Other parts of this series:

Between AI chatbots and ecosystems, though, insurers need help to stay competitive

Years of rapid change have brought the insurance industry into a new era, where it is being quickly reshaped by digital technology. Advances come not just from new technologies, but from the many new and innovative ways technology is being deployed to serve people.

This change is clear from Accenture’s Technology Vision for Insurance 2017 research, where 87 percent of insurance responders agreed that advances are no longer marked by linear progress, but by an exponential rate of change. Accenture’s earlier research had recognized that the rising expectations of customers required companies to put people first, and our latest research expands this, showing that power has firmly shifted. No longer are people adapting to technology. Instead, technology is adapting to people.

Today’s technology is far more interactive than in the past. Machines that use combinations of touch displays, mixed reality and natural language feel more human. In fact, artificial intelligence, including image recognition, contextual analysis and deep-learning algorithms, is capable of mimicking humans so well that customers and employees can have satisfying conversations with these machines.

Accenture’s comprehensive research has identified five business trends that will shape the market in the years ahead. Together, they can help savvy insurers identify where they need to be as competitive, relevant businesses in a new environment.

The stakes are high. Property-casualty insurers are embarking on a major journey to provide user experiences that exceed expectations of agents, employees and customers. As with any trek, success is easier and more likely with a knowledgeable guide at your side. A single partner able to provide effective technology and implementation for a comprehensive customer-centric and employee-centric solution can enable an insurer to achieve outstanding results. For this reason, Duck Creek and Accenture are teaming up to provide a single, seamless partnership for the insurer’s entire journey.

Here are two of those trends and what they mean for insurance companies:

Trend 1 — AI is the new UI

Artificial Intelligence (AI) is fast becoming the insurer’s digital ambassador to the world. In fact, Gartner expects AI chatbots to power 85 percent of customer-service interactions by 2020. Insurers, who had been delighted with their gains from assigning rules-based tasks to computers, are moving to the next step: creating robotic process automation (RPA) and AI interfaces that seem more human and approachable for customers, agents and employees. Customers – internal and external — will log in to chatbots or virtual assistants that will draw on internal and external data assets to provide meaningful responses.

Artificial Intelligence (AI) is fast becoming the insurer’s digital ambassador to the world. In fact, Gartner expects AI chatbots to power 85 percent of customer-service interactions by 2020. Insurers, who had been delighted with their gains from assigning rules-based tasks to computers, are moving to the next step: creating robotic process automation (RPA) and AI interfaces that seem more human and approachable for customers, agents and employees. Customers – internal and external — will log in to chatbots or virtual assistants that will draw on internal and external data assets to provide meaningful responses.

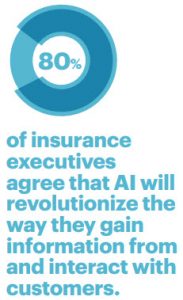

AI’s ability to do this well will drive the bar ever higher. Four out of five insurers are prioritizing ease of use and simplicity in designing a user interface (UI) that provides a more “human” experience. In other words, the interface of the future will only seem simple. Beneath the façade, it will be driven by complex technology processes and data, starting with RPA and moving to AI and machine learning.

Early attempts to automate customer service have not always pleased customers. People still cringe when they have to navigate through a seemingly endless series of phone buttons or computer screens to reach the person or place they wanted. But consumers are ready for satisfying interactions with smart machines. In fact, our consumer research shows that 74 percent of consumers say they would be happy to get insurance advice generated by a computer.

Increasingly, insurers are expanding into information delivery through chatbots. Some, for example, provide general insurance information as a “skill” through Amazon’s Alexa. But this is only the start. In the next skills iteration, Accenture can directly integrate voice assistants like Amazon Echo and Google Home into the Duck Creek platform to sell insurance through a voice interface.

These advances now also require insurers to use a new approach to their purchasing decisions connected with AI. It is unwise, for example, to choose core systems based only on the user interface. Instead. you also should consider how the system can enable other interactions through open-application programming interfaces (APIs) that will engage customers.

Despite initial skepticism of AI, this momentum is very real. In our research, 85% of executives we surveyed report they will invest extensively in AI-related technologies over the next three years.

To make the best use of RPA and AI, though, Insurers need a partner that understands the user experience and has domain expertise and digital capabilities to bring channels to life. Accenture’s DISC, for example, has used RPA to automate business processes across the insurance value chain, and its insurebot capabilities bring the power of RPA to the Duck Creek platform.

Trend 2 — Ecosystem Power Plays

The second trend we’ve observed involves the emergence of digital ecosystems, which in turn is changing the nature of business relationships from traditional partnerships to integrated platforms. For insurers, core business functions like customer service and underwriting will rely heavily on a complex network of digital partners reaching far beyond the walls of a single organization. And platforms will be king – serving as the central hubs for the rich and complex emerging ecosystems.

The second trend we’ve observed involves the emergence of digital ecosystems, which in turn is changing the nature of business relationships from traditional partnerships to integrated platforms. For insurers, core business functions like customer service and underwriting will rely heavily on a complex network of digital partners reaching far beyond the walls of a single organization. And platforms will be king – serving as the central hubs for the rich and complex emerging ecosystems.

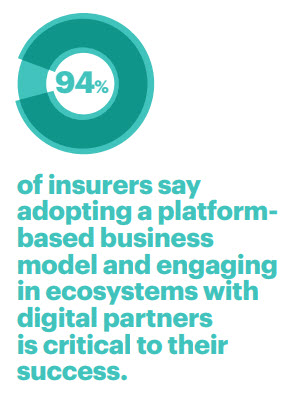

Accenture research shows overwhelming agreement on the importance of platforms, with 94 percent of insurers saying that adopting a platform-based business model and engaging in ecosystems with digital partners are critical to their success.

For savvy insurers, these relationships will enhance their roles in new digital ecosystems and unleash new strategic growth, bringing them new customer touchpoints and access to new markets. More than three in four insurers now believe that competitive advantage will not be determined by their organizations alone, but by the strength of the partners and ecosystems they choose.

Succeeding in these complex ecosystems requires the right planning, technology and expertise. Accenture’s digital capabilities and Duck Creek’s open APIs provide a robust foundation for new ecosystem-driven and platform-driven business models.

Duck Creek’s flexible variety of products lend themselves to customized user interfaces, mobile applications or plug-and-play into systems of ecosystem partners. A multichannel distribution platform can handle front-end, carrier-producer transactions over the web, integrating to agency management systems, comparative raters, claims reporting and other insurtechs and startups. Accenture’s DISC also fosters carrier agility by partnering with traditional third-party vendors and insurtechs to build an ecosystem enabled by Duck Creek.

Interestingly, despite their recognition of the importance of engaging in ecosystems, most insurers are not moving as fast as they say they should. They face growing competition from digital disruptors and other nontraditional rivals, yet our research shows that only 33 percent of insurers are aggressively taking steps to participate in digital ecosystems. We anticipate that more will follow once they see the gains others are making, but there will be opportunities missed.

Accenture can help insurance carriers understand the opportunities digital platforms offer to move beyond traditional insurance. Integrating with powerful ecosystem partners in areas such as connected cars and smart homes can open new channels for insurers.

Next week, we’ll continue the discussion of insurance trends and how to stay ahead.

For more information read Technology Vision for Insurance 2017: Duck Creek