Use of algorithmic underwriting is increasing across the insurance industry. With enhanced decision-making and improved risk assessments, an algorithmic approach to underwriting can optimize operations for insurers and experience for their customers.

In this post we delve into the evolution and advantages of algorithmic underwriting and share our insights on building and scaling an algorithmic underwriting platform.

The evolution…

Algorithms have always been part of the underwriting process, but they have generally been restricted to rating. For example, in determining risk factors for car insurance, algorithms, or mathematical formulas, would be used to set rates based on vehicle make, model, driver age, location and previous history. Whether simple or complex, algorithms have long been our core rating tool.

The use of algorithms in other areas of the underwriting process has been limited due to fear of overlapping these factors with rate making, or simply the lack of data and analytical capabilities at other parts of the underwriting process to make these decisions. Instead, the insurance industry has typically depended on complex rules engines for decisions on risk acceptance, risk tiers and report ordering.

With advancements in data access and analytics tools, carriers are now rethinking the use of algorithms, using them either alone or alongside traditional rules engines, to enhance decision-making throughout the underwriting process.

How it works…

Algorithmic underwriting employs analytical models to automate decision-making in the underwriting process or to provide insights to assist underwriters. For more homogeneous risks, it can fully or partially automate underwriting.

Key decisions made using algorithmic underwriting:

- Determining if a submission fits the carrier’s risk appetite

- Identifying key risk characteristics such as the correct SIC/NAIC code

- Prioritizing accounts based on desirability and winnability

- Making risk determinations on portions or the entirety of risk

Through this approach, carriers can achieve faster risk acceptance or rejection and reduce underwriting workloads. It also helps in providing customers more personalized risk assessments, real-time risk management and a seamless experience.

5 advantages of algorithmic underwriting

Algorithmic underwriting significantly benefits the insurance industry across 5 key areas:

- Process efficiency: By automating the underwriting process, we are seeing algorithmic underwriting reduce processing times by up to 50%, streamline operations, increase testing speed and simplify the maintenance of complex decision-making systems. In addition, the automated processes of algorithmic underwriting can help handle an increase in applications reviewed by up to 25%, enabling insurers to increase premium without additional operating costs.

- Accuracy: The accuracy of risk assessments can be improved through analysis of more extensive data sets. These analyses help identify patterns and correlations that might be missed by human underwriters alone. With this augmentation of the underwriter’s insight and judgement, errors in risk assessments can be minimized and fraud can more easily be detected. We estimate fraud losses may be reduced by up to 30% for some insurance companies.

- Price: Pricing decisions can be more accurate by enhancing risk assessments. Algorithmic underwriting helps tailor premiums to individual risk profiles, enhance customer satisfaction and competitiveness. Additionally, it supports dynamic pricing, adjusting premiums in real-time based on changing risk factors, which we see improving underwriting profitability by up to 20%.

- Proactive risk management: Algorithms can help insurers proactively identify emerging risks and adjust their underwriting and risk management strategies. This can help to mitigate potential losses, reduce loss ratio and improve overall portfolio performance.

- Customer experience: Algorithmic underwriting allows for instant or near-instant decisions on coverage eligibility, pricing and personalized offers. With predictive and prescriptive analytics, insurers can make real-time, contextualized offers, making insurance more accessible and relevant to the individual customer’s needs. It also makes insurance more attainable to customers or segments that may have been marginalized by underwriting methods of the past.

Building an algorithmic underwriting platform at scale

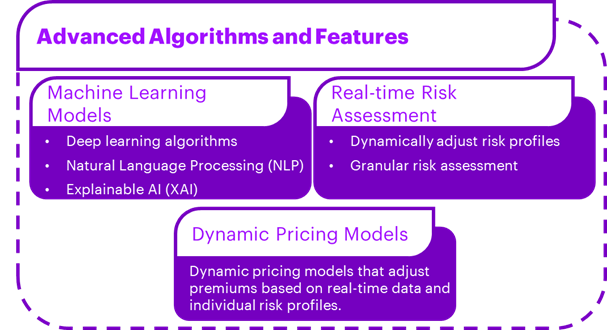

An algorithmic underwriting platform requires a multi-layered approach that takes future scalability into consideration. Advanced features needed when considering an algorithmic underwriting platform include machine learning models, real-time risk assessment, and dynamic pricing models.

Challenges to consider as you optimize your data and algorithmic underwriting platform:

- Data quality and availability: Data may be fragmented, incomplete or outdated.

- Model interoperability: Complex machine learning algorithms used for underwriting may lack transparency and interoperability making outcomes difficult to explain.

- Compliance: As regulation of algorithmic models and AI increases, insurers must stay ahead of the guidance and adjust models as needed.

- Fairness and bias: If not proactively addressed, algorithmic underwriting presents the risk of perpetuating unfair practices and historic biases.

- Data privacy and security: Algorithmic underwriting involves collecting, processing and storing large volumes of personal and sensitive data. Securing customer data is vital for compliance and maintaining customer trust.

Success stories…

We see examples of success with algorithmic underwriting across the industry. In P&C for example, Ki Insurance leverages AI and algorithms for instant commercial insurance quotes and automated policy issuance. Hiscox collaborated with Google Cloud to develop and AI model that automates underwriting for specific products. Meanwhile, on the life insurance side, ethos employs machine learning to asses risk and to offer simplified insurance applications.

Conclusion

While algorithmic underwriting is not a novel concept in insurance, it is revolutionary in its enhancement of access to new data sources, improved data quality and better analytics tools. These enhancements allow underwriters insight from other areas of the value chain and extend their capability beyond archaic models or knockout rules.

Despite their sophistication, insurers will need to be aware of the potential for bias and a lack of transparency in algorithmic underwriting models. Ethics and compliance, including data privacy, consumer protection and fair lending laws will pose challenges for insurers to address from the outset.

As technology continues to evolve and data analytics capabilities expand, we bear witness to how algorithmic underwriting will revolutionize the insurance industry, drive innovation and empower financial institutions to make more informed, data-driven decisions.