5 predictions for the insurance industry in 2026

Insurers enter 2026 amid heightened geopolitical and macroeconomic uncertainty—reshaping risk, pricing, and customer affordability. That volatility isn’t the differentiator; how carriers respond is. The ones pulling ahead today are shifting from reactive execution to deliberate reinvention: they are strengthening their digital core and putting AI to work where it changes outcomes—faster decisions, lower unit costs,…

3 key success factors for AI-led health claims modernization

The potential of AI in transforming health insurance claims management is vast, but realizing its full benefits requires more than just implementing new technology. In our previous blog on this subject, we explored how agentic AI can transform the health claims experience. In this blog, we will provide a roadmap as to how insurers can truly reap the full benefits by endorsing a holistic A.R.T. (“AI-powered, Resilient, Trusted”) reinvention model by rethinking core…

Agentic AI is transforming health insurance claims

Many of us have experienced the frustration of long waiting times to secure a patient slot in a clinic or hospital. Let’s imagine Jane, a policyholder, facing a delay in diagnosis of her acute appendicitis. This delay results in limited treatment options, days of clinical examinations, extra hospital admissions, and additional medical procedures like blood…

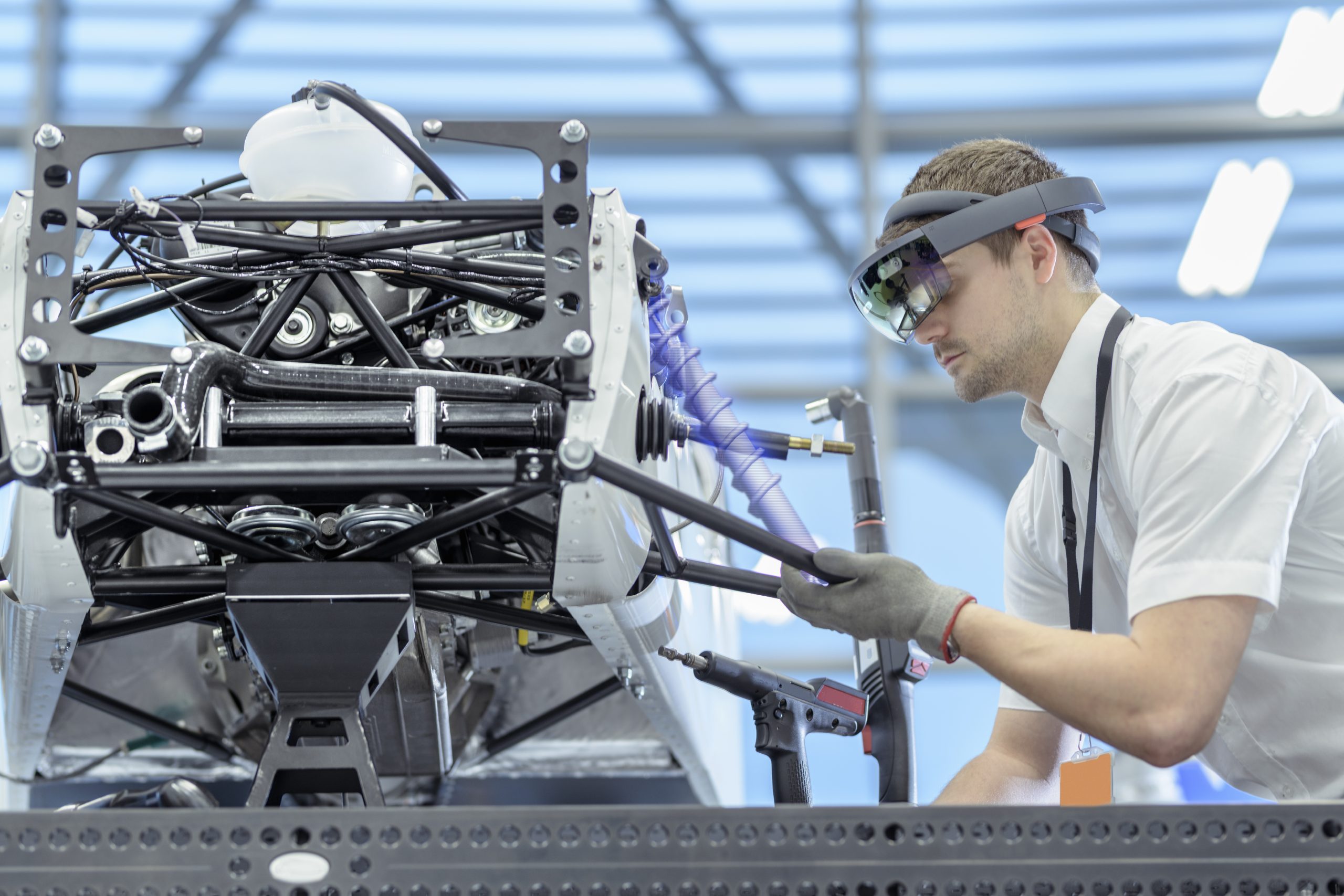

When LLMs get their bodies: Tailored robotic solutions for insurers

The integration of Large Language Models (LLMs) with physical robots is set to redefine the way we interact with the world around us. This convergence, as highlighted in the Accenture Tech Vision 2025 trend “When LLMs Get Their Bodies” promises a new generation of highly tuned, ‘generalist’ robots that can take on a wide variety…

AI Underwriting: Beyond the hype

We have periodically conducted surveys on underwriting for more than 15 years to understand the state of the function and how technology is—or isn’t—helping it to evolve. In our most recent report Underwriting rewritten, we asked what percentage of time underwriters are spending on non-core tasks. This time, we saw some incremental improvement year–over–year compared…

Four key ways for insurers to build resilience in a shifting trade landscape

In the context of fractious global trade dynamics, businesses have no choice but to adapt their strategies for planning, pricing and protection. The interconnected nature of the global economy means that instability in one sector often has ripple effects across others. Insurers are no exception to this with recent trade developments having introduced a more…

Khalid Lahraoui & Kenneth Saldanha & Naoyuki Shibata

5 predictions for the insurance industry in 2026

Marco Tsui & Sher Li Tan

3 key success factors for AI-led health claims modernization

Marco Tsui & Sher Li Tan

Agentic AI is transforming health insurance claims

Venkat Viswanath & Cindy De Armond

When LLMs get their bodies: Tailored robotic solutions…

Michael Reilly

AI Underwriting: Beyond the hype

Khalid Lahraoui

Four key ways for insurers to build resilience…

Dernières Réflexions

Nos Blogueurs

Le Plus Populaire

5 predictions for the insurance industry in 2026

Insurers enter 2026 amid heightened geopolitical and macroeconomic uncertainty—reshaping risk, pricing, and customer affordability. That volatility isn’t the differentiator; how carriers respond...

The new learning loop: How insurance employees can co-create the future with AI

The annual Accenture Tech Vision report is in its 25th year and continues to be a huge source of insight for our technological future. This year, AI: A Declaration of autonomy features four key trend...

3 ways to prepare the insurance workforce for the generative AI era

With 30% of insurance workers reaching retirement age by 2030, and the rise of generative AI, including the emergence of agentic systems, the insurance industry’s workforce is poised for a major trans...

AI Underwriting: Beyond the hype

We have periodically conducted surveys on underwriting for more than 15 years to understand the state of the function and how technology is—or isn’t—helping it to evolve. In our most recent report Und...

Your face in the future: Humanize your insurance brand experience to differentiate

In its 25th year, the annual Accenture Tech Vision report continues to be a guiding light for the future of technology. This year, the report highlights four key trends that are set to revolutionize t...

The binary big bang: Building agents that build apps in insurance

The annual Accenture Tech Vision report has always been a beacon for the future of technology. Now in its 25th year, this year’s report AI: A Declaration of autonomy highlights four key trends that ar...

How to achieve profitable portfolio decarbonization in insurance

Throughout history, insurers have been pivotal in driving social change, enabling human progress, innovation, and prosperity. From seatbelts to vaccines and fire-retardant materials, insurers have fos...

Agentic AI is transforming health insurance claims

Many of us have experienced the frustration of long waiting times to secure a patient slot in a clinic or hospital. Let’s imagine Jane, a policyholder, facing a delay in diagnosis of her acute a...

When LLMs get their bodies: Tailored robotic solutions for insurers

The integration of Large Language Models (LLMs) with physical robots is set to redefine the way we interact with the world around us. This convergence, as highlighted in the Accenture Tech Vision 2025...

Four key ways for insurers to build resilience in a shifting trade landscape

In the context of fractious global trade dynamics, businesses have no choice but to adapt their strategies for planning, pricing and protection. The interconnected nature of the global economy means t...