Other parts of this series:

New generations of workers have different expectations of their employers in terms of technology and ways of working.

The insurance workforce of the future will be shaped not just by automation and augmentation but also by the workers themselves. Our Workforce 2025 research indicates that new insurance employees are bringing with them new values, new attitudes and new ways of collaborating and working. They’re the first generations to grow up with the web, mobile devices, social media, the cloud and other technologies.

These workers:

- Expect technology to be an integral, yet invisible part of their lives.

- Seek a different work experience than older employees.

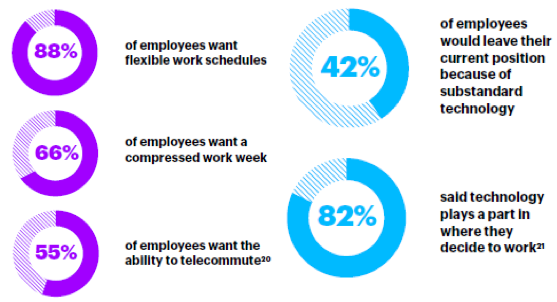

- Choose to work in different ways and seek more flexibility in deciding which employers to work for, how to work and the times when they work.

These expectations could be reinforced by the COVID-19 pandemic, with the current social–distancing and working–from–home measures being taken to flatten the curve. Many workers, who have not been able to work remotely previously, will now have tried it on a temporary basis. How much this affects their long-term expectations of employers, we’ll find out over the coming months.

But even before the pandemic, remote work was growing—across financial services, around nine percent of the workforce in the US were remote workers. The sector was already moving toward more flexible work in facilities and operations, IT, customer support, sales and administrative roles. As a result of the pandemic, insurers are seeing the limitations and advantages of this approach firsthand and gaining insights they can use in future workforce strategies.

Other factors to consider when planning the workforce of the future include:

- Freelancers and contractors bring flexibility and the ability to scale the workforce up and down when needed.

- Tapping into the rising number of on-demand workforce marketplaces and crowdsourcing sites can significantly enhance an organization’s agility.

- HR leaders must focus their strategies on ensuring that people have the right skills for the new jobs that technology enables. Skills associated with data science, machine learning and deep learning are among those in high demand. Additional new roles will emerge as humans and machines collaborate in a new environment.

- There is a valuable potential pool of experienced senior talent for insurers to tap into, with more workers delaying retirement out of financial necessity and to stay active.

With the right talent mix and engagement strategies, and a diverse and multi-generational workforce, insurers that heed workers’ changing expectations will be well placed to grow their business and take advantage of productivity gains.

To discuss how Accenture can help you plan for the workforce of 2025, reach out to me directly, or read the Accenture report: The Financial Services Skills & Roles of the Future

For information on navigating the human and business impact of COVID-19, see our site for insurers.