Other parts of this series:

How ready is your company for an artificial intelligence strategy? Take the AI readiness quiz to answer the questions every insurance leader should ask.

In my previous post , we reviewed the what of artificial intelligence, along with the current and future possibilities it presents for forward thinking insurers. The next step on the AI journey is to establish a strategy by addressing key concerns that are top of mind for the company.

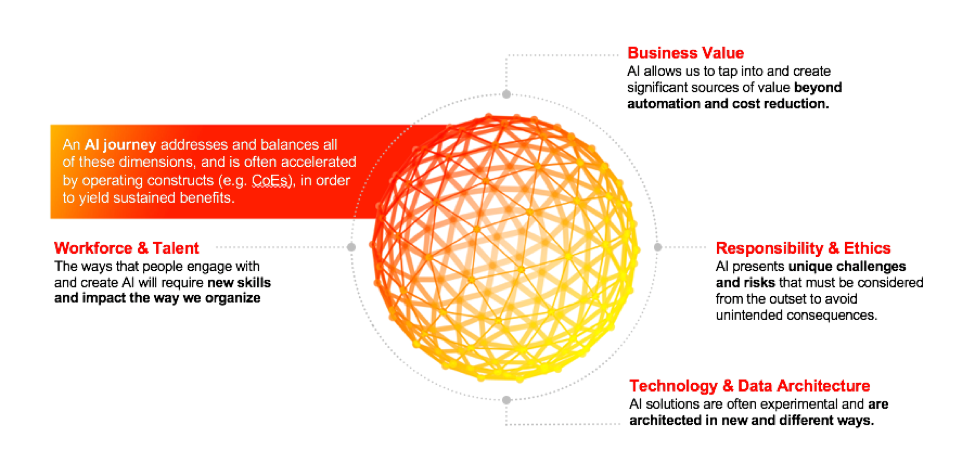

The dimensions of the AI journey

In order to yield sustained benefits, your chosen strategy must address and balance the following dimensions:

- Responsibility and ethics

- Technology and data architecture

- Business value

- Workforce and talent

While you may be keen to adopt AI in your business model, it’s unlikely to be a perfect fit across the board. One area may be ready for new technologies to create value in a sustainable fashion, but the others not—at least not yet.

While you may be keen to adopt AI in your business model, it’s unlikely to be a perfect fit across the board. One area may be ready for new technologies to create value in a sustainable fashion, but the others not—at least not yet.

An example of a company that chose one area to focus on is Metromile, which last year began leveraging artificial Intelligence and sensor data from low-impact car crashes to tackle insurance fraud. This was an area where they felt they could create an efficiency to help automate the process and to fight against fraud that contributes to rising insurance rates.

The questions every insurance leader must ask when considering an AI strategy

To address the four dimensions of the AI journey, there are three categories of questions a leadership team must answer in order to go down the AI path with purpose. I recommend grabbing a pen and paper to take this ‘quiz’. There are no wrong answers; this is simply a pulse check.

Strategic

- How will AI affect my customers, and what does that mean for my company?

- Where is my company most vulnerable to AI-induced competition / disruption?

- What priority AI use cases should I focus on?

- How will AI’s changes in human-machine interaction affect my workforce and organization?

Operational

- How does my workforce need to change to enable AI?

- Where are my talent deficits?

- How do I attract / build talent to enable / support AI on an ongoing basis?

- How will AI be governed?

- How do my business and IT operating models need to change to enable AI over the near and long term?

- How do I scale AI across my organization?

Tactical

- Which parts of my organization are best suited to leverage AI over time?

- Which parts of my organization are likely to derive the greatest value from AI in the near term?

- Which specific AI business opportunities have the greatest value?

- Which standalone AI proof-points would be good for AI pilots?

- Which types of AI are likely to be of most benefit to my company – and over what timeframe?

- What development process will I use to create and deploy AI solutions?

- How does my technical architecture need to change to support AI?

What insights have your responses provided you?

Answering the tough questions provides clarity of vision

Now that you’ve answered the ‘quiz’, you may have greater insight into where AI can fit within your business model now, and what needs to be done for it to expand in the future.

The top four insurance companies in the U.S. recently implemented machine learning in key areas where they felt it would create efficiencies and value. This shows that while insurers may be tentative in their explorations of AI, when they look at the big picture, they make the decision for what is right at the time.

In my next post, we will look at the ‘secret sauce’ of AI. For more insight into AI for insurance, download the Accenture Technology Vision 2019 for Insurance, or get in touch with me here.