the adaptations you need to make – will depend on your specific business mix. We believe there will be significant differences in the approach needed between personal and commercial lines, and we explore these in a bit more detail in today’s post.

Personal lines: riding out – and riding beyond – the race to the bottom

In 2020, personal lines saw relatively low levels of claims, especially in motor insurance, with some providers even going as far as premium givebacks. While this has been great for car insurers’ short-term profitability, it raises questions about top-line growth prospects, as fewer new drivers enter the market and plenty of others mull car sales.

Vaccine or no vaccine, the trends of remote-working, reduced car usage and alternative transportation are unlikely to reverse, and this will increasingly weigh on premiums and prices.

Conventional motor insurers can ride out this race-to-the-bottom, with cloud and automation as potential levers for lowering the cost base and scaling customer service digitally. Or, they can make a bold play for differentiation, such as pay-as-you-drive products – anticipating customers’ reduced car use.

Changed travel habits are also feeding brand new risk pockets, especially third-party liability for bikes and e-scooters – which have seen adoption surge during the lockdown. Another risk pocket to watch is home cybersecurity, an unavoidable reality now that employees have swapped the relative security of their office desk for the crumb-strewn jeopardy of the kitchen table.

These opportunity areas are small-scale for now and will do little to offset lost growth and shrinkage in bread-and-butter lines like motor and travel. However, by choosing wisely, insurers could be taking a leader’s stake insuring one of 2030’s major consumer markets.

Commercial lines: victories for carriers, but business insurance still falls short of its mission

The dynamic in personal lines has been one of the limited claims but slackening top lines. In Commercial, we are often seeing the opposite of this.

Some lines have been especially hard hit, such as events, trade credit and directors and officers (D&O). This has driven out many players, reduced market capacity and definitively rung the knell for any lingering softness in the market.

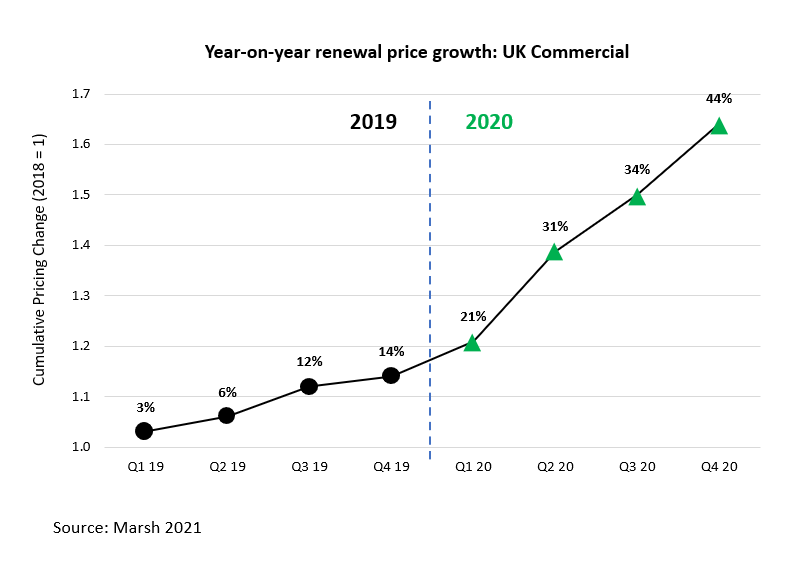

Consequently, those carriers still in the game are finding themselves, in many cases, with attractive rate opportunities at renewal. According to the Marsh Global Insurance Index, commercial pricing in the UK rose by 34% in Q3 2020 and 44% in Q4, accelerating a hardening begun already in 2019.

Several London market players have raised capital with the explicit aim of exploiting these higher rates. Even those players who have been burnt may look for ways to realise liquidity, so as not to let the opportunity pass. But, like selling your house to buy Bitcoin, this approach could leave insurers overleveraged in the event that COVID-19 has a sting in its tail.

The recent Supreme Court ruling on business interruption claims is a case in point, providing for pay-outs from a wide range of BI policies. However, since coronavirus first hit UK shores, insurers have been running off their exposure to BI claims, and this ruling will only accelerate the move towards iron-worded COVID-19 exclusions on standard policies.

This retrenchment by carriers, while understandable commercially, cuts against the newly awakened appetite for innovative insurance solutions on the part of small and medium-sized businesses (SMBs), which continue to find themselves imperfectly served by the industry.

In short, 2020 was the insurance cycle on speed, with its winners and losers, virtues and vices: a spring of chaos gutted an oversaturated market and set up autumn of lucrative opportunities for a select and savvy few.

However, it also showed up the industry’s limitations in leaving so much risk on the table, as in the case of SMBs. There are certainly commercial insurance innovations in the works – everything from parametric products to Open Insurance – but, with such copious and long-awaited low-hanging fruit on offer, it’s unclear just how much priority major players will give these in 2021.

Insurance Revenue Landscape 2025: our report examines 4 key areas of innovation that offer revenue opportunities for insurers over the next 5 years.

Learn moreStriking the right balance

For all this talk of difference, there is also overlap in the challenges (and opportunities) that the new normal brings for personal and commercial players.

Both categories are likely to see an uptick in M&A activity over the next 12 months, with good reason to seek consolidation or to release cash, depending on your position. Both have plays in Insurtech also. This could be prioritising later-stage partnerships to realise value sooner or, conversely, prospecting for early-stage companies in niches temporarily low on investor competition.

As ever, the key will be balanced: selecting the right long-term trends for investment while extracting maximum value from the legacy business. Whatever their approach though, insurers must first acknowledge that there are aspects of the COVID-19 world that are here to stay. And new opportunities they pursue must be in line with this new normal, not in spite of it.

Over our next two posts, we explore the prospects for personal lines in full depth, covering both cost-saving strategies and opportunities around emerging risk pockets. We then finish the series with a further look at Commercial lines.