Other parts of this series:

- Forget COVID-19, it’s time to start insuring the new normal

- A new normal for consumers and businesses – and for their insurers

- Personal lines post-COVID: New table stakes and wildcard prospects

- Wildcard insurance opportunities, from home cyber to e-scooters

- Can business insurers fulfil their customer mission in a post-pandemic world?

- Commercial lines post-COVID: Growing SMB cover and defending the back book

In our previous post, we looked at rising consumer expectations in the wake of COVID-19, and how technology can help personal insurers remain competitive in this environment.

By delivering, as table stakes, value for money, and superior customer service, insurers ensure their continued relevance. However, if they aren’t careful, the new normal could easily turn into a period of managed stagnation.

Indeed, in many UK personal lines, top-line growth is not scheduled to return until 2023 (Accenture Research modeling). For this reason, now could be the perfect time to think outside the box and tap new risk pockets.

In today’s post, we present three “wildcard” growth opportunities that have been pushed to the fore by the COVID-19 pandemic:

- home cyber risk

- pay-as-you-drive solutions

- cover for bicycles and e-scooters

New markets do not appear fully formed overnight, and waiting for them to mature will often leave you late for the party – so carriers need to be willing to speculate. However, by taking a portfolio approach and exploring a variety of opportunities, you can boost your chances of uncovering one of 2030’s major new insurance markets.

Wildcard I: A man’s home is his (cyber) castle

Risks are like a pulley system: when one goes down, somewhere else a different one goes up. And this is precisely what has happened following the coronavirus outbreak.

Right now, many ex-commuters are barely driving their cars, let alone crashing them, since they’re largely confined to their homes. This development, while great for accident rates, has sent up both biscuit consumption and, more pertinently, cyber exposures. People are online more than ever before – often in a state of morbid uncertainty and on low-security home networks – and this makes them low-hanging fruit for attackers.

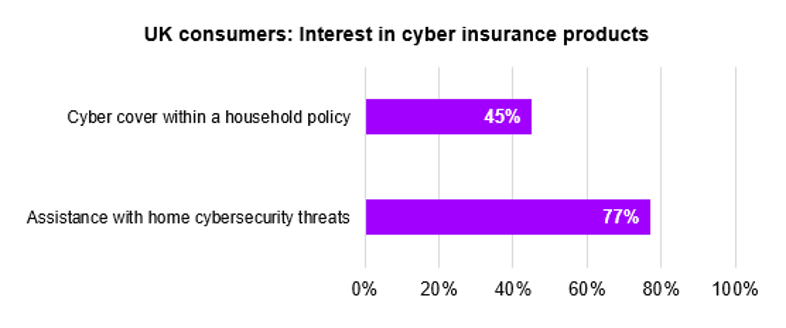

As cyberattacks on individuals become more commonplace, people will start to shop for solutions. Already, 77 percent of UK consumers say they’re interested in assistance with cybersecurity threats, according to Accenture’s Global Insurance Consumer Study. And 45 percent are interested in cyber cover as an extension of their household policy.

It’s not clear yet just how much premium is on the table with home cyber insurance. However, there is certainly an opportunity here around home assistance – something insurers have long experimented with, often unsuccessfully – and this could provide sufficient differentiation for an otherwise standard household policy to stand out from the crowd.

Guide insurance customers to safety and well-being – Insurance Consumer Study 2021

Learn moreWildcard II: Pay-as-you-drive for a home-working future

Lockdowns and furlough have pushed more drivers than ever into the traditionally overcharged low-mileage category, and the normalisation of remote work over the past year will likely leave things this way.

It’s no surprise then that we’re seeing renewed interest in pay-as-you-drive solutions – where a telematics black box or mobile app measures a customer’s actual drive time and charges them accordingly.

In 2020, two-thirds of UK consumers were interested in pay-as-you-drive car insurance, up from around half in 2018. But the fact that demand was already high in 2018 – without triggering much activity – points to difficulties mainstreaming this model.

The way that mass-market car insurers have so far reflected lower overall traffic and claim volumes following the coronavirus outbreak is instead through modest premium givebacks and pricing adjustments (a ~14 percent YoY drop in Q1 2021, according to Confused.com’s price index).

However, given insurers’ frequent reliance on lagging indicators for their modelling, there is reason to believe the overall price floor could be lower. And even assuming a perfect correction in average prices, the newly enlarged class of infrequent drivers still lose out. All the industry needs is one provider to make a bold move and break from the pack.

Today’s adoption base is small, admittedly. At the end of 2019, only 10 percent of UK drivers reported having a telematics policy. Of these, just 27 percent listed pay-as-you-drive as their reason for having one, although over half pointed to premium reductions as a motivating factor.

Source: Accenture Insurance Consumer Survey 2020

It’s clear from the above that there’s a lot of telematics value, like driver coaching, accident response and bolt-on services, that a purely price-focused approach leaves on the table. Nevertheless, there is always scope for motor insurers to convert pay-as-you-drive customers to higher-value products – both telematics-based and traditional – over the course of their lifetimes.

Wildcard III: I want to indemnify my bicycle

The lockdown-induced grounding of cars has created somewhat of a power vacuum in the world of personal transportation, which bikes, scooters and mopeds of every ilk have rushed to fill.

Between April and June 2020, bike sales surged 63 percent year on year (UK Bicycle Association). Then, in July, the Department for Transport announced a one-year fast-track trial of rental e-scooters on UK streets.

These new mobility formats are likely to remain buoyant even after lockdown restrictions are fully lifted. Many commuters will favour private transport over public options due to lingering fears of infection, and bikes and scooters may prove more cost-effective than cars, especially for those in busy cities. But they do bring a host of new risk considerations.

Even if insurance isn’t legally mandated for cyclists the way it is for motorists, cycling liabilities can still be substantial, with recent examples of large pay-outs being awarded to injured pedestrians after collisions. As more cyclists (many lacking experience) clatter down city pavements, these cases will only become more commonplace.

This creates opportunities for insurers – be they generalists or standalone providers – in a market with plenty of room to grow. Comprehensive bike cover could be bundled with a household policy (currently, many only cover first-party risk like theft). Or insurers could go the white-labelling route, targeting cycle-to-work schemes or gig-economy firms that deliver by bike.

The same thoughts apply to e-scooters. Insurtech Zego recently partnered with several e-scooter providers, including Ginger, Tier and Brite Mobility, to cover their users’ third-party liability. Public rental schemes are the only legal market in the UK and Ireland for now but, if legislation follows the example of Europe, a private e-scooter market could quickly develop.

Take a portfolio approach to innovation

So, what does the new normal hold for personal lines, in summary?

A race to the bottom that can be safely ridden out with continued technology investments, and a handful of higher-risk, higher-return opportunities. The weighting of these things will depend on your specific book of business and existing digital estate. In any case, a portfolio approach would be well advised.

In our next installment, we move on to the often quite different dynamic the new normal has created for commercial insurers.