Other parts of this series:

As insurers transform, their workforces must leverage new technologies to work more efficiently, perform new tasks and adapt to new digital-era roles. Now, technology strategies need to be adapted once again to support new ‘human+’ ways of working in the post-digital age. Many insurers have fallen behind, and need to pick up the pace.

Insurers’ workforces continue to evolve and insurance enterprises, optimised for a pre-digital workforce, are not keeping up. Seventy-six percent of insurance executives agree that their employees are more digitally mature than their organisation. This is resulting in a workforce ‘waiting’ for the organisation to catch up.

The challenge for insurers

Insurers cannot support the wider range of career paths that human+ workers are exploring. Their talent-finding strategies are out of sync with the capabilities of human+ workers, and investments in learning and reskilling are falling far short of where they need to be for the high rate of employees transitioning to different roles.

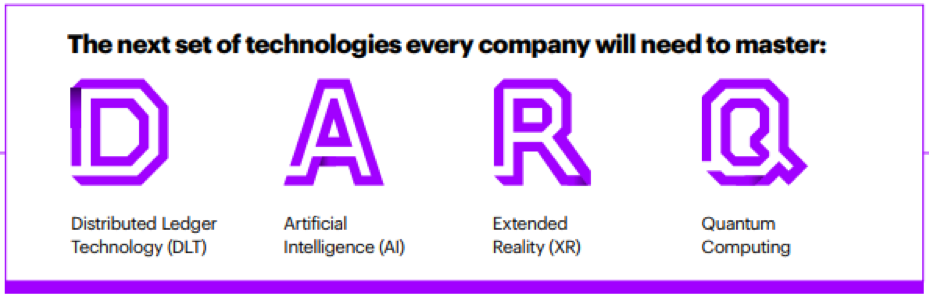

In addition, as the post-digital age dawns, a new set of DARQ technologies—distributed ledger technology (DLT), artificial intelligence (AI), extended reality (XR) and quantum computing—are entering the working environment.

To empower a next-generation workforce, insurers will need to apply a number of strategies. These include rethinking the way they hire, and how they use technologies like AI, XR, people analytics and modern collaboration platforms to prepare workers for new roles, to share knowledge, learn and maximise their potential.

A number of insurers are showing how this can be done.

Technology Vision for Insurance 2021: We outline five emerging technology trends that will impact the insurance industry in 2021 and beyond.

LEARN MORETechnology strategies for a post-digital workforce

Insurance companies such as GEICO and Bajaj Allianz are using automated video interviewing solutions to screen talent and identify good potential matches.

Spain’s Mapfre has piloted the use of VR to reduce the cost of training its loss adjusters in assessments of electric vehicles. Its adjusters no longer need to have a physical car on site for them to interact with. VR makes it affordable to train them on a wide range of vehicle models and inexperienced adjusters can also learn without exposing themselves to electrical hazards.

Sun Life is making institutional knowledge the responsibility of the organisation itself though use of Facebook’s Workplace. It aims to use the platform as a collaborative space to share news and updates on company strategy with employees across 26 countries, highlight articles of interest related to the business, reward and recognise employees, and celebrate key project milestones.

Can insurers close the gap between the organisation and the technology needs of the human+ workforce?

Taking human+ workers post-digital

How can insurers close the gap between the organisation and the technology needs of the human+ workforce?

Two key areas to consider are digitisation of key HR practices and rethinking talent strategies.

- Identify practices that are still optimised for pre-digital workers (e.g., knowledge management, employee learning) and how this negatively impacts the organisation (e.g., driving attrition, low employee engagement, etc.). Then explore how technologies like AI, XR can address these issues, run pilot programmes and industrialise successes.

- There is also considerable value in optimising talent-finding and -acquisition strategies for the post-digital era. Review current approaches, rethink hiring methods and consider the use of AI to assist in finding talent.

Join me next week as I take a look at how DARQ technologies will lay the foundations for a new generation of products and services, and how they can add value to the organisation and its workforce.

Meanwhile, for more insight, click through to Accenture’s 2019 Technology Vision for Insurance.