Other parts of this series:

As the insurance industry further adopts artificial intelligence, a change in mindset is the key to finding and nurturing the right talent to design, craft and manage the technology.

In my previous post, we looked at the AI “secret sauce” for insurers. Continuing on our AI journey, it’s time to have a more in–depth look at one of the ingredients: talent. Specifically, the importance of the right talent to design, craft and manage AI solutions; the investment needed; and finding the balance between augmenting and automating.

If you took the AI readiness quiz earlier in this series, you will know the key operational questions insurance leaders must ask on their AI journey. They include:

- How does my workforce need to change to enable AI?

- Where are my talent deficits?

- How do I attract / build talent to enable / support AI on an ongoing basis?

- How do my business and IT operating models need to change to enable AI over the near and long term?

- How do I scale AI across my organization?

Commonly, an organization’s initial answers may reveal this truth bomb: organizations and people are not ready for AI.

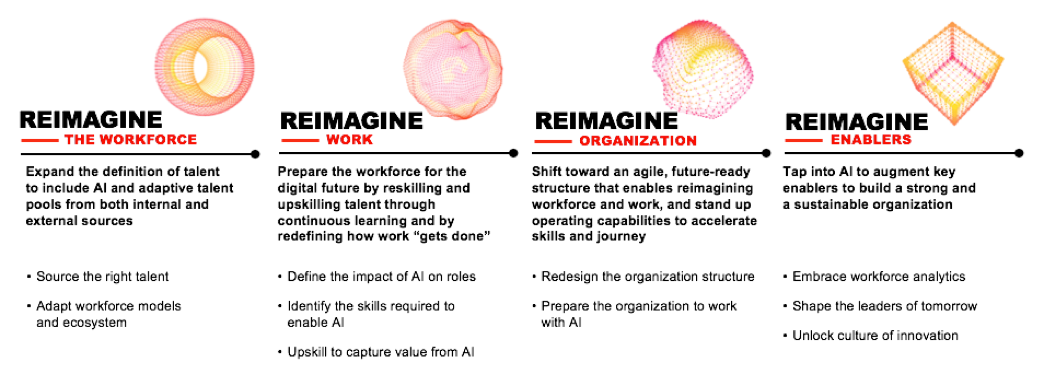

AI is the catalyst to reimagine the workforce

Change—particularly that brought on by technology—can be scary. In my first post, I touched on the fact that the insurance industry has been slow to fully adopt AI. The below statistics demonstrate why:

Reimagining the workforce requires a shift in mindset

Despite knowing that intelligent technologies will create value and innovation, insurance leaders are in a mental holding pattern. Instead of looking at AI as an expensive or risky change, it’s important to view it as a way to reimagine the work and talent framework.

Once you have reimagined this framework, it’s easier to see where AI fits in your enterprise now, and when, where and how it can be implemented.

Here are some common starting points:

- Automation of business functions—what can be made more efficient and will allow employees to work on more value-added tasks?

- Scanning of unprecedented amounts of data—what additional information can be leveraged?

- Analytics more widely available—what can be forecast?

Once companies clear the hurdle of doubt, they can begin to plan and implement a successful AI strategy—one that enables and empowers their organization and people to be properly equipped and skilled to leverage the benefits of the technology.

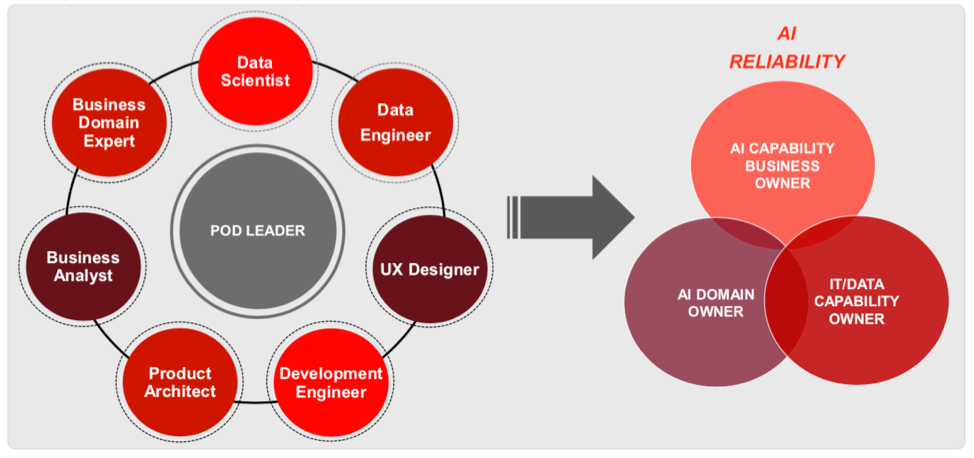

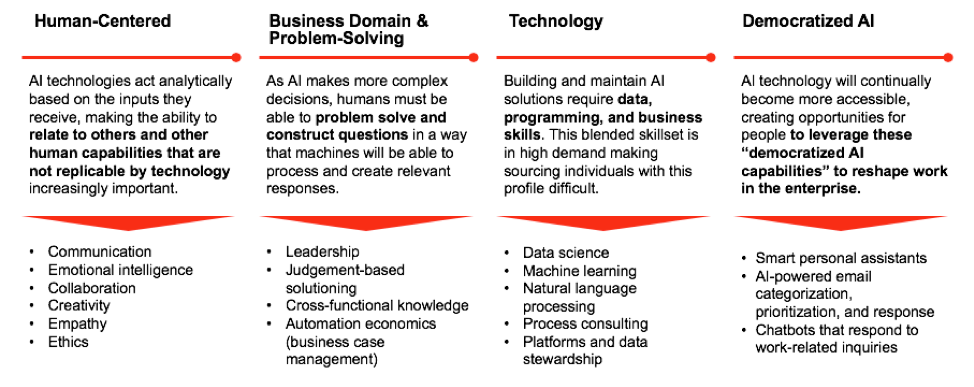

Investment and unique skills and are required to staff AI build teams

Implementing AI means that carriers need to establish new business capabilities—capabilities that require a new talent profile of skills and competencies in order to create value. Insurance leaders should be willing to invest in order to obtain those skills and competencies; both to attract outside talent and to upskill current employees.

Find the right balance of augmentation and automation

When looking at what can be automated or augmented, and the skills needed to realize the vision, it is imperative to find the right balance between automating and augmenting.

In times of tech disruption, there is often an air of uncertainty—which can trickle down from leadership. It’s no surprise that workers are concerned about how, in this case, AI will affect their jobs through automation and augmentation. At the same time, hesitant leaders should know that employees are keen to work with AI. Sixty-two percent of employees believe intelligent technologies will create opportunities for their work and 67 percent feel it will be important to learn new skills to work with AI.

Investment, firm buy-in from leadership, and the right strategy will attract the needed talent and elevate employees to more rewarding roles and value-added work with AI. Equally important on the AI journey is to explore and implement the technologies in a responsible fashion. This will be the topic of my next post.

For more insight into AI for insurance, download the Accenture Technology Vision 2019 for Insurance, or get in touch with me here.