Other parts of this series:

- Forget COVID-19, it’s time to start insuring the new normal

- A new normal for consumers and businesses – and for their insurers

- Personal lines post-COVID: New table stakes and wildcard prospects

- Wildcard insurance opportunities, from home cyber to e-scooters

- Can business insurers fulfil their customer mission in a post-pandemic world?

- Commercial lines post-COVID: Growing SMB cover and defending the back book

In our previous post, we outlined the strain COVID-19 has put on small businesses but concluded that pandemic risk is uninsurable in a broad sense.

While insurers may struggle to build a net for the whole world, many by-products of the pandemic – and the new normal we are entering – represent ripe opportunities for insurers. We examine some of these in today’s post, along with a few other pandemic by-products that may prove thornier for risk carriers.

One source of opportunities is the SMB sector, which offers solid long-term growth prospects for insurers.

Small and medium-sized businesses (understood as having <250 employees) make up over 50 percent of UK private-sector turnover; insurance penetration is currently patchy, and nothing has primed business owners for the task of identifying and excising risks quite like the past year.

True, the market is depressed at the moment, with many cash-strapped firms canceling non-mandatory covers. And certain lines – like commercial property – will likely remain slack for the foreseeable future as well. However, we can expect fresh demand for many coverage types to hit the market in the second half of this year, now that the country is fully reopening.

Swiss cheese, without the holes

In recent years, there have been attempts to standardise and simplify SMB cover, exemplified by Berkshire Hathaway’s Three – with its promise of three-page policy documents. While this approach can certainly help popularise insurance, it also risks being Swiss cheese: very edible but also very full of holes.

Combining standard policies with point solutions – targeted to fill the biggest of these holes – could be an efficient way to create a large safety net out of several smaller ones. Policy customisation is obviously not a new concept, but what is new are the increasingly elegant and cost-efficient ways that this can be done, such as using parametric solutions.

Parametric products pay out on a pre-agreed trigger event, eliminating the vagaries of the claims process, and are particularly suited to the acute crises that businesses have come to fear the most.

Take COVID-19, for example. Following lockdowns, the UK government stepped in with business support, which has absorbed some of the pandemic’s chronic sting. However, irrespective of its size and scope, this support was not immediate, putting firms with shallower reserves at risk of bankruptcy. Such “acute phases” are fertile ground for parametric innovation.

Lloyds Lab participant Thimble have designed a low-limit parametric BI product specifically to provide firms with a stopgap as soon as a qualifying event – such as a lockdown mandate – occurs. This small but instant lifeline ensures that small businesses do not run out of funds while waiting on government aide, or potentially drawn-out or litigious insurance claims.

Other areas of parametric innovation right now in the Lloyds market include IT downtime risk (e.g. Parametrix), terrorism risk (e.g. Qomplx) and cyber risk.

The SMB cyber opportunity

Although ongoing market hardening and price hikes may undermine its near-term appeal for SMBs, cyber is an area with strong future growth potential. According to Accenture’s Insurance Revenue Landscape, the line will grow by $25bn globally by the end of 2025 (relative to early 2020).

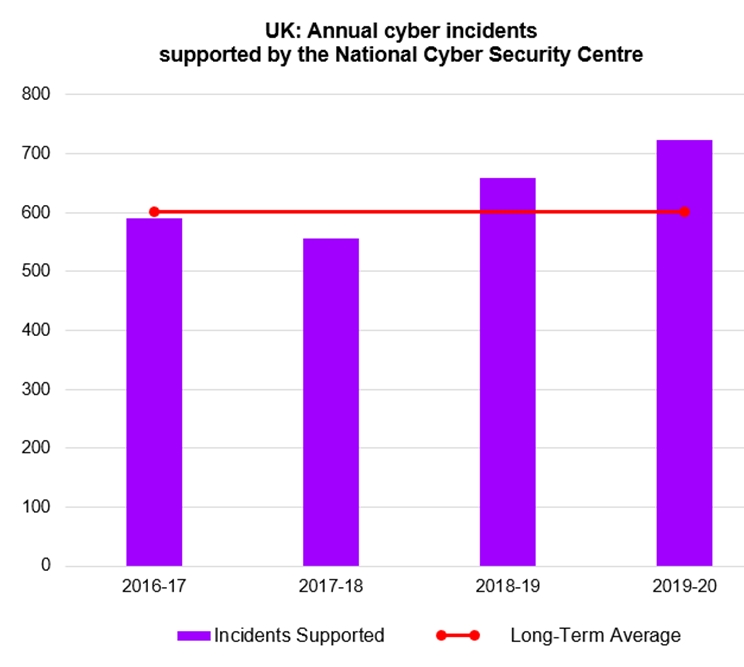

Firms of all sizes have reported a heightened perception of cyber risk during the pandemic. And they would not be wrong. The National Cyber Security Centre (NCSC) reported 723 cyber incidents in 2020 (“incident” defined here), a 20 percent rise on the long-term average. Around a quarter of these were seeking to profit in some way from COVID-19.

Source: NCSC Annual Review 2020

While larger corporations, especially those with multiple sites, had secure remote systems access before the pandemic, this is rarer among SMBs. The remote-working trend, which is likely here to stay, has meant small firms with makeshift arrangements are henceforth prime targets for hackers.

Much still needs to happen for cyber insurance to be both affordable and effective in the long run. One important lever for insurers will be partnerships with cybersecurity providers – by ensuring that insureds have basic protection in place, carriers reduce gratuitous exposure and put themselves in a position to price more affordably. There is also an opportunity to use cybersecurity software packages as an indirect sales channel for coverages.

Open Insurance for SMBs, via APIs and neobancassurance

Increasingly, insurers can build precise solutions for many SMB challenges. However, the problem of how to take these to market remains. One avenue we have touched on is the standard policy document, especially as a bridge to more customised solutions. But intuitive policies are not the only way to gain mass appeal, intuitive distribution is a powerful tool also.

One promising distribution approach is to embed cover within other services – as in our example of bundling cyber insurance with cybersecurity software. Indeed, approaches leveraging ecosystems and APIs (as in Open Banking) are especially well suited to the SMB context.

Small firms often consume more services – from finance and legal to HR and risk – than they employ specialists. As a result, insurance often ends up as a side job or forgotten about entirely. However, the consolidation of different services onto common platforms unlocks administrative economies of scale. And the accompanying consolidation of firm data leads to better-fitting services too.

We see this dynamic in action at neo-banks, some setting their sights on being a one-stop-shop for SMB financial needs.

For example, Tide Bank has partnered with Hokodo to offer on-demand invoice insurance on top of its core banking services. Starling Bank, through its marketplace, has partnerships with Dinghy (cover for freelancers), So-Sure (mobile phone insurance) and Nimbla, whose invoice protection service also integrates directly with accounting platforms like Xero and QuickBooks.

It’s early days for neo-bancassurance and Open Insurance more generally, and traditional channels still have many things in their favour.

For a start, the complexity of small firms’ needs – especially if off-the-shelf covers are to be combined with custom products – augurs well for the future of advised sales. However, there are ample improvements to be made here too. Insurers can turbocharge broker channels through the right digital investments, for example by building out their self-service quote-and-bind platforms.

Keep an eye out for rot in the back book

As we have seen, 2021 presents commercial insurers with opportunities both conventional and emerging.

Conventional in the form of hardening rates in key lines, provided they can steer clear of long-tail liabilities from COVID-19. Emerging in the form of a severely rocked SMB sector with an increasingly pragmatic view of insurance.

However, just as the pandemic has created new risk opportunities for carriers to go after, it has also created new exposures within existing categories – some of which are less visible than others.

Let’s take healthcare as an analogy. A year of delayed procedures and voluntary postponement of GP appointments means a year of undiagnosed and untreated illnesses. While new customers can be underwritten on an “as is” basis, it’s unclear exactly what the lockdowns mean for health insurers’ back books. So, we ask: are analogous issues lurking across commercial and specialty lines?

Conservatively speaking, the past year has represented a “maintenance gap” of sorts, and this could materialise in higher rates of attritional claims as the country opens back up. Commercial property is an obvious place to look, especially as regards underused piping and HVAC systems.

The same concern applies to idle marine and aviation stock. And a related, perhaps more hidden, exposure lies in the associated overloading of harbour facilities. These bring into play alarming accumulation risks absent when the global supply chain is functioning optimally, such as fire and explosion.

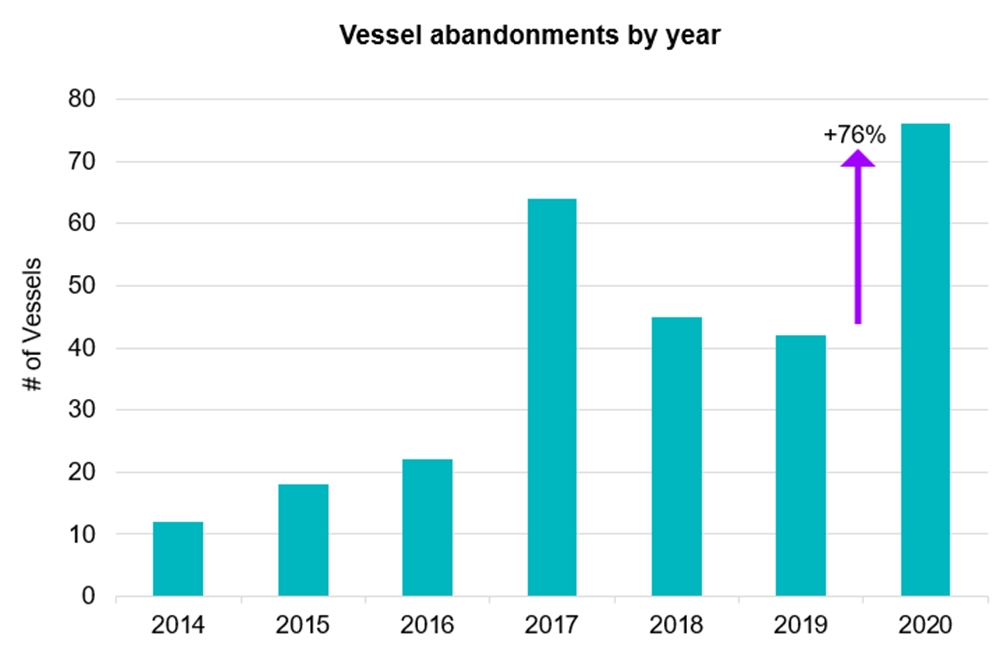

A particular contributor here has been the recent upwards trend in vessel abandonments. This reached a new peak in 2020, as maritime trade slumped and financial troubles mounted for shipowners, with the International Labour Organisation (ILO) reporting a 76 percent annual increase in cases.

Source: International Labour Organisation (by abandonment date, not notification date)

It’s not just hulls of abandoned ships that can prove to be ticking timebombs, but their contents also. The Beirut Explosion in August 2020 was ultimately traced back to 2,750 tonnes of ammonium nitrate being stored in a harbour warehouse – the one-time cargo of the Rhosus, abandoned and impounded at the port in 2013.

Much of this back-book rot – a by-product of temporary lockdowns – can be re-underwritten, so it should fade away as the global economy gets back into full swing. But it’s worth bearing in mind for commercial insurers that might otherwise be inclined to see 2021 solely as a long-awaited reward for their patience during a nigh on the twenty-year soft market.

Insurance Revenue Landscape 2025: our report examines 4 key areas of innovation that offer revenue opportunities for insurers over the next 5 years.

Learn moreSo, that was the new normal for commercial insurers: a hard market, for the time being at least; opportunities in the SMB sector around product and distribution; and a brood of insidious claim trends to keep one step ahead of. For our take on the rather different dynamic the new normal brings for personal lines, see our earlier entries.

If you’d like to get in touch in the meantime, please reach out to me

Contact James Thomas

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.