Other parts of this series:

Successful connected wellness services create substantial value for life insurance providers and their customers.

Advances in digital technology have thrust customer relations to the forefront of many organizations’ business strategies. Companies across a variety of industries are using innovative digital solutions to strengthen ties with customers and thereby improve retention, increase cross-selling and maximize new business opportunities.

Many life insurers, however, have held back on investing in these digital solutions. They’ve viewed the traditional gap between themselves and their customers to be too big to be bridged by this emerging technology. Most customers rarely contact their life insurance providers. If they do, it’s usually to query an account, update a policy or make a claim.

Now, this often distant relationship looks set to change. Connected wellness, together with similar offerings such as connected health and some forms of telemedicine, offer carriers a great opportunity to use digital technology to cultivate much closer ties with their policyholders. The benefits are likely to be substantial. We estimate, for example, that life insurers could gain US$16 billion to $24 billion in new revenue in mature markets by tapping the burgeoning demand for connected services that use wearable devices (wearables). Such revenues would be gleaned from market sectors currently underserved by life insurers.

Connected wellness services link large numbers of digital devices, such as wearables, sensors and mobile phones, with sophisticated analytics systems to provide insurers with a constant flow of real-time customer data. Insurers use this data, with their customers’ permission, to encourage policyholders to lead healthier and safer lifestyles, and thereby live longer and claim less. Furthermore, the vast volume of real-time customer data generated by connected wellness services allows insurers to improve significantly their risk assessment and pricing.

Life insurers could gain US$16 billion to $24 billion in new revenue by tapping the burgeoning market for connected services that use wearable devices.

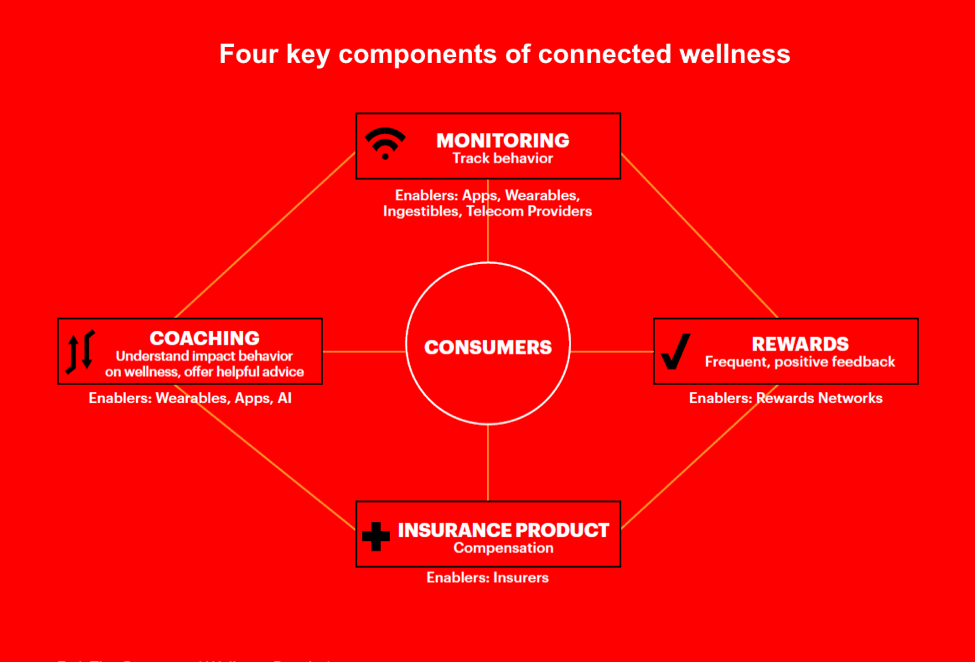

Successful connected wellness services combine insurance products with monitoring applications, that track customer behavior, with coaching and rewards programs to promote healthy lifestyles (See diagram below). Alongside such wellness offerings, some insurers are considering providing complementary services, such as telemedicine facilities that provide customers with fast access to medical care providers. The recent acquisition of American Well, a Boston-based provider of healthcare communications services, by Allianz’s Allianz X venture investment fund is an example of this strategy.

Connected wellness creates value for both the customer and the insurance provider. The customer can benefit from better health, greater safety and quicker access to care as well as enjoy a variety of rewards and incentives. The insurance provider can reduce its costs, strengthen ties with policyholders and deliver a variety of new, potentially lucrative, connected products and services.

Life insurers that don’t embrace connected wellness risk being limited to the wholesale insurance business. Long-term opportunities to grow revenues and expand operations in this sector are modest.

In my next blog post, I’ll discuss how connected wellness can help life insurers transform their businesses so they can take advantage of the many opportunities emerging in the digital economy. Until then, have a look at these links. I’m sure you’ll find them worthwhile.

Connected Wellness: Livening-up Life Insurance.

Seniors want their Digital Health, too.

Evolve to Thrive in the Emerging Insurance Ecosystem.