Other parts of this series:

- It’s time for insurers to conquer their cloud fears

- Smart insurers are transforming themselves in the cloud

- Three big goals for a winning cloud strategy

- Let business – not technology – set your cloud agenda

- Powerful cloud services will drive ecosystem innovation

- Big insurtech opportunities for carriers entrenched in the cloud

Carriers can boost their revenue growth if they match their current—and future—business needs with cloud providers’ offerings.

Insurance companies can substantially improve the benefits they gain from cloud computing if they align their business needs with the products and services offered by big cloud providers. Besides stepping up the migration of key applications and workloads to cloud services, choosing the provider with the right cloud solutions and tools can help them grow their businesses and increase revenues.

Too often, insurers fix their sights on their current technology when they journey into the cloud. They want to make sure that they can migrate key applications and systems to their cloud providers. This makes sense. It’s important that this transition goes smoothly.

But it’s vital that insurers also look at their future business needs.

By identifying how their businesses are likely to change, and understanding what technologies they will need to support new business initiatives, insurers can build relations with the cloud service providers that best meet their evolving needs.

We’ve found that the most successful cloud projects are collaborations between organizations that are transforming to meet the demands of the future, and technology providers eager to facilitate change. AXA, for example, is working with both Amazon and Microsoft as it moves many of its core data resources into the cloud and develops new business applications. Deutsche Bank recently announced a partnership with Google that will enable it to migrate its IT services to the cloud while also working with the digital services provider to develop a suite of innovative financial products.

Outside the financial services industry, the Renault-Nissan-Mitsubishi alliance is using Microsoft’s Azure cloud platform to deliver a host of digital services to connected vehicles in nearly 200 markets around the world. Renault has also announced plans to use Google’s cloud services. The automotive manufacturer intends migrating the IT activities that support its production facilities and supply-chain management to Google Cloud. Renault will use Google’s cloud-based data analytics, machine learning, and artificial intelligence offerings to improve the efficiency of its operations and enhance its industrial data-management platform.

Some technologies are critical to insurers but bring cloud providers little extra revenue.

So, what should insurers consider when selecting a cloud provider? The selection of products and services on offer, and their pricing, can sharpen their focus.

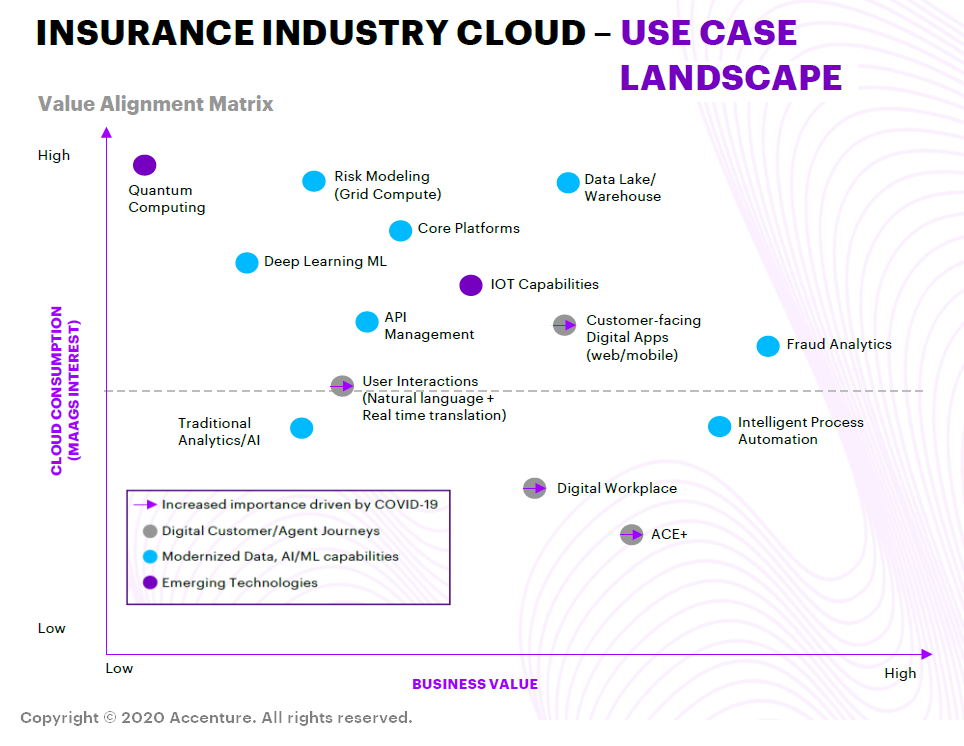

Our Insurance Industry Cloud – Use Case Landscape matrix shows the value of key digital technologies to both insurers and cloud service providers. The perspectives of users and service providers are often very different. Intelligent process automation, for example, is an increasingly important technology for insurers but is a lower priority for cloud service providers. This is because it doesn’t consume a lot of computing power. Similarly, technologies that have come to the fore during the COVID-19 pandemic, such as digital workplace systems, chatbot and voicebot solutions, and customer experience offerings, have been critical for insurers but don’t drive a lot of revenue for cloud providers. By contrast, data lakes and data warehouse applications are in the sweet spot for both insurers and cloud companies.

This value-alignment matrix is a broad guide. It maps the current and expected needs of insurers against the average cloud consumption requirements of users of Microsoft, Amazon, Alibaba, and Google’s (MAAG’s) cloud services. Each of these cloud service providers has a wide product set. The features and pricing of offerings, such as Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS), can vary considerably. Insurers should look carefully at the products and services offered by each of the major cloud providers and align themselves with the companies that will best serve them now and in the future.

Migrate, accelerate, grow—as businesses progress along typical cloud journeys, business value can be amplified if it is defined and actively pursued.

Business benefits are often overshadowed by the search for cost savings.

A business-driven cloud agenda is a big change from the way insurers have tended to view the cloud in the past. Cost savings, as I mentioned in my previous blog post [Link], are the most common motive for insurers moving to the cloud. Better control and management of technology resources come next. Business benefits, such as greater agility or the ability to scale new services or applications, rank much lower.

A business-driven agenda requires insurers to manage three key steps as they journey further into the cloud.

- Migrate: Migrating infrastructure and software to the cloud reduces IT operating costs and the “technology debt” caused by inefficient legacy systems, and provides users with scalability on demand.

- Accelerate: By building on robust cloud infrastructure, insurers can accelerate technology enhancements and speed up business efficiency improvements. Quick gains include service center enhancements, reduced administrative reworking, and less IT down time.

- Innovate and Grow: Platform solutions allow insurers to hasten business improvements and enhance risk management. A variety of proven solutions, which continue to be upgraded, are available for applications such as claims processing, product distribution, and business development.

Technology improvements and cost control are important components of any cloud agenda. But they should never overshadow the business benefits of cloud migration.

In my next blog post, I’ll discuss how insurers can use their cloud services to boost the effectiveness of their digital ecosystems. Until then, have a look at the links below. I’m sure you’ll find them useful.

Considerations for an effective cloud strategy (blog post)

Cloud Migration Services and Strategy

Subscribe for more from Accenture Insurance.