Other parts of this series:

As part of their strategy for intelligent technology adoption, insurers must address the unique ethical concerns surrounding AI.

AI is the single biggest evolution of technology the world has ever seen. It opens the doors for carriers to elevate their organizations and employees and create a brand-new experience for customers who are wary of the industry. Within the strategy insurers choose, a responsible approach to AI must be ingrained.

As AI accelerates, unique ethical concerns come into play

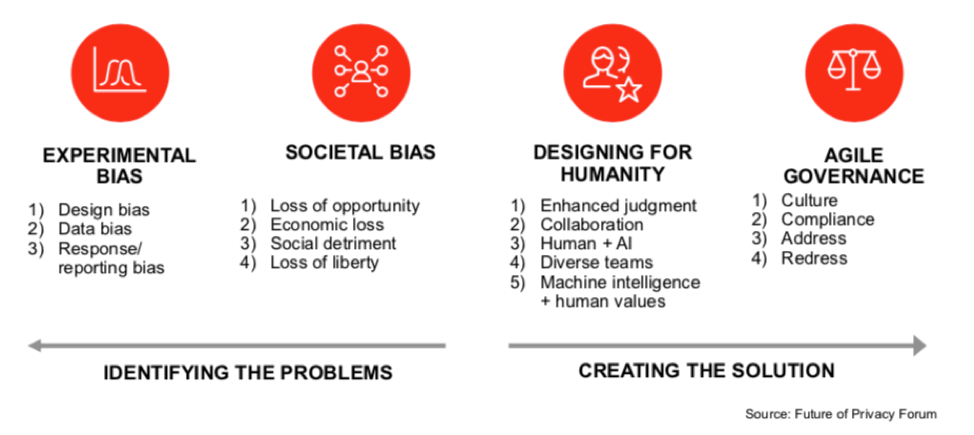

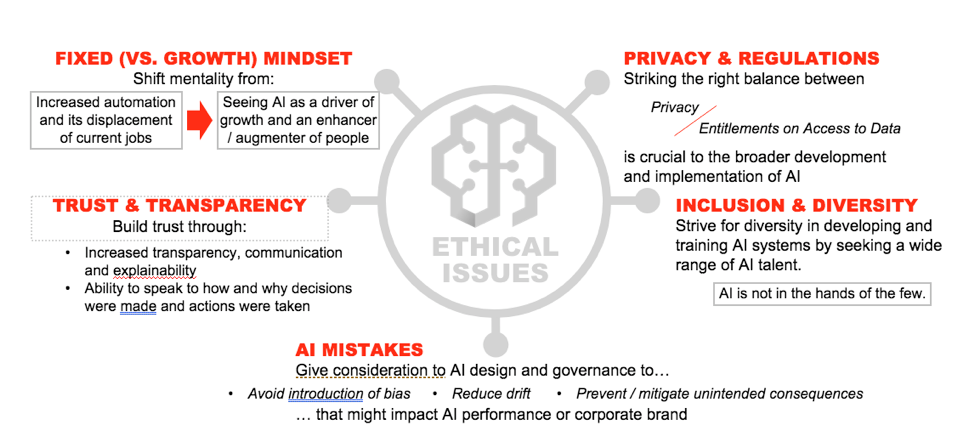

AI is progressing rapidly, but the topic of AI governance is still very new, with no industry consensus on standards. Not having a specific governance framework may bring to light ethical concerns such as:

- Job displacement as a result of increased automation.

- Lack of transparency and ability to understand how and why decisions were made and actions were taken (e.g. black box algorithms).

- Bias and drift from the desired state, amplified when using AI .

- Lack of diversity in how systems are developed.

- Data privacy and entitlements on access to data.

Ethical concerns should inform the AI journey

If not addressed from the start, ethical concerns can have a detrimental effect on, and even halt, AI adoption. This is where it’s key to know what strategy is right for your organization. In gauging your AI readiness these concerns may have come up. (A recent Accenture Insurance Influencers podcast episode also shares insight into the ethics of AI in insurance.)

A simple way to map them out can look like this:

Avoiding bias is integral to AI governance

Avoiding bias is important, but it’s a particular concern when hiring—not just for AI implementation roles, but overall. Ironically, bias in AI-based hiring…is due to AI-based hiring.

To streamline the recruiting process, some financial services companies have begun to use AI in the initial candidate search process: sorting resumés and getting candidates to speak with robots via webcams. But the drawbacks of AI-based hiring have included algorithms that unintentionally develop biases, the consideration only men for IT roles, and the automated rejection of resumés without good reason.

With these concerns in mind, many companies like Bajaj Allianz have implemented AI-based hiring with the goal of nipping bias in the bud. It’s all about how and what kind of data is fed to the algorithm.

Carriers must recognize the line between privacy and customization

Eighty-four percent of insurance executives believe that consumers’ ‘digital demographics’ are becoming a more powerful way to understand customers and more than 80 percent of consumers are willing to share more personal information with their insurer in return for benefits such as lower pricing, and priority or more personalized services. But as incumbent insurers strive to catch up to startups like Lemonade, and evolve to stay relevant to customers, they are aware that there is a fine line to walk with the large amount of data to which they can gain access.

Spanish insurer Caser Seguros addressed a privacy concern of its motorcycle customers with its ReMoto product. For context, some motorcyclists are reluctant to share journey information with insurers in real-time, but fear being stranded after an accident on a solo run. ReMoto features a custom device that geolocates an insured motorcyclist only at the time of an accident. It gives customers personalized, lifesaving help when they need it, while addressing their privacy concerns.

The EU’s Data Privacy Law has also placed AI use in insurance under close scrutiny.

The stakes are high if ethical concerns and AI governance are not addressed at the start

- If unaddressed, the unique ethical concerns surrounding AI can lead to:

- Poor AI performance, causing limited to no value from the investment made.

- Regulatory implications, resulting in an inability to use the existing AI solutions.

- Employee resistance to AI, affecting adoption rates.

- Embarrassing PR incidents, affecting the corporate brand.

- Bad publicity, putting the survival of the company at risk.

- Unintentional infringements of the law, legal actions, and fines and settlements.

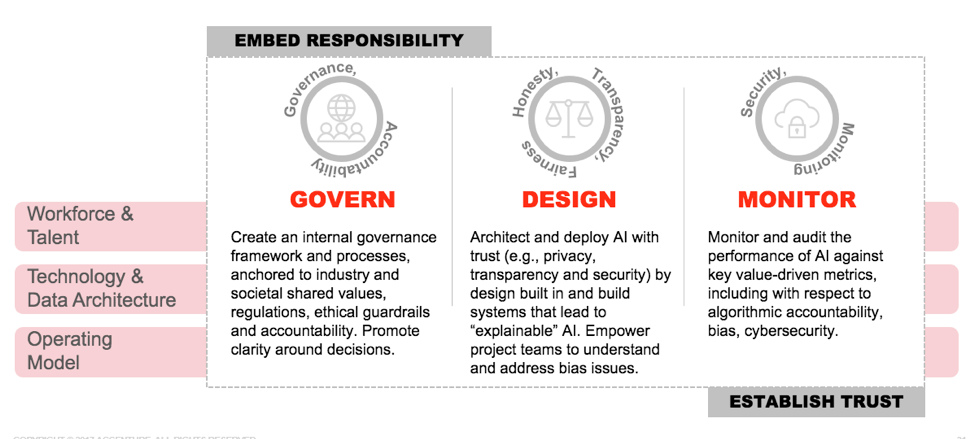

Embed responsibility, establish trust

The responsible adoption of AI is the only way to (re)establish trust within an organization and with insurance customers. Through solid governance, transparent design and secure monitoring, carriers can adopt the right AI strategy with confidence.

In this blog series, we have covered a lot of ground on the AI journey for insurance. For more insights, download the Accenture Technology Vision 2019 for Insurance, or get in touch with me here.