Other parts of this series:

- Insurers: Start Boosting your “AIQ”

- How to use AI throughout the insurance value chain, starting with sales and distribution

- How to use AI throughout the insurance value chain with a focus on underwriting and service management

- How to use AI in the insurance value chain: claims management

- How to use AI in the insurance value chain: customer service and policy administration

How to manage the increase in incoming unstructured information is a key challenge in the insurance industry—we explore how Accenture’s Machine Learning Text Analyzer can achieve this using historical data.

How do you approach customer service and policy administration within your organization? In this blog post, I’ll demonstrate how artificial intelligence (AI) and a raised AIQ can help you get the most out of your data. To do this, I’ll discuss how insurers can use machine learning to analyze texts.

How can insurers use AI in customer service and policy administration?

The customer service and policy administration workforce can make their lives easier by using AI to:

- Understand and action external emails and requests.

- Automate call center and webchat services—helping them get on with more intricate work.

- Enable self-service queries on policy issuance, endorsements, cancellations and renewals—using virtual assistants, for example.

- Process unstructured data, which means fewer mistakes and better customer service

How does AI add value to customer services and policy administration?

Intelligent technologies are reshaping the way insurers approach the customer service and policy administration function. AI enables more efficient administration processes. Insurance executives plan to invest in seven AI-related technologies in the next three years. They are:

- Machine learning;

- Deep learning;

- Natural language processing;

- Video analytics;

- Embedded AI solutions;

- Robotic process automation;

- Computer vision.

In addition to increasing the efficiency of administration processes and enhancing analytical insights, AI technologies also benefit customer services through:

- Machine learning—using machine vision and natural language processing to improve customer interactions.

- Virtual advisor—transforming the customer and salesforce experiences with data-driven virtual advisors; for example Munich Re’s Digital Doctor.

- Everyday coach—helping customers manage and reduce their risk by providing frequent, personalized advice and incentives; for example Generali’s in-car device that gives real-time coaching.

- Real-time protection—leveraging applications and the IoT to help customers manage their risks; for example Homies, an IoT-based, peer-to-peer alarm platform developed by Achmea.

As I will show in the use case below, the customer service and policy administration workforce can use machine learning to process information faster and with greater accuracy.

Use case: Machine Learning Text Analyzer (MALTA)

Insurers today must figure out how to manage the exponential increase in incoming unstructured data. Eighty percent of data generated is unstructured in nature, and the volume continues to grow exponentially. Forty percent of business executives complain that they have too much unstructured text data and don’t know how to interpret it.

Insurers face three main challenges:

- Too much unstructured information

- A large amount of incoming information through a variety of channels;

- Incoming data is structured as well as unstructured;

- Much of the workforce is occupied with processing unstructured information;

- A large amount of existing unstructured information within the organization.

- Too many communication channels

Customers use a large variety of channels to communicate with their insurance company, such as e-mail, contact forms, the service desk (e.g. ticketing), letters, applications, etc.

- The information is not linked to business processes

- Workers lose a lot of time when they have to identify received information and allocate requests to the right channels;

- They also lose time owing to inefficient processes caused by breaks in the system;

- This prolongs the response time to clients;

- Humans are prone to errors which creep in at all points.

Solution: Machine Learning Text Analyzer (MALTA)

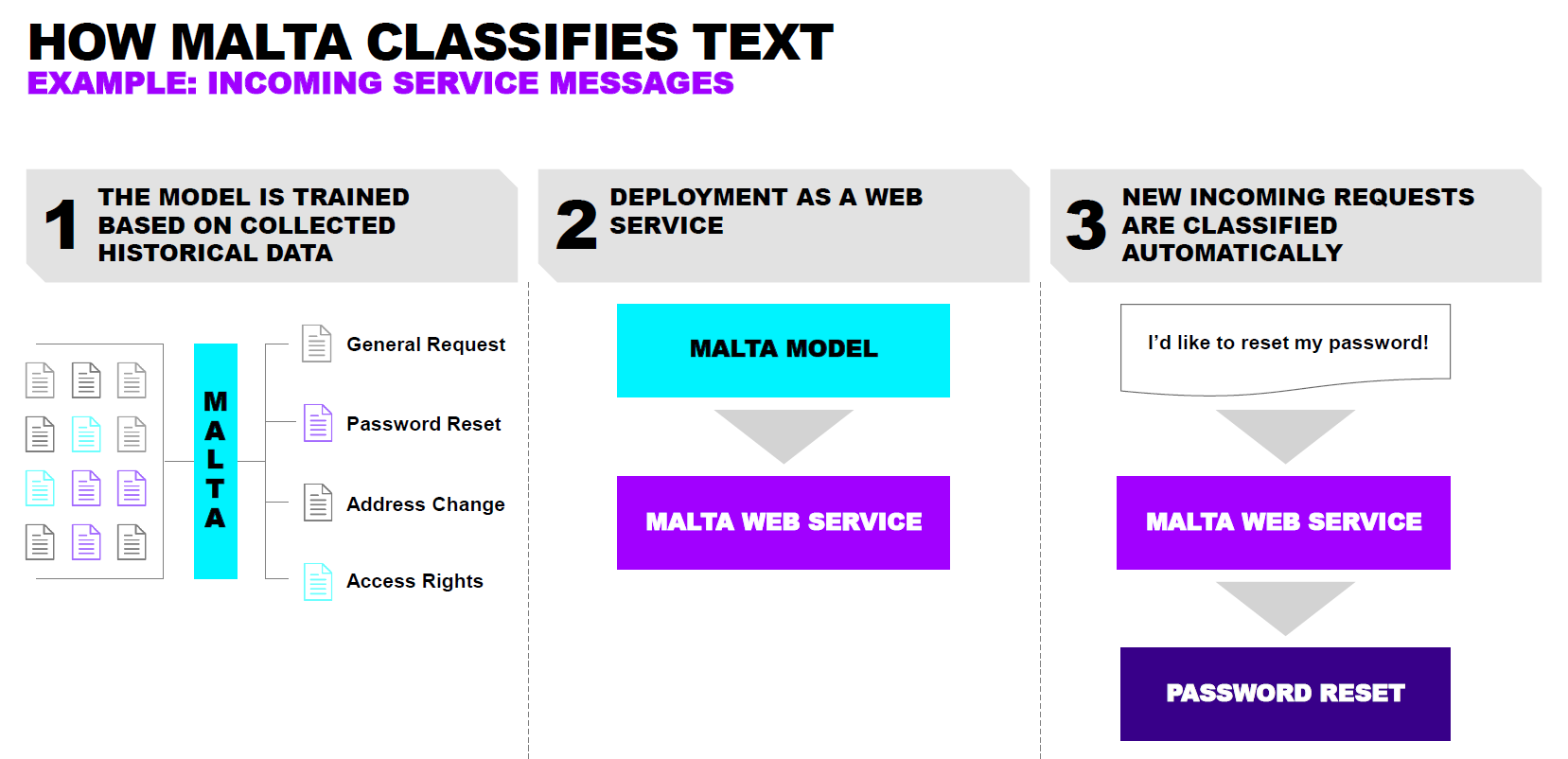

Now, insurers can automate the analysis and classification of incoming text by applying machine learning and using historical data.

How does MALTA work in customer service and policy administration?

MALTA can analyze any incoming documents, for example when customers send their policy documents via email.

These documents can be analyzed and classified using natural language processing methods and machine learning algorithms. MALTA is also trained with historical data which enables it to classify, understand and extract information.

In the next step, MALTA links your customer’s policy document to business processes, prompting different functions to take action. Depending on the business and architecture set-up, MALTA or the output of the API triggers a process chain, a robot or an agent so that the necessary processing steps can be executed.

Benefits of MALTA

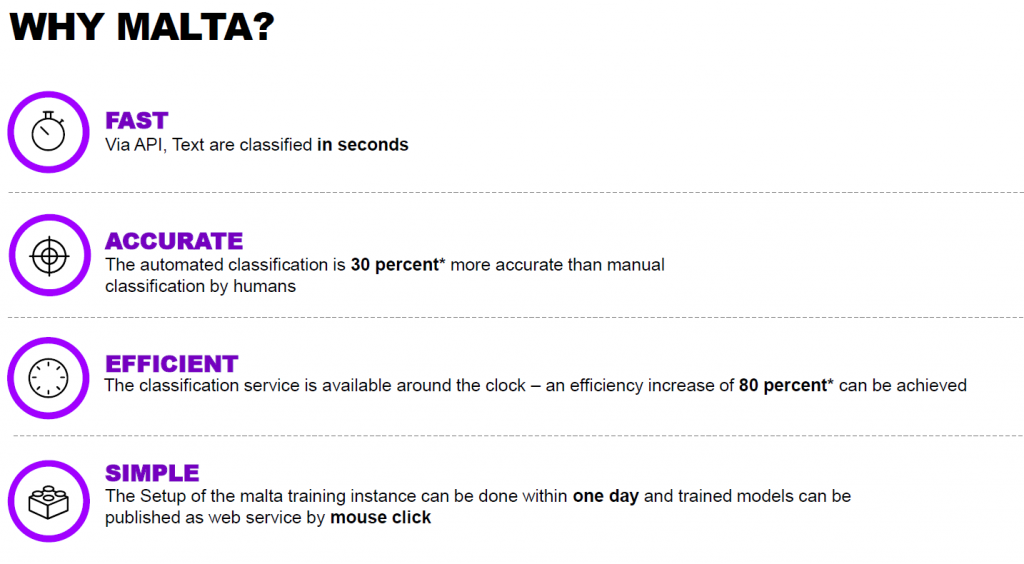

MALTA is flexible, customizable, independent, multilingual, state-of-the-art, and end-to-end using Accenture’s machine learning text analyzer, insurers can:

- Increase classification accuracy and efficiency, and reduce errors.

- Create individual learning models based on training data.

- Deploy the solution on-premise, not only in the cloud.

- Automate repetitive tasks, allowing employees to focus on more complex work.

- Categorize new requests immediately and send them to the relevant departments.

- Use state-of-the-art models and tools.

- Work on a platform-independent web service.

- Carry out classification outside regular business hours.

- In additition to classifying text, MALTA can also cleanse data, and extract and evaluate features.

- Link robotics and process automation tools to classification.

- Set up and train employees with minimal effort.

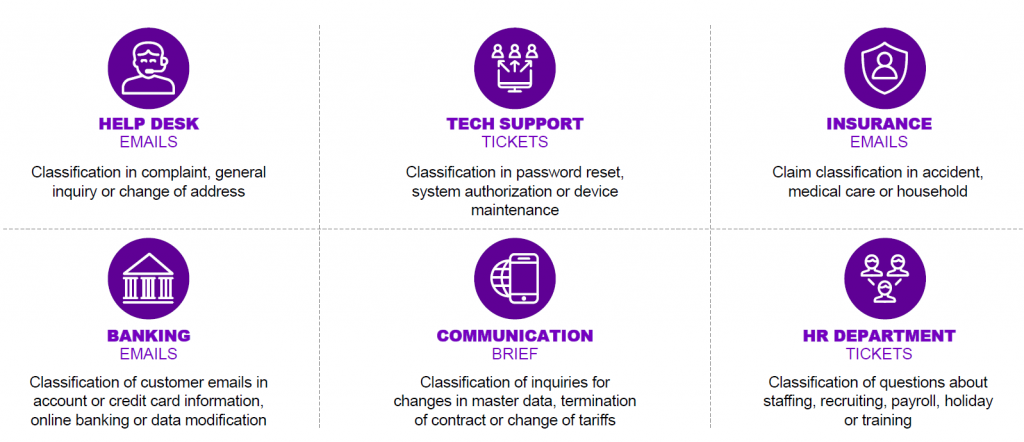

In addition to customer services and policy administration, insurers can use MALTA across other parts of the enterprise, for example:

Are you ready to power up your business with AI? Get in touch to learn more about how to use machine learning in the insurance value chain. Download the report on How to boost your AIQ for more insight.