Other parts of this series:

How to best invest in intelligent technologies to drive growth in insurance

I started this series by stating that although investment in intelligent technology is on the rise, many insurers are struggling to unlock the trapped value that exists in their organizations. I then went on to demonstrate the value of AI and automation, as well as cloud and DevOps, for the insurance industry.

In this final post, I’ll explore the crux of the matter as set out in my first post: how can insurers increase their return of investment in advanced technologies?

What is the secret of high-growth companies?

Our survey of 840 executives of the world’s largest multinationals revealed something very interesting. There were a few companies—represented by 14 percent of respondents—who were identified as high-growth. These companies adopt a distinct innovation approach that is:

- Change-oriented

- Outcome-led

- Disruption-minded

What does this mean for insurers?

To becoming change-oriented, you need to have the courage to apply innovation with greater intensity to reinvent existing ways of working. By becoming change-oriented, a company can achieve deep organizational change.

An outcome-led approach entails fostering innovation efforts across the business, and having the discipline to tie them rigorously to financial performance.

Finally, a disruption-minded organization is one that commits to investing more aggressively, over time, in truly disruptive innovation initiatives that have the potential to create entirely new markets.

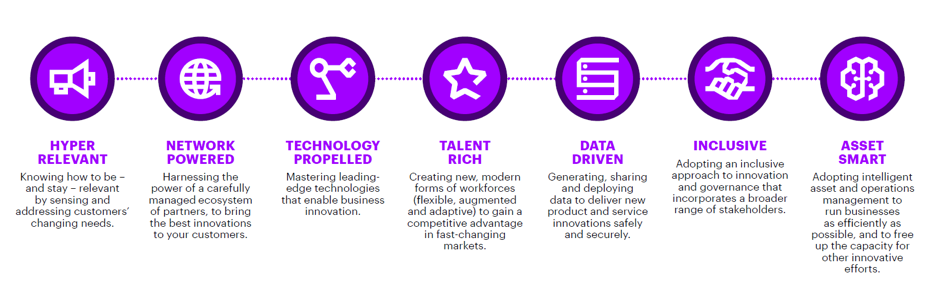

In our research on what enabled high-growth companies to achieve success, we discovered seven characteristics that they have in common. They are all:

Case study: How SoftBank is investing in intelligent technology

The SoftBank Vision Fund, the Japanese Internet group’s technology fund, is active across a range of “frontier” technologies, including robotics, AI, and computational biology. The aim is to target “meaningful, long-term investments in companies and foundational platform businesses that seek to enable the next age of innovation”.

The Vision Fund invested $500 million in Improbable, a gaming company founded in London that offers large-scale special simulation technology to help solve seemingly impossible problems. The company’s SpatialOS platform is used for running large-scale simulated worlds and makes it possible for organizations to build massive agent-based simulations in the cloud to inform and improve decision making.

How to maximize value from technology spending

Steve Poniatowski writes in an article for Accenture Strategy that extracting value from technology is essential for growth and competitiveness. He recommends that companies do three things to maximize value from technology spending:

- Companies need to reduce debilitating technical debt.

Industry disruptors, such as the fintech startups I highlighted in my previous post, leap to prominence and steal market share from traditional industry leaders because they are technologically nimble and agile. To keep up, traditional insurers need to invest in technologies that are current, capable and flexible, such as cloud platforms and SaaS applications.

- They should collaborate for speed and financial leverage.

For traditional companies to start moving with speed at a manageable cost, they need to leverage SaaS and cloud platforms and foster collaborative relationships with digital ecosystem partners.

- They must relentlessly manage technology unit costs

To eliminate waste associated with perceived versus actual need, it could be useful for companies to adopt a zero-based mindset. This can help them identify areas where money can be freed up and reinvested in strategic growth opportunities. For more information, read Poniatowski’s article here.

The proven ability of intelligent solutions to deliver fast, measurable bottom-line results makes investing in intelligent solutions a smart choice. The key question is: can you invest in them intelligently?

To continue the conversation, get in touch with me here. To learn more on how industry leaders are unlocking their true potential using intelligent technologies, read the following research materials: