Other parts of this series:

Advanced technologies are creating more opportunities for growth, but many insurers are failing to convert potential into value

Accenture’s newly released 2019 Technology Vision has found that digital technology is a strategic priority for every business. In our survey of more than 6 600 business and IT executives—including almost 600 insurers—94 percent of respondents said that the pace of technology innovation had either accelerated or significantly accelerated over the past three years.

And yet, despite significant investments in innovation and technologies, many insurers struggle to unlock their trapped value and convert potential into real business performance.

Advanced technologies are becoming cheaper—and businesses are investing more in innovation

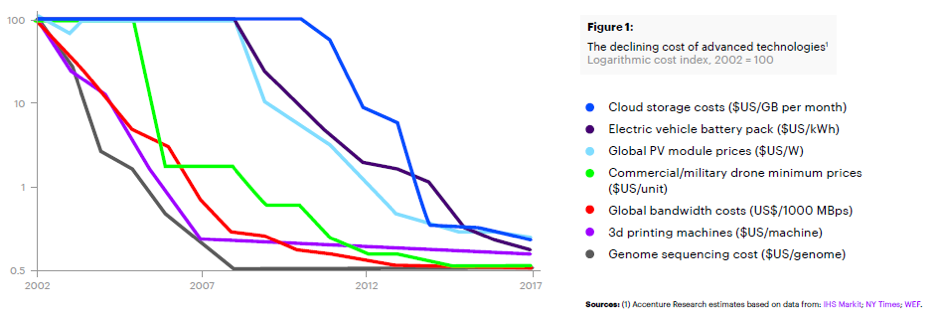

As the figure above shows, advanced technologies’ performance relative to cost is improving exponentially. Unsurprisingly, this trend presents an abundance of value opportunities.

And businesses are recognizing the potential. Over the past five years, companies have invested around $3.2 trillion in innovation-related technologies. We sent out a survey to 840 executives of the world’s largest multinationals and found that over the next five years, a majority of companies are planning to increase investments in innovation by more than 25 percent. Almost one-third of respondents expect to increase their investments in innovation by more than 50 percent.

Advanced technologies present an abundance of value opportunities

Combinations of new technologies are bringing exponential disruption to the structure, competition, business models and economics of financial services organizations. Advanced technologies are working together for the greater good—for example applying artificial intelligence (AI), cognitive computing and robotic process automation (RPA) to offer a better, wider and more efficient service to customers. It also enables more cost-effective automated back-office operations, leveraging technologies that enable automated machine learning for big data, as well as real-time transactions and interactions.

For example: GoodData, a US-based embedded and distributed analytics startup, has entered the insurance industry by introducing two solutions—underwriting insights and claims insights—that will automate data integration and give insurers actionable insights.

GoodData’s robust enterprise insights platform is a scalable, secure, end-to-end, pre-integrated cloud platform containing data management, analytics and large-scale insight delivery capabilities. Combined with native machine-learning and AI capabilities, the solutions ensure swift alignment between business operations and changing strategies, improving business agility for insurance organizations.

The platform delivers next-best-action recommendations to help insurers make accurate adjusting decisions, enhance customer service, and deliver immediate business outcomes for specific claims and underwriting decisions. By doing so, GoodData is bringing analytics and recommendations directly into the business process so employees can determine the correct course of action within seconds. The startup also plans to develop additional insurance-specific offerings, for example automated underwriting and claims. This could mean great value for the insurance industry.

Yet many financial services organizations struggle to unleash their trapped value

Advanced technologies are becoming more affordable and hold immense opportunities for FS organizations, yet companies are failing to unlock their true potential.

Our survey indicates that 57 percent of respondents who increased their investment in innovation by more than 25 percent underperformed compared to their industry peers. The return on companies’ innovation spending has declined by 27 percent over the past five years.

With the continued improvement of advanced technologies, the gap between what technologies make possible and the ability of companies to internalize this is only likely to grow. The result is a steady escalation of “trapped value”—the gap between what’s possible and what’s being achieved today. It’s the value that businesses could be releasing and sharing if only they could change faster and more fundamentally.

We see this in our clients’ journey to the cloud

I often see this trend reflected in our clients’ journey to the cloud and the introduction of new software development methodologies like Agile and DevOps. Cloud computing costs have, on average, more than halved every three years since 2009, according to an analysis in App Developer magazine. Financial services organizations have shown that they are ready to go to the cloud, but it’s a difficult journey—one that must not be underestimated. The business case is obvious, but the journey is often hampered by challenges such as:

- Current state of applications

- Lack of expertise

- Governance and control

- Security challenges,

- Regulatory compliance, etc.

As the evidence suggests, insurers are investing in technology, but they’re not getting the best return on investment. How can they overcome these challenges and start using advanced technologies to reduce costs and increase efficiencies—and beyond that, grow their enterprise into the future? This is a topic I will explore further in my upcoming posts. Until then, read our research on How to unlock the value of your innovation investments as well as Accenture’s 2019 Technology Vision—or get in touch with me here.