Other parts of this series:

Today’s life insurers face pressure to reinvent their businesses on many fronts. They must keep pace with rapidly shifting technologies, competition, regulations, risk typologies, and customer expectations. This year’s Technology Vision for Insurance—Accenture’s annual global survey of industry leaders—revealed that this feeling is widespread. Over 80 percent of the executives surveyed agree that their organizations must innovate at an increasingly rapid pace just to maintain a competitive edge.

Some life insurers are already experimenting with emerging technologies like blockchain, virtual reality, and artificial intelligence. Dai-ichi Life Insurance of Japan, for instance, has launched an AI-powered feature for its mobile app. It analyzes a photo of a recent health checkup to determine a customer’s “health age.” Based on this, it can recommend a health improvement course.

Such efforts are part of a larger strategy seen across the life insurance industry. Almost 85 percent of surveyed executives said that companies are weaving themselves into the fabric of how people live today. The Tech Vision report projects that this trend will accelerate in coming years, as current revolutionary technologies mature and new ones appear.

These new technologies will create new risks and dangers. Insurers, through partnerships with customers, employees, other businesses, and even governments, can help society harness the power of such new tools while mitigating their risks. Along the way, insurers will also be empowering their own growth.

The world is rewiring itself around digital innovation and the companies providing tech-driven services, just like cities were built around railroads, or people rebuilt their lives around electricity. As the world becomes more connected, the lines separating customer, employee, citizen, company, and even government are blurring.

This is profoundly changing how life insurers operate and what their customers expect.

In this blog series, we’ll go over five emerging tech trends that are driving this change, with examples from across the life insurance industry:

- Citizen AI: As artificial intelligence grows in capability and impact, life insurers must ‘raise’ their AIs to act as responsible, productive members of society.

- Extended reality: Virtual and augmented reality technologies are shrinking the distance between people, information and experiences, transforming the ways life insurers train workers and reach customers.

- Data veracity: Data, long the lifeblood of insurance, is more important than ever. Life insurers must adapt existing capabilities to combat a new kind of vulnerability: inaccurate, manipulated and biased data that leads to corrupted business insights.

- Frictionless business: To fully power the external technology-based partnerships they depend on for growth, life insurance companies must move on from internal legacy systems and re-architect themselves with blockchain and microservices.

- Internet of thinking: From AI to robotics to immersive experiences, bringing intelligent environments to life means extending enterprise infrastructures into dynamic, real-world environments.

We’ll also look at the major decisions life insurers will need to make with respect to each trend.

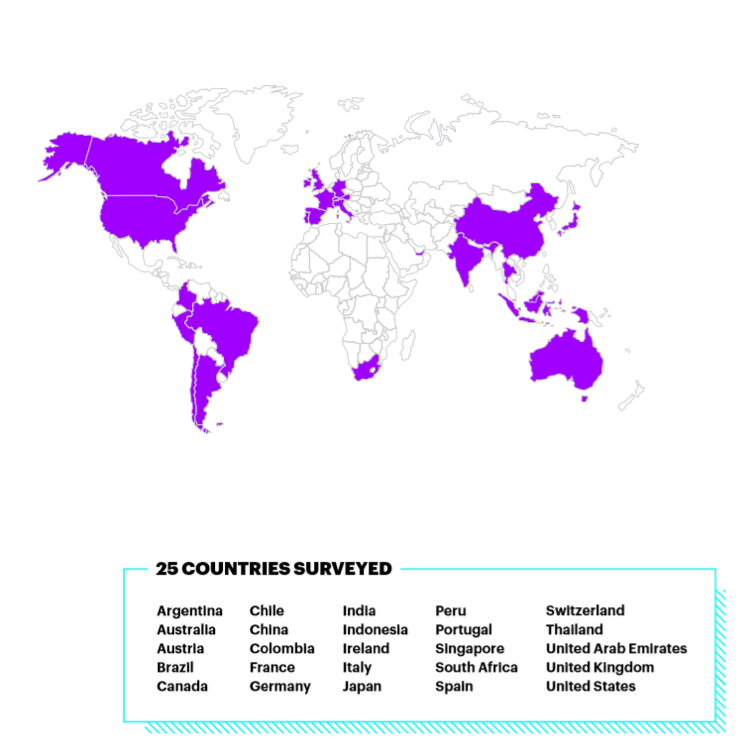

Our guide through these ideas will be the 2018 Accenture Technology Vision for Insurance. Each year, Accenture researchers combine input from a panel of luminaries, dozens of expert interviews, and a global survey of thousands of business and IT leaders to pinpoint the emerging tech trends that will have the greatest impact on the industry and the world in the years to come.

This year’s survey included responses from 623 insurance executives from around the world.

Join me next week for a look at how AI is coming of age and what it means for life insurers. In the meantime, the full Tech Vision for Insurance 2018 report is available here.

Good article.