Other parts of this series:

Learn which insurance workforce roles are expected to be the most affected by automation and augmentation.

In recent weeks, as a result of the COVID-19 pandemic, the North American insurance workforce has had to adjust to new working conditions in unprecedented ways. To meet the social-distancing measures required to flatten the curve of the virus, many workers are working from home, leaving just a core team of essential workers in the office. These temporary changes are likely to affect where and how work gets done in the future as management gains insights associated with a dispersed workforce’s impact to productivity, innovation, collaboration and cost. Looking to the future, we’re seeing other changes impacting the workforce that we expect will have a potentially even greater impact.

Automation and augmentation

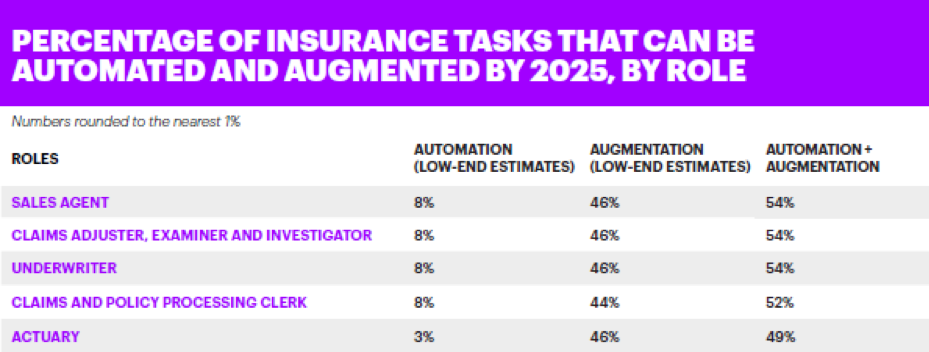

Automation and augmentation are two areas I’m watching closely. Accenture’s recent Workforce 2025 research found that accelerating automation is driving significant cost savings across the entire financial services sector while augmentation has the potential to unleash massive productivity gains. For insurers, a number of workforce roles are likely to be affected.

Finding the right talent will be critical

To enable this degree of automation and augmentation, competition for talent has been fierce in the insurance industry—workers with capabilities in digital technologies, automation and analytics are in particularly high demand.

The Brookings Institution analyzed the 13 million new jobs created in the US between 2010 and 2016 and concluded that some four million of these new jobs required high-level digital skills, while nearly 8.1 million demanded either high- or medium-level digital skills. It also found that only 41 million American jobs in 2016 did not require significant digital skills while nearly 100 million did.

Insurers will need to decide whether to build the workforce’s competencies from within; buy capabilities through external recruitment; borrow capabilities from other departments within the organization or external partners; or assign specific tasks to a robot or artificial intelligence (AI).

The nature of work will change for frontline workers

Insurers also need to reassure their workforce that automation and augmentation won’t ‘take away’ their jobs, and their customers that they will still be able to talk to a person when they need to. Rather than removing the human touch, automation will help insurers offer personalized and human experiences at scale.

By automating the front- and back-office tasks, insurers will have opportunities to provide workers with meaningful work and to emphasize relationships rather than routine transactions. Our research suggests that by putting algorithms back ‘under the hood’, AI and other intelligent automation tools will free people to do what they do best: inspire, create, influence, lead, judge, problem-solve and counsel.

Insurers need to build trust

Leading insurers already know that employee trust is key when it comes to building a capable and dependable workforce. They recognize that front-line workers feel particularly vulnerable and anxious about the changes that will result from automation and augmentation. They will share their workforce strategies and be transparent about how they plan to build the workforce’s competencies, so that workers know they are valued and feel empowered to embrace new tasks and roles.

Over the next seven years, automation could save the North American insurance industry between $5-7 billion and augmentation could provide productivity gains of $23-37 billion. Insurers that choose not to or are slow to adopt these technologies are providing opportunities for their competitors and industry newcomers to gain an advantage and increase market share. But along with these technologies, insurers should not forget the workforce—the new capabilities they will need and the skilled people who will deliver them.

To discuss how Accenture can help you plan for the workforce of 2025, reach out to me directly, or read the Accenture report: The Financial Services Skills & Roles of the Future

For information on navigating the human and business impact of COVID-19, see our site for insurers.