Other parts of this series:

Open insurance pioneers are unlocking industry opportunities to create incredible value for customers.

The insurance industry is going to a new frontier: open insurance ecosystems. It’s not the Wild West, but it’s mostly uncharted territory. Insurtech deal values are going up and customers continue to demand micro-tailored services, so providers need to step lively to provide effective and streamlined services—and stay ahead of their competitors.

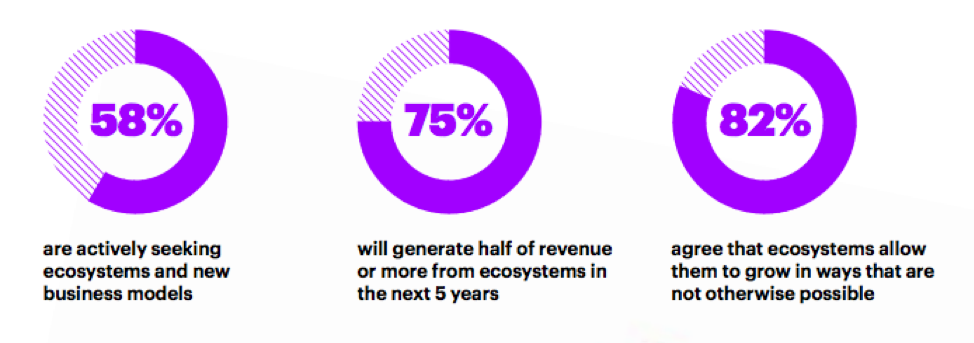

This is where connected ecosystems come in. A new Accenture report shows that insurers are very aware of the importance of ecosystems for the industry.

The report also highlights pioneering providers who have embraced ecosystems and started new industry trends. Let’s have a look at the trends.

The report also highlights pioneering providers who have embraced ecosystems and started new industry trends. Let’s have a look at the trends.

Open insurance that provides access for all industry players.

Over the last decade, Ping An Insurance has been on the forefront of industry innovation. Open insurance is no exception to where it creates value for both the industry and customers. The company strategy is now focused on building open platforms that are accessible to all industry players.

In order to provide advanced insurance technologies at a low cost, Ping An’s key strategy lies with its OneConnect subsidiary. OneConnect solutions include Smart Insurance Cloud for authentication; loss adjustment and AI-based claims solutions; and an extensive proprietary database. Open insurance offerings also include a platform to determine personal injury severity and insurance scoring.

Real-time, on demand cargo insurance.

Cargo insurance isn’t always the easiest—or quickest—type of coverage to obtain, but some providers have begun to use open application programming interfaces (APIs) to automate the process. This has been especially helpful for shipments that are less than a truckful.

Reliance Partners recently took this one step further, collaborating with logistics tech company, Project 44 to niche out the smaller end of the cargo insurance market. The result of this partnership enables customers to get real-time quotes and purchase coverage via their own transportation management systems—all through the Project44 API, insurers and third parties can leverage shared, permission-based access to data. Not only does this efficiency cut out a third party, it can also be done per shipment. This is a prime example of streamlining what can be a tedious process.

Comparably, the insurance arm of UPS has leveraged its suite of six APIs to help make purchasing and claims easier for small and mid-sized shippers. Real-time execution through a transportation management system allows shippers to buy specific coverage at point-of-need.

Automated claims payments for parametric microinsurance.

When we think about streamlining the purchase and claims process, microinsurance absolutely needs things to be quick and easy. API technology now allows partners to easily “plug in” for quote, policy administration, claims and messaging services. If certain criteria are met, payouts are automatically approved.

The elimination of claims notice and assessment time is especially beneficial for weather related incidents. The Blue Marble Microinsurance consortium offers parametric insurance protection against extreme weather conditions for smallholder farmers in Zimbabwe and Colombia. Satellite, remote and point-sensor tech give comprehensive climate data, and the ultimate benefit of automatic calculation and payment policy holders.

“Smart” life insurance based on open banking data.

Though the insurance industry doesn’t (currently) have the same regulatory push as banking, open banking data can be applied to life insurance through data and machine learning. For example, when customers connect their account or transaction history, UK insurer Anorak (in partnership with TrueLayer) can tailor advice and coverage recommendations based on customer data. Anorak also offers an API that integrates their services with a partner’s app or website.

These trends give a taste of what the future holds for the insurance industry. Open insurance pioneers are proving that offerings can be efficient and provide the value customers need and want. And yet still keep customer data safe and secure—a cornerstone of the industry.

In my next post, I’ll dive into APIs and how they can enhance and streamline insurance offerings. In the meantime, for more insight into open insurance, download the report, or get in touch with me here.