Other parts of this series:

Breaking down the what and how of AI, and why insurance carriers need to map out their game plan ASAP.

A recent Accenture Technology Vision for Insurance survey shows that the majority of insurers know DARQ technologies—specifically AI—will be transformational or will bring extensive change to their businesses (DARQ includes distributed ledgers, AI, extended reality and quantum computing). The insurance industry is among those most susceptible to future disruption, but it has been hesitant to fully adopt AI and take the reins. Only 50% of carriers are in the evaluation or pilot stage and only 29% have adopted a form of AI into the fold.

In an industry based on assessing risk, insurers may perhaps feel a bit mystified or overwhelmed by AI. Technology continues to evolve at a pace that the industry is not accustomed to, but firms that haven’t adopted AI need to dive in and keep up with competitors who are maximizing the benefits of the technologies.

In this series we will take a journey through AI—beginning with a review of the technology, and how insurance carriers can begin implementing a strategy to address its opportunities and challenges.

What is AI in the 21st century?

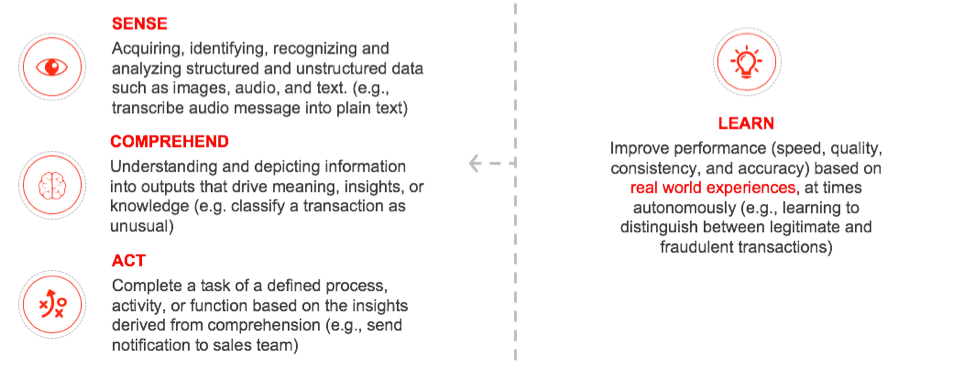

AI is a collection of different technologies that enables machines to act with the semblance of human-like intelligence. With a framework of carefully mapped out capabilities, AI allows machines the foundational skills to sense, comprehend and act.

Most important in the mix, however, is the more recent ability for machines to learn. This is a true game-changer, spurring digital trends that continue to disrupt the industry and customer patterns that adapt in response. These four components make up the single biggest technology revolution the world has ever seen—but some insurers remain hesitant.

How can a machine learn?

An initial thought may be that AI would tolerate too great a margin for error in an industry based on details. But machine learning is all about the details—more accurately, the data, and its resulting algorithms:

- Supervised learning – Using labelled data sets to help identify a specific object. E.g. how your phone identifies a face, food, etc. in your photo album.

- Unsupervised learning – Using unlabeled data sets to identify similarities and anomalies. E.g. to identify a fraudulent claim.

- Reinforcement learning – Using trial and error to create a significant data set where the machine learns through positive or negative reinforcement. E.g. text summaries for dialogue systems.

What AI can do for insurance today?

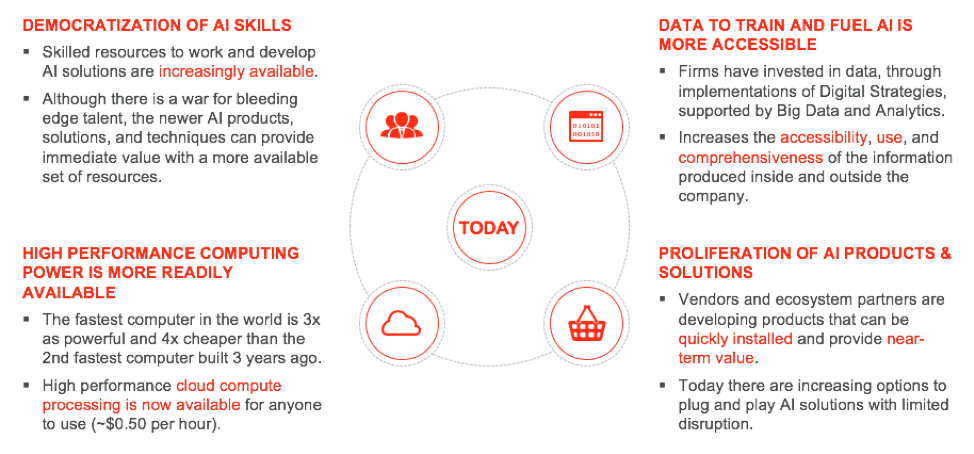

Current combinatorial technologies are making AI affordable, doable, and available today.

AI can be leveraged for insurance advice, underwriting, claims processing, fraud prevention, risk management and direct marketing. To free underwriters from tedious data entry, AXA XL is currently piloting AI and natural language processing software to help populate and process information on commercial business properties. The solution automates the production of the engineering survey reports used for providing appropriate insurance coverage and accurate pricing.

And when we look ahead, there are many promising opportunities; but insurers need a strategy to succeed and stay relevant.

Insurers need to adopt AI to stay relevant in the digital landscape

Accenture’s Living Business Survey found that 64% of the times that customers shift from one insurer to another, it’s to seek a more relevant product, service, or experience—at the same speed they can order an Uber. This is where legacy companies have struggled, but where innovative insurtechs have shone. The good news is that it’s not a lost cause.

Customer behavior and advances in technology have opened the door for AI to create value, reduce costs, increase efficiency and achieve higher customer satisfaction and trust. It has also inspired the opportunity for strategic partnerships, like MetLife choosing to offer travel insurance via WeSure and the recently announced partnership between Belgian insurance leader Ethias and Paris-based startup Shift.

But this can’t happen without a strategy.

What is required to make AI happen?

As the foundation for future business, and because of its complexity, AI requires flexibility and strategy for value creation and sustainable growth. Insurance companies need to become ‘living businesses’ that have a better understanding of the changing digital needs of customers; all the while considering the following dimensions:

- Responsibility and ethics

- Technology and data architecture

- Business value

- Workforce and talent

In my next post on the AI journey, we will look at the questions insurance leaders need to ask and answer when adopting an AI strategy in their business model. For more insight into AI for insurance, download the Accenture Technology Vision 2019 for Insurance, or get in touch with me here.