Other parts of this series:

Insurers need to adapt while pushing standards and regulations forward to make the new world as insurable as the old.

In the first two parts of our series, we’ve discussed how changes in the technology, ecosystems, workforce and customer relationships are affecting insurance companies. The fifth trend – The Uncharted – is the untrodden path. This is where new digital industries are invented and shaped, and where new standards must be developed. It has its own set of opportunities — but also its own pitfalls — as revealed in our Technology Vision for Insurance research.

Trend 5 — The Uncharted

What are the safety standards for an industry that never existed before? What insurance products and what partnerships will be needed? How, for example, do you underwrite autonomous vehicles that have no loss history, are evolving quickly, and whose manufacturers have promised consumers deep premium discounts?

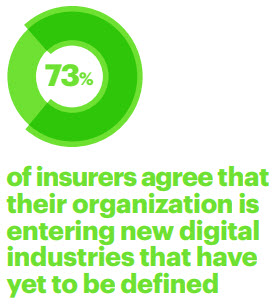

Insurers are feeling both exhilaration and trepidation these days as 73 percent report that their organizations are entering new digital industries that have yet to be defined. Our new world of robotics, artificial intelligence, 3-D printing, the Internet of Things, and other technologies creates new opportunities for insurance, but perhaps not for traditional insurers relying on age-old, proven protocols. To master the uncharted future, insurers must become adept at incorporating digital technology into their organizations to build innovative products, services and business models that serve the new, uncharted reality.

Insurers are feeling both exhilaration and trepidation these days as 73 percent report that their organizations are entering new digital industries that have yet to be defined. Our new world of robotics, artificial intelligence, 3-D printing, the Internet of Things, and other technologies creates new opportunities for insurance, but perhaps not for traditional insurers relying on age-old, proven protocols. To master the uncharted future, insurers must become adept at incorporating digital technology into their organizations to build innovative products, services and business models that serve the new, uncharted reality.

Gone are the days that insurers can – or even wish to — do it all themselves. Pulling off such dramatic change requires the right partner.

Duck Creek’s suite of software provides the modern features, functionality and agility needed to support business transformation. It can rapidly configure new products and bring them to market quickly, allowing insurers to innovate and act on emerging opportunities. And Accenture integrates its proven digital innovation into the heart of Duck Creek, employing its connected platform as a service, to enable insurers to harness the wealth of data generated by telematics and the Internet of Things. Together, the companies are pioneering new business models for insurance that integrate digital ecosystems, connected cars, connected homes and other innovations. Accenture is even providing the first Blockchain proof of concept with Duck Creek and Ethereum to simplify medical payments and eliminate fraud.

Another major uncharted area involves a vacuum — the absence of agreed-upon regulatory standards. In fact, 61 percent of insurers believe the regulatory environment for their industry or business is outdated. Civil and criminal liability standards, for example, have not kept up with emerging risk from new motor vehicle safety features and levels of vehicle autonomy.

Insurers who work with regulators to update and shape the new rules of the game will help create trust among consumers, businesses and governments and win a spot near the center of their new ecosystem.

Into the future

The future belongs to insurers who prepare for and embrace change. They will create new revenue streams, transform the cost curve and establish new roles they can fill.

Opportunities abound for insurers who reinvent themselves, latching on to new technologies such as autonomous and connected vehicles or precision agriculture and shifting their focus toward preventing losses, not just paying for them. They are the organizations that will deliver a highly personalized experience to customers and provide new products and services – delivered fast.

Speed is a huge competitive advantage in this climate, and the right technology partner can quickly move a business idea from possibility to reality. Insurers embarking on this journey also need predictable delivery results and reduced implementation risk, which the right partner can bring.

There are additional benefits to working with a single partner to seamlessly help plan, test, provide and implement technology for the entire journey. Duck Creek and its premier partner Accenture have a long and successful track record of working together and can help clients achieve outstanding results.

Given the amount of investor interest in Insurtech and AI, change is speeding up across all industries. Savvy insurers have begun staking their claims to business in a new environment. Waiting is no longer an option.

For more information read Technology Vision for Insurance 2017: Duck Creek

For more information read Technology Vision for Insurance 2017: Duck CreekEarlier posts in this series: