Highlights

Open insurance offers insurers an opportunity to substantially enhance their products and services while also opening many new revenue streams.

Carriers can capitalize on the huge flows of real-time data that open insurance unleashes to launch a host of new customer offerings.

The “network effect” that occurs in open insurance provides insurers that are early-movers with a wealth of new business opportunities.

The rise of open banking offers carriers valuable insights into how open insurance is likely to affect their businesses.

Introduction

The insurance industry is facing more disruption than almost any other sector. Advances in digital technologies, increasing competition from innovative and nimble rivals and flat investment returns are forcing insurers to radically transform their businesses (See our Disruptability Index).

Many insurance providers are looking to digital ecosystems to give them the agility and customer reach they require to thrive in the post-digital era where digital technology is everywhere. Our research shows that 75 percent of insurers expect ecosystems to deliver at least half of their revenues within five years.

To unlock the potential of ecosystems and thereby generate strong revenue growth and build sustainable asset value, insurers need to seize an important opportunity – open insurance.

Questions answered in this ultimate guide

Which insurers have adopted open insurance?

Why does open insurance matter?

How can insurers benefit from open insurance?

What can insurers learn from banks about open insurance?

Will regulators force insurers to adopt open insurance?

What role do digital ecosystems play in open insurance?

Why are application programming interfaces (APIs) vital to open insurance?

What is the best application programming interfaces (APIs) strategy for insurers?

What is the best digital ecosystem for open insurance?

How can insurers use digital ecosystems to grow their open insurance businesses?

Why are only a few insurers running successful open insurance businesses?

How can insurers use ecosystems more effectively?

What firms make good open insurance partners?

What is open insurance?

Open insurance is a new way of doing business that enables insurers to boost revenues, increase efficiencies, gain business partners and reach many more consumers. It requires carriers to open their data resources to other organizations and to share and consume data and services from many sources and across lots of industries. This allows insurers to create new value propositions, generate fresh revenue streams and deepen their relationships with customers.

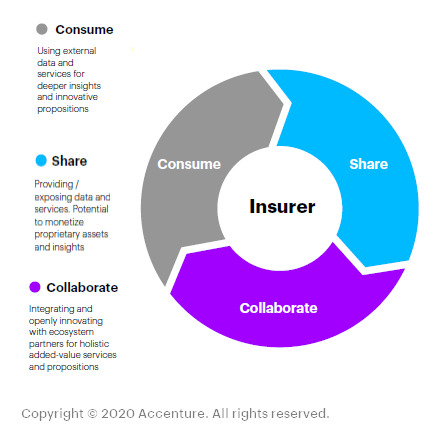

Open insurance business models must address the three essential functions of a data enterprise—consume, share and collaborate.

Which insurers have adopted open insurance?

Open insurance is only beginning to make its mark on the insurance industry. However, some far-sighted insurers have already begun to adopt open insurance. They’re capitalizing on the big flows of data that are now travelling across digital ecosystems. Open insurance pioneers include:

Ping An in China is opening parts of its information technology infrastructure and systems to monetizing its data resources. It is building open platforms, underpinned by new technologies, that are accessible to many participants in industries such as financial services, automotive repairs, healthcare and real estate.

UK insurer Anorak has teamed up with fintech firm TrueLayer to use data analytics and machine learning to assess big volumes of consumer data and provide customers with insurance advice and recommendations.

Reliance Partners in the US is working with supply-chain technology firm Project44 to offer real-time cargo insurance to shippers and logistics service providers. Their open insurance service allows customers to obtain quotes and buy cover as they book their shipments.

Wakam, previously known as La Parisienne, is a France-based insurer that is offering over 50 open insurance APIs. It is scaling its open insurance model rapidly across Europe, partnering with highly visible companies like IoT network provider Sigfox to offer connected insurance solutions. Wakam reports that its integration platform as a service (iPaaS) currently handles more than 10 million API requests a month.

Why does open insurance matter?

Rapid advances in technology and fast-changing market forces are causing extensive disruption in the insurance industry. Open insurance offers insurers an opportunity to substantially enhance their products and services while also opening many new revenue streams. Carriers that are quick to embrace open insurance will gain a significant advantage over competitors that are slow to respond or remain locked in traditional business models.

How can insurers benefit from open insurance?

Open insurance offers insurance providers a host of new business opportunities. Here are some of the most important benefits:

Innovative customer propositions.

Carriers can capitalize on the huge flows of real-time data that open insurance unleashes to launch a host of new customer offerings. They can improve the customer experience substantially by using real-time data and analytics systems to deliver on-demand, personalized services and experiences with variable pricing. Insurance quotes, for example, can be assessed far more accurately by using automated systems to process vast volumes of customer information and related data to gauge risk. This improves the insurer’s risk management, replaces cumbersome and inefficient manual estimates and processing, and allows customers to benefit from cover tailored to their specific needs.

Closer ties with customers also enable insurers to introduce new ecosystem services that combine their products with value-added offerings supplied by business partners from outside the insurance industry. Insurance providers can increase their interaction with customers and encourage their customers to share their data by offering them extra services or better prices. New real-time risk protection and mitigation services, for example, will not only improve customers’ perceptions about the value they’re getting from their insurers and thereby boost retention rates. They’ll also enhance the insurance providers’ risk management and reduce their loss ratios. Both customers and their insurers will enjoy on-going benefits from this open insurance “virtuous circle”.

Open insurance will create more opportunities for consumers to benefit from sharing their data with service providers. They will be able to make better, more informed decisions about their insurance needs. For example, policyholders will be able to identify where they’re underinsured and require additional cover.

New partnership and distribution models.

Open insurance gives carriers a bigger market for their products and services. It enables them to extend their distribution footprint beyond their traditional markets by securing alliances with new business partners. They can then integrate their products with the non-insurance offerings of their business partners to deliver a broader and more enticing seamless customer experience.

The more partners and customers that insurers gain through their open insurance initiatives, the more appealing they will become to prospective new partners. The “network effect” that occurs in open insurance provides insurers that are early-movers with a wealth of new business opportunities. They’ll have more to offer potential partners than insurers that were slow to embrace open insurance.

Extra revenue sources.

Insurers that adopt open insurance can better monetize their proprietary information and data services. For example, they can use their extensive technology infrastructures to provide other organizations with transaction processing services. Alternatively, carriers could use application programmable interfaces (APIs) to offer other companies specialized applications such as payment services, risk analysis or customer acquisition.

Open insurance will enable insurers to create new revenue streams by positioning themselves earlier in their customers’ buying processes. For example, greater access to real-time customer information gives insurers the opportunity to alert policyholders to appropriate risk management solutions as soon as their circumstances change. They’ll then be able to move quickly to provide customers with the cover they need. Such changes might include changing jobs, moving home, taking a vacation or buying a valuable asset.

Open insurance allows carriers to increase their revenue streams by providing their customers with value-added products and services that have been sourced from their ecosystem partners.

Operations improvements.

The network of alliances and business partnerships that underpins open insurance allows insurers to fast-track product innovation. They can draw on the skills and resources of their partners to swiftly design, develop and launch products and distribute them quickly to a large number of consumers. Traditional bottlenecks, created by legacy systems and outdated processes, can be speedily bypassed.

Open insurance offers insurers considerable savings in operating costs. These can be achieved through improved transaction speeds and efficiencies, reduced development and maintenance expenditure, decreased data duplication, lowered fractional costs and the roll-out of automated straight-through processing.

Operating improvements achieved through open insurance are likely to ripple along the insurance value chain. For example, improvements in an insurer’s processing efficiencies will often spread to the operations of its business partners and intermediaries.

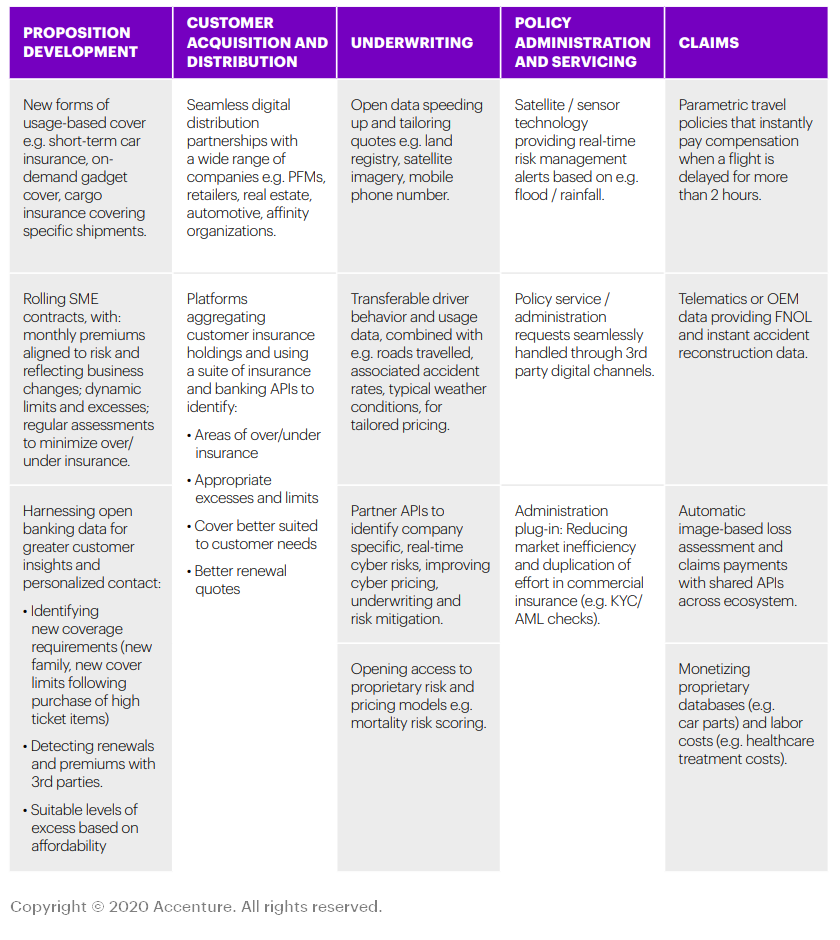

The illustration below shows some of the many applications of open insurance.

What can insurers learn from banks about open insurance?

Legislation in Europe and the UK forced banks to open their data resources and share customer information with other organizations. The European Union’s revised Payment Services Directive (PSD2) and the UK’s Open Banking Standards require banks to give other financial services providers access to their customers’ banking information if account holders give consent. Banking regulators want to encourage innovation and competition. Similar open banking regulations are in place in Australia and could soon be introduced in Canada. We estimate that open banking initiatives in Europe will generate close to €61 billion this year. That would be around 7 percent of the region’s total banking revenues. Almost all the major banks in Europe are making big investments in open banking.

Progressive banks, start-ups, lenders and payment companies in Europe and the UK moved quickly when the open banking laws were first proposed in 2015. They built platform businesses that capitalized on the availability of growing volumes of consumer data. By linking to expansive digital ecosystems, these new businesses could connect with scores of data providers and offer customers enticing data-rich products and experiences. Furthermore, they were able to use these ecosystems to team up with new business partners and through these alliances give their customers additional offerings that often stretched beyond banking. Far-sighted companies in the banking industry also used their new platform businesses to build innovative value propositions that enabled them to capitalize on market disruption and seize unforeseen opportunities.

The rise of open banking offers carriers valuable insights into how open insurance is likely to affect their businesses. Key take-aways include:

- Customer expectations will soar. Open banking is providing banking customers will an array of new data-rich services and experiences. Many of these customers also buy insurance. They’ll want their insurers to match or better the digital experiences they’re being given by other service providers. Insurers will need access to greater volumes of data from more sources. If they don’t, they won’t be able to deliver new digital offerings their customers will demand.

- Digital technologies will pump up data flows. The arrival of the post-digital era, where digital technology pervades every aspect of life, has rocketed the amount of data available to service providers. Data traffic across ecosystems continues to climb. Open banking has shown how financial services companies can monetize their data resources and capitalize on the value of data held by other organizations. Carriers shouldn’t underestimate the significance of this critical resource. Those that do, are likely to slip behind their competitors.

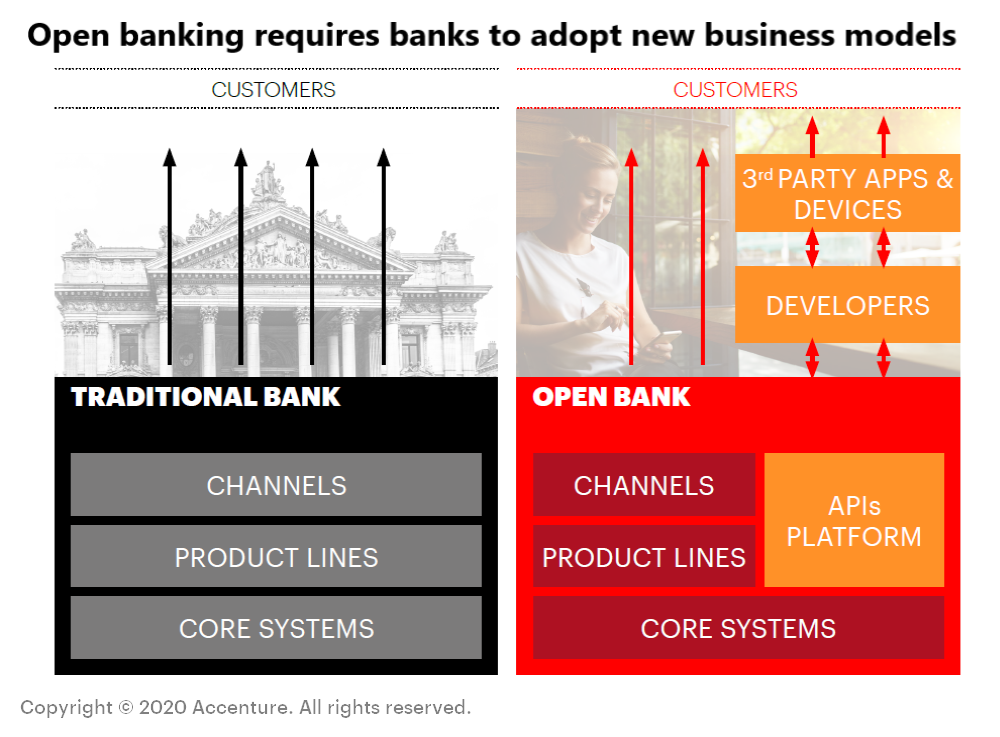

- Business models will change. Open banking has forced banks to find new ways to engage with customers and partners (See illustration below). Open insurance will put similar pressure on insurers. Brokers and other intermediaries are especially vulnerable. They need new business models that enable them to thrive in the ecosystem economy.

- Industry disruption will escalate. Open Banking exposed the payments businesses of traditional banks to fierce disruption. Fintech firms and other industry newcomers now dominate this sector of the banking market. These nimble disrupters are beginning to turn their sights onto other sectors. They’re are using innovative technologies to offer consumers a host of new financial services. Open insurance will at first disrupt product distribution and customer acquisition. However, it will soon trigger upheaval in other sectors. Carriers should prepare themselves for rising industry disruption by increasing their capacity to innovate, collaborate and adapt. Business agility will be vital.

Will regulators force insurers to adopt open insurance?

Regulators are unlikely to force insurers to follow the example of the banks, and open their data resources to other organizations, any time soon. However, other disruptive forces are already prompting insurers to share more data. These forces are likely to drive the growth of open insurance. They include:

- Rising demand among consumers for integrated, personalized, data-rich digital services.

- Growing competition from technology firms offering insurance products alongside other digital products and services.

- Increasingly potent digital ecosystems that often include insurance products and services in their consumer offerings. Our research shows that insurers believe the rise of ecosystems will be one of the biggest causes of disruption to their businesses in the next five years.

Technology Vision for Insurance 2021: We outline five emerging technology trends that will impact the insurance industry in 2021 and beyond.

LEARN MOREWhat role do digital ecosystems play in open insurance?

Digital ecosystems are essential for open insurance. They provide the pathways that transport huge volumes data between insurers and their partners and customers. Open insurance allows insurers to harness the vast flow of data that travels across ecosystems to enhance their customer offerings, grow their business partnerships and reach large numbers of consumers. Insurance providers don’t have to own the technology platforms that support these digital ecosystems. However, they must have a clear ecosystem strategy that supports their open insurance business models. This strategy should show why the company is adopting open insurance, identify the types of ecosystem that best support this objective and define the roles that insurer will perform within their chosen ecosystems. The strategy may require an insurer to own or control the technology platforms that underpin their ecosystem activities. Often, it will allow insurers to run their open insurance initiatives across ecosystems that are maintained by a trusted technology partner.

Why are application programming interfaces (APIs) vital to open insurance?

APIs are key to the development of open insurance solutions. They enable insurers and other organizations to open their data, algorithms and processes to one another. This allows companies that are linked to the same ecosystem to incorporate each other’s data resources into their own digital services and experiences. The spread of APIs is dramatically increasing the volume of data traffic that is flowing across ecosystems. As data volumes rise, opportunities for companies to create additional value from the ecosystems they operate across also increase.

The business benefits of APIs are substantial. They enable insurers to quickly build robust technology platforms that can consume and share big volumes of data and link multitudes of partners and customers. This allows them to streamline their processes, improve efficiencies and accelerate innovation. The time to design, develop and roll-out new products, for example, is considerably reduced. Insurers can also collaborate with new business partners more quickly, gain faster access to large numbers of additional customers, and deliver more enticing data-rich products and experiences. Research firm Celent believes that insurers that fail to build APIs into their technology platforms will cease to be competitive.

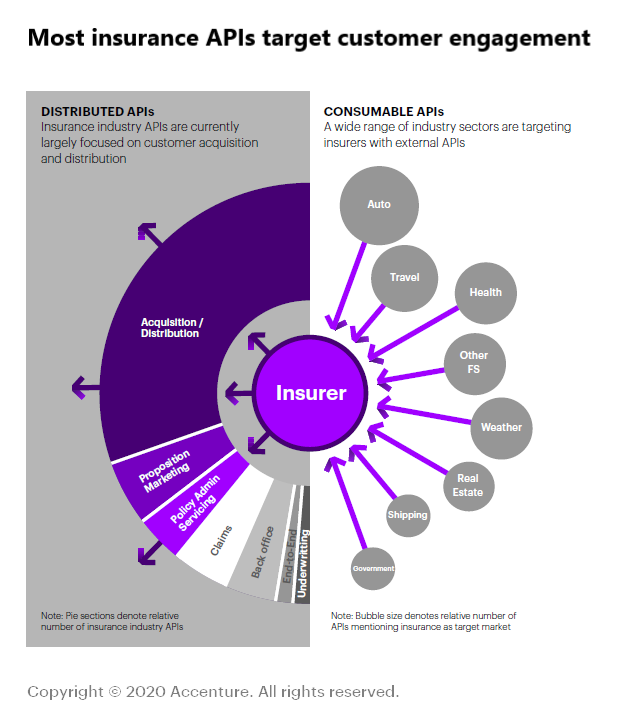

The number of APIs available to insurers is a fraction of what’s on offer in the banking industry (See illustration below). Companies in the banking sector have had a head start on insurers because of the implementation of open banking regulations. However, interest in insurance APIs is rising fast.

Most insurance APIs currently focus on customer engagement. They support customer acquisition or product distribution solutions. But many more insurance applications will soon be available. This will allow lots of companies from many different industries to connect to providers of insurance data. Front-runners include motor vehicle distributors, travel firms and healthcare providers (See illustration below). These firms will be able to bundle insurance products with their own offerings. They’ll provide customers with a seamless portfolio of data-rich services.

What is the best application programming interfaces (APIs) strategy for insurers?

Insurers need a strategy that will enable them to quickly build, publish and install large numbers of APIs. It should address four key steps:

- Decouple technology architectures. To extract value from their traditional technology resources and increase their business agility, insurers need to add a new layer of decoupled digital components between their core systems and their applications. An API-enabled architecture, that can interconnect many different systems and applications, will enable carriers to access quickly the data resources they need to team up with new partners and seize promising business opportunities.

- Adopt a cloud-first approach. Cloud computing gives insurers the ability to swiftly develop and launch new products, roll them out to large numbers of customers and, if necessary, port them to other technology platforms.

- Engage with third parties. Increased collaboration with third parties, such as insurtech firms, incubators, academic institutions, research companies, data providers, public utilities and business partners, improves creativity, accelerates innovation and creates new revenue opportunities.

- Design for re-use. Insurers should ensure that the APIs they develop are simple to use and very portable. By publishing these APIs and making sure they can be found easily, insurers can encourage other parties to become their ecosystem partners and provide them with complementary products and services.

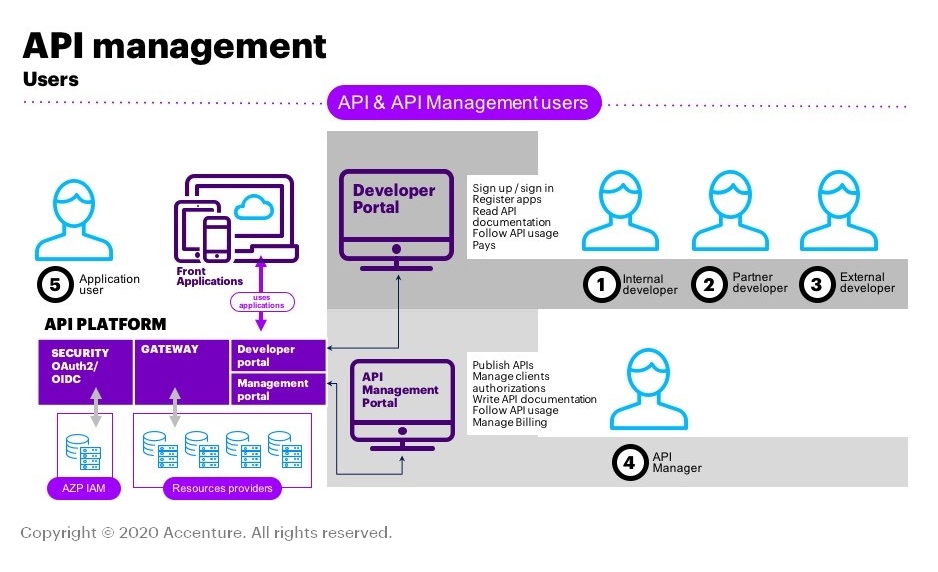

- Implement an API platform. This provides internal teams and partners with the tools and capabilities they need to make the best use of the organization’s APIs. An API platform usually combines four main components: a developer portal for external partners to leverage your existing APIs; an API management portal to publish APIs, monitor usage and manage billing; a security layer; and a gateway to access internal resources.

What is the best digital ecosystem for open insurance?

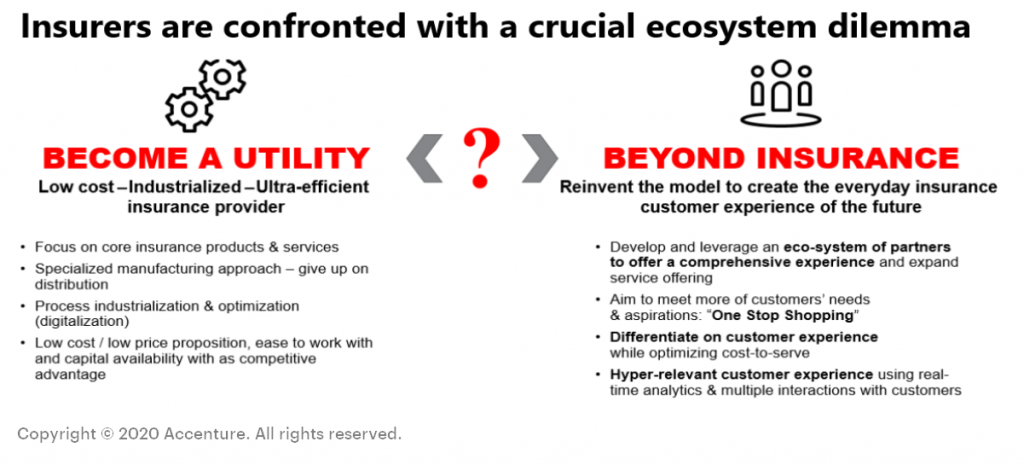

Insurers must choose a digital ecosystem that meets their specific open insurance objectives. They should be clear about the type of business they want to conduct. Do they want to become low-cost service providers and function as utilities, for example, or do they see open insurance as an opportunity to extend their businesses beyond traditional insurance activities? Insurers that plan to become utilities can use open insurance to capitalize on their current operating and processing efficiencies. They can generate additional revenues by providing data services to a variety of insurers and other organizations. Alternatively, carriers that want to move beyond insurance can use open insurance to introduce an array of new digital products and services. By opening their data resources and exchanging information with many different parties, they’ll be able to deliver offerings that go well beyond the portfolio of products traditionally provided by insurers. The illustration below shows this initial dilemma that insurers must resolve before venturing further into open insurance.

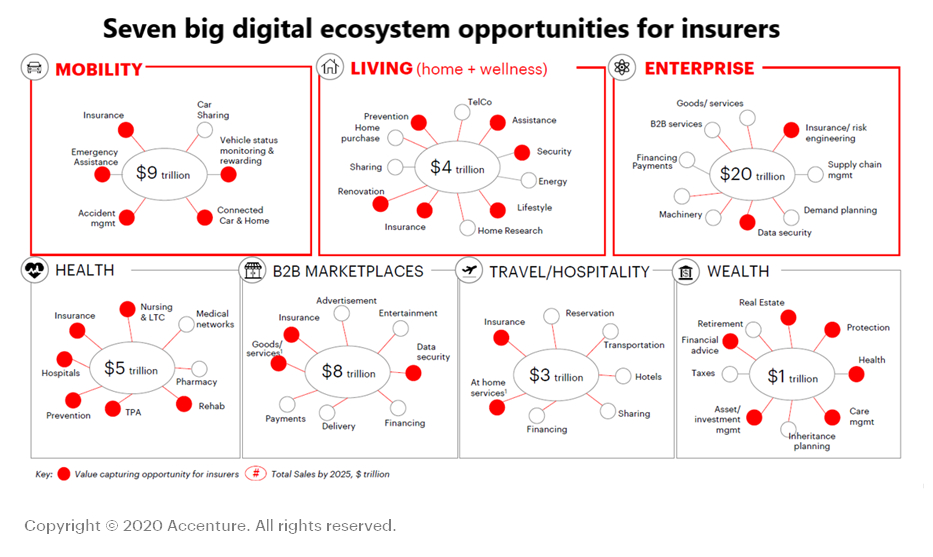

Insurers that view open insurance as a way to expand and extend their product offerings need to assess carefully their current capabilities before they launch any new ecosystem businesses. They should identify the ecosystem opportunities they can exploit using their established assets and resources. Only once they have finished assessing these opportunities should insurers turn their attention to ecosystem ventures that might require extra infrastructure and resources. We have identified seven big ecosystem opportunities for insurers (See illustration below). Each of them enables insurance providers to use open insurance to enter new markets and expand their product offerings. We believe that the revenue generated by these seven ecosystems could top US$50 trillion by 2025.

All these ecosystems generate value for insurers, their partners and their customers. They achieve this by:

- Giving customers an easy “frictionless” gateway to a host of diverse digital services.

- Harnessing the “network effect” that operates across platform businesses and delivering greater value to each ecosystem participant as the data traffic increases.

- Encouraging the flow of big volumes of data between large numbers of ecosystem participants.

- Spanning one or many technology platforms that are managed by trusted service providers.

How can insurers use digital ecosystems to grow their open insurance businesses?

Once insurers have chosen the ecosystems that best suits their open insurance objectives, they need to select the role they want to perform within these ecosystems. A clear understanding of these roles will enable carriers to galvanise their resources and grow their open insurance businesses. Many insurers have already identified the ecosystem roles that will enable them to develop strong open insurance businesses.

- Ecosystem initiator. Big insurers such as Ping An have built their own extensive ecosystems. These sprawling ecosystems generate huge volumes of data traffic and deliver a vast array of products and services. Such insurers are custodians of their ecosystems. They deliver a wide range of their own products and services across their ecosystems but also host offerings from many other organizations.

- Ecosystem orchestrator. Carriers such as USAA and Discovery have built strong ecosystem businesses by enhancing their own offerings with products and services drawn from other providers. This enhances the value these carriers give to their customers while also generating more revenue for themselves and their partners.

- Ecosystem player. Some insurers, including Zurich and Groupama, have built successful businesses on ecosystems that are managed by other companies. They have tailored their digital insurance offerings to suit these specific channels.

- Ecosystem contributor. La Parisienne is one of several companies that is providing insurance-as-a-service (IPaaS) offerings to ecosystem operators. Such IPaaS offerings include ecommerce, payments and analytics services.

Why are only a few insurers running successful open insurance businesses?

One of the biggest challenges facing many carriers looking to establish open insurance businesses is their lack of ecosystem capabilities. Many insurers believe they possess the ecosystem skills and resources they need to run an open insurance business. However, our research shows that most of these companies are substantially overestimating their readiness. For example, 84 percent of insurers identify ecosystems as an important part of their strategies. And 58 percent of insurance providers have even begun pursuing ecosystems strategies. But we found that less than 5 percent of insurers have what’s needed to run an ecosystem-dependent business.

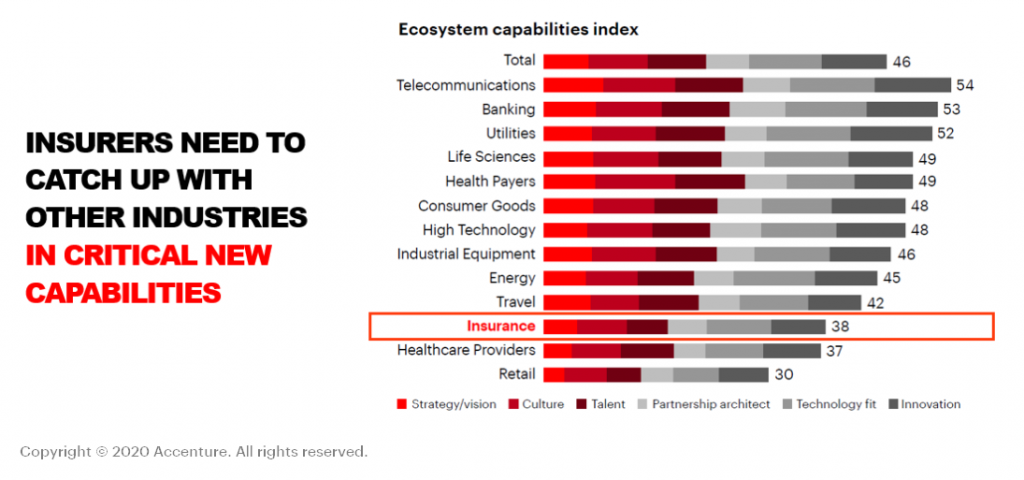

Where are the shortfalls? Most insurers haven’t developed the correct ecosystem strategies. They’re also short of the skills they require and lack the necessary organizational structures and cultures. Furthermore, many insurers don’t have the technology architectures they need to support ecosystem initiatives. These shortcomings put insurers well behind their peers in the banking and telecommunications industries (See illustration).

There’s another stumbling block. Insurers are often reluctant to share their data. Open insurance requires carriers to exchange big volumes of data with multiple partners. Yet, insurers have long viewed their data as a valuable proprietary asset that gives them an advantage over competitors. To benefit from open insurance such carriers must make an about-turn. They need to be willing to share information and to exchange it responsibly and securely. This requires a big culture shift.

How can insurers use ecosystems more effectively?

Many insurers will need to transform their businesses so that they use ecosystems more effectively and launch successful open insurance initiatives. They should focus on three key areas:

- Carriers engaged in open insurance need robust and flexible technology architectures that can manage vast, variable and rapid data flows. These architectures should decouple core systems, support powerful application programming interfaces (APIs) and incorporate cloud-based resources.

- Open insurance requires insurers to nurture workforces that excel in creative-thinking and problem solving. A culture of continuous improvement and fail-fast innovation is essential.

- To succeed in open insurance, carriers must craft partnering strategies that guide them as they navigate new business relationships and creative collaborations. They should be flexible enough to accommodate many diverse partnerships and to capitalize on unexpected opportunities.

What firms make good open insurance partners?

Good ecosystem partners are critical to the success of open insurance. They give insurers access to big volumes of valuable data and enable them to reach many more customers. They can also provide insurers with additional digital services that complement their own offerings and enhance the customer experience. Furthermore, collaboration with innovative partners can provide insurers with a host of new business opportunities.

However, selecting the right open insurance partner is not easy. Nor is the process of managing a spread of diverse ecosystem partners (see illustration below).

Insurers should devise a comprehensive strategy that will govern their selection and management of open insurance partners. It will need to differ from standard distribution agreements and accommodate new types of partners such as start-ups, insurtech firms, data providers and analytics specialists. The strategy should to be sufficiently flexible to capitalize on unexpected opportunities, accommodate innovative solutions and respond to sudden changes in the business landscape.

The type of partners that insurers will require to succeed in an open insurance environment will depend largely on the ecosystems they’ve chosen to address as well as the roles they intend performing within those ecosystems. Insurers, for example, should decide early on their journey to open insurance whether they are making this move to enhance their traditional products with value-added services such as discounts and rewards. Alternatively, they might see open insurance as an opportunity to extend their product portfolio beyond insurance or even completely transform their businesses. Only once they have determined their value propositions should insurers then look to select the most suitable partners for their open insurance activities. Key considerations when choosing potential partners should include an assessment of their ecosystem profiles, innovation capabilities, customer reach, data resources, technology platforms and business strategies. As well as scouring for new open insurance partners, carriers should also make sure that they remain attractive partnership candidates. They should constantly assess their readiness for such partnerships and ensure they can quickly collaborate with further companies to seize new business opportunities.

Conclusion

To unlock the benefits of their ecosystem strategies and thrive in the fast-changing insurance industry, carriers need to embrace open insurance. By opening their data resources to other organizations and sharing and consuming data and services from multiple sources, insurance providers will be able to adopt innovative value propositions and business models. They’ll secure new revenue streams, increase their engagement with customers, improve their operating efficiencies and gain greater agility. Furthermore, collaboration with a wide variety of ecosystem partners can propel insurers beyond their traditional markets. They’ll be able to reach far more consumers and provide them with an array of enticing data-rich products and experiences. Insurers that are slow to embrace open insurance are likely to fall behind their competitors and may struggle to retain their customers.

Read more about open insurance and ecosystem opportunities:

Tomorrow’s open insurance opportunities.

Technology Vision for Insurance 2020.

Insurers: Go all-in on ecosystems.