Other parts of this series:

- It’s time for insurers to conquer their cloud fears

- Smart insurers are transforming themselves in the cloud

- Three big goals for a winning cloud strategy

- Let business – not technology – set your cloud agenda

- Powerful cloud services will drive ecosystem innovation

- Big insurtech opportunities for carriers entrenched in the cloud

The cost benefits delivered by cloud services are often substantial. However, when combined with initiatives to drive growth and accelerate digital transformation, the returns can be spectacular.

A comprehensive cloud strategy enables insurers to reach not one but three key business objectives. It will accelerate growth, drive digital transformation, and also curb costs.

All too often insurers settle for just one of these goals. It’s usually cost control. But they miss the big picture. They underestimate how scaling up their cloud services can transform their businesses and deliver benefits across their organizations. Before pushing ahead with their current cloud agendas, insurers should stop and check that they’re on track to get the most benefit from their service providers.

Missed opportunities can lead to disappointment. Our research shows that two-thirds of the organizations that have ventured into the cloud have not achieved the benefits they expected.

Sure, the savings that cloud services can deliver are often substantial. But cloud initiatives are most likely to succeed when they charted within a well-defined long-term technology and business strategy.

The cloud is giving some insurers substantial cost savings.

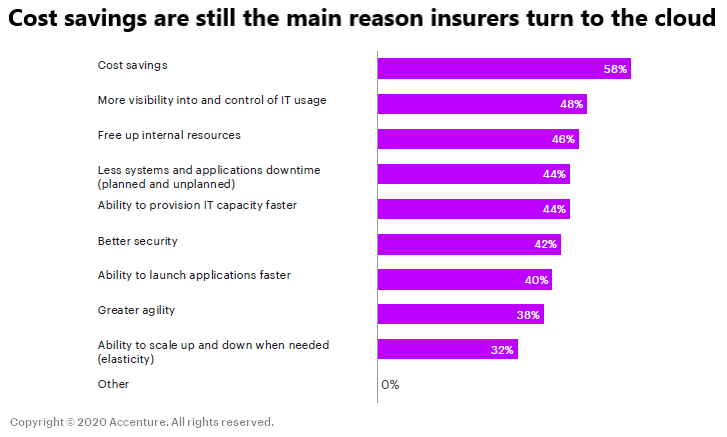

We found that nearly 60 percent of insurers identify cost savings as a key benefit of cloud computing. It’s well ahead of other advantages such as the quick provision of IT resources (44 percent), greater agility (38 percent) and the capability to scale technology applications and resources (32 percent).

According to our research, some insurers are enjoying substantial cost savings since moving to the cloud. They’ve achieved combined ratios well below 95 percent and expense ratios of around 20 percent. These levels are far ahead of the industry averages for either P&C or life insurers. Furthermore, these industry leaders have been able to use their savings to shift some of their technology spending from maintenance to innovation. They’ve cut their “run” costs, for example, from 75 percent of their IT budgets to 65 percent while pushing up spending on “change” initiatives from 25 percent to 35 percent.

These benefits are impressive. But when combined with cloud-based initiatives to drive growth and accelerate digital transformation they can become spectacular. Insurers that shift their key applications and critical workloads to the cloud can reduce their technology expenditure and improve spending controls. At the same time, they can also use the on-demand capabilities of cloud services to modernize their operations and develop strategic growth initiatives. The illustration below shows how a global insurer is using the cloud to go far beyond just cost savings. The company is also reaping the benefits of rapid digital transformation and aggressive business growth.

Insurers should take advantage of the advanced digital technologies that big cloud providers offer their clients to overhaul often cumbersome operations such as product distribution and claims processing.

The cloud can deliver significant operations improvements.

The sophisticated data analytics and artificial intelligence (AI) tools offered by cloud service providers enable insurers to better understand and anticipate the needs of their customers. Carriers can also measure the success of new distribution initiatives by generating quick and accurate metrics such as cost of sales, renewal rates, strike rates, customer service costs, number of digital touchpoints and retention levels.

Claims processing is a major cost overhead for insurers. But many carriers have been reluctant to overhaul this facet of their organizations. They’re often wary of disturbing this critical business function or altering the complex legacy technology that frequently underpins its operations. However, the rise of remote claims processing teams and new adjudication methods are giving insurers an opportunity to relook at their claims processing operations. They can benefit substantially from using data analytics systems to deliver insights into customer behavior and market sector trends as well as employing machine learning solutions to sort and assess claims.

Insurers migrating to the cloud at scale are gaining savings and agility across the insurance enterprise. Find out more in our latest report: Reimagining insurance: The new cloud imperative.

LEARN MORECloud services can drive new business growth.

Carriers can also take advantage of the flexibility and agility of cloud services to accelerate the growth of their new business initiatives. They can quickly refine their business models, for example, to address the fast-changing needs of small businesses, leisure companies and property management firms in the wake of the COVID-19 pandemic. Greater nimbleness will also enable insurers to fast-track new products that address risks related to business interruption, income protection, and cybersecurity.

Access to an extensive suite of cloud services and resources gives insurers the ability to build robust, secure and cost-effective ecosystem offerings. This capability will become increasingly important in the growing digital economy. It will allow carriers to grow revenues through much more effective marketing and sales into sectors beyond the traditional insurance industry, such as healthcare, wellness, and home security.

Furthermore, far-sighted insurers can also deploy cloud services to respond to the pressing social and economic changes that are occurring across the world. Declines in asset ownership, the rise of the gig economy, far-reaching changes in transportation and growing environmental concerns require a new generation of risk-management solutions. Cloud-based services using technologies such as the Internet-of-Things, quantum computing and augmented reality will become increasingly important.

In my next blog post, I’ll discuss why it’s vital that insurers align their business objectives as well as their technology needs with the products and services offered by their cloud providers. The stakes are high. Until then, have a look at the links below. They provide lots of insightful information about how companies can maximize the benefits of on-demand cloud services.

Considerations for an effective cloud strategy (blog post)

Cloud Migration Services and Strategy

Subscribe for more from Accenture Insurance.