Other parts of this series:

From talking to workers, to mapping job tasks, to scaling up ‘new skilling’—discover the steps insurers can take now to prepare for the workforce of 2025.

In previous posts in this series, I’ve talked about how automation and augmentation, and the workers themselves, will affect the insurance workforce in 2025. In this post, I’ll dive into how insurers can start planning for these changes now, to assemble a new machine-augmented workforce and drive optimal value from artificial intelligence (AI) and intelligent automation.

The workforce of the future will be built on the workforce of today, but it will require a number of new skills that insurers need to build, buy, borrow or automate. To determine which methods to use, insurers need a clear picture of the skills of the current workforce and to be able to anticipate which skills will be needed. This means mapping jobs, roles, tasks and processes, and leveraging predictive analytics and AI.

I recommend insurers take the following steps:

- Start a dialogue with workers: Seek views from workers about how they view the future of work, their fears and their aspirations.

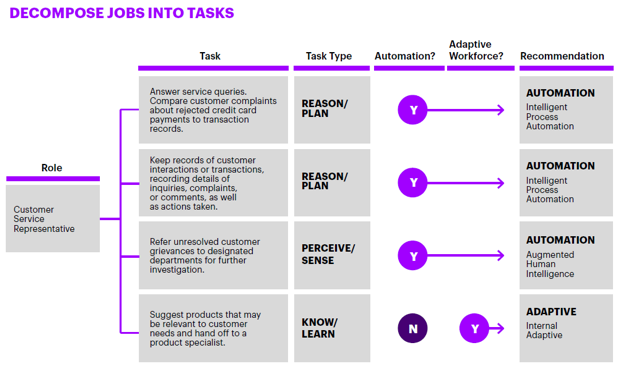

- Decompose jobs into tasks. Allocate work to machines and people, balancing the need for automation and augmentation with customer expectations.

- Move beyond legacy job descriptions and create new skills profiles. Unbundle tasks and skills-based responsibilities and then reconfigure them into new, fluid roles. Free people from functional roles and build project-based teams.

- Map skills to jobs. Assess the internal capabilities required and map them to existing skills. Then reskill, new-skill and source new talent.

- Rethink career frameworks. Shift from vertical career paths to a career matrix that offers movement in more directions for members of the workforce.

- Scale up ‘new skilling’. Prioritize skills for development, assess different levels of skills and willingness to learn, and nurture a culture of lifelong learning among workers.

- Protect humans from displacement from automation to the extent possible.

Insurers must get ready for a future of work that will be very different compared to today—one where they need new skillsets; where some tasks and roles have disappeared or changed fundamentally; where new roles are emerging; and where the profile of the work, where it is done and the people who do it continue to evolve at high speed as technology becomes ever more capable and pervasive.

It will take the full engagement of the C-suite and the leadership team to lead the workforce through this time of disruptive change. The challenges of pivoting the workforce will be immense. But those insurers that create a superior customer experience, an agile operating model, and a motivated, productive and innovative workforce will secure an enduring competitive advantage.

To discuss how Accenture can help you plan for the workforce of 2025, reach out to me directly, or read the Accenture report: The Financial Services Skills & Roles of the Future

For information on navigating the human and business impact of COVID-19, see our site for insurers.