Other parts of this series:

Most insurance providers lack the capabilities they need to become successful ecosystem businesses.

Plenty of insurers are keen to capitalize on the rapid rise of digital ecosystems. But few of them are ready to seize this opportunity.

The benefits of open insurance that I discussed in my previous blog post will be beyond their reach. Unless they make big changes to their businesses. Let me explain why. Then I’ll discuss the changes insurers need to consider.

Our research shows that most insurers overestimate their ability to build ecosystem businesses. Eighty-four percent of insurers say ecosystems are an important part of their strategies. Fifty-eight percent of insurance providers have even begun pursuing ecosystems strategies. What’s more, almost all the insurers we approached see themselves as attractive ecosystem partners. But here’s the rub. Less than five percent of them have what’s needed to run a successful ecosystem business. They don’t have the necessary capabilities.

Insurers lack three key ecosystem capabilities.

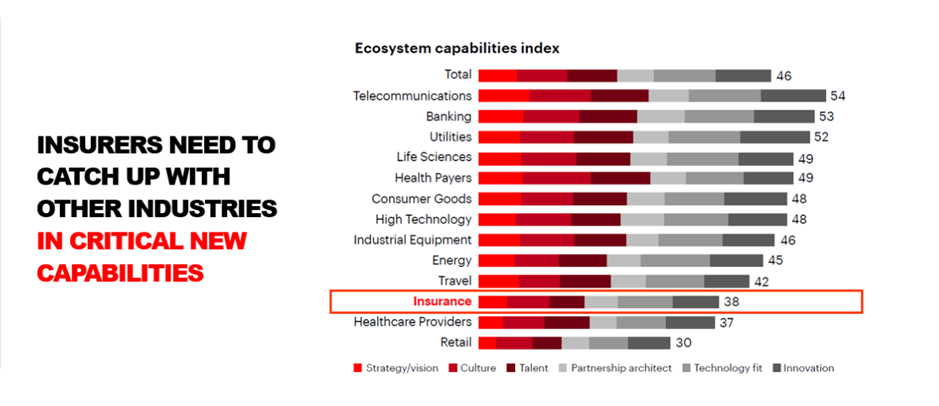

Why are most insurers not ready build ecosystem business? We found that most insurers haven’t developed the ecosystem strategies they need. They’re also short of the necessary skills and lack the correct organizational structures and cultures. Nor have they installed the appropriate technology architectures. These shortcomings have put insurers well behind their peers in banking. This is clear in the illustration below. Open banking, as I mentioned in my previous blog post, has spurred many firms in this industry to embrace ecosystems.

Insurers often lack ecosystem capabilities because they’re tied to legacy systems and processes. Our Disruptability Index shows that many insurers have been slow to invest in technology to boost innovation and efficiency. They lag companies in most other industries. Their current technology resources can’t meet the demands of an ecosystem business. They’re unable to support lots of business partnerships. Nor can they deliver personalized customer services or flexible business propositions.

Carriers looking to become open insurers face another obstacle. For many years they’ve viewed their data as a valuable proprietary asset. Now, they must share much of this information. It requires a big culture shift.

Reluctance to sharing data is one of the biggest challenges that insurers must conquer if they’re to become open insurers. They’ve got to improve their mastery of their data resources and also loosen their hold on these assets. Only then can they win the confidence of their customers and partners. And only then will they be able to show how all parties can gain by sharing data across a secure, well-managed ecosystem.

Three big changes insurers need to make to become ecosystem businesses.

So, how should insurers go about transforming their businesses to become successful ecosystem enterprises? It’s vital that they realign their technology infrastructures. They also need to adjust their organizational structures and cultures as well as their approaches to partnerships. Without these changes they’re likely to struggle to become open insurers.

Technology. Technology architectures designed handle vast, rapid data flows are essential. They should incorporate powerful application programming interfaces (APIs). Insurers need to build, publish and install APIs fast. They should be easy to use and accessible to third parties. Insurance providers will also need to decouple their technology architectures. This will allow them to accommodate many different systems and applications. A “cloud-first” strategy will help insurers upscale and port new business solutions.

Organization. To become open insurers most carriers will need to restructure their organizations. They should also review their company’s culture. Insurers need to promote flexible thinking and problem solving among their workforces. They ought to adopt a culture of continuous improvement and fail-fast innovation. Targeting “early wins” during a transformation allows insurers to release capital for investment.

Partnerships. Insurers should adopt an effective open insurance partnering strategy. This will enable them to build new business relationships and pursue creative collaborations. It needs to accommodate lots of diverse partnerships. What’s more, it should be flexible enough to capitalize on unexpected opportunities. Insurers should always be on the lookout for potential new partners. Yet, they should also keep a watch on themselves. They need to ensure they remain appealing and able ecosystem partners.

In my next blog post, I discuss what insurance providers can learn from banks about ecosystem businesses. Many banks have had to change their businesses to meet open banking standards. In the meantime, have a look at the links below. Otherwise, send me an email. I’d like to hear from you.

Tomorrow’s open insurance opportunities.