Other parts of this series:

Open data platforms enable insurers to develop ecosystem businesses and capitalize on their vast data resources.

Many of the insurance executives I talk to recognize the huge potential of digital ecosystems. But, lots of them wrestle with one big question. “How do I change my company to capitalize on the promise of digital ecosystems?” It’s an important question, and one that I encounter more and more.

Most of us understand that ecosystems can protect our businesses from digital disruption. We know that ecosystems also enable us to develop new businesses and attract customers. But how does a traditional insurance company become an ecosystem business?

The answer: Open insurance.

Open insurance offers carriers one of the best routes to become an ecosystem business. What is open insurance? Open insurance is a new way of doing business. It requires insurers to share and consume data and services from many sources and across lots of industries. It allows insurers to create new value propositions and generate fresh revenue streams. Especially important, it enables carriers to deepen their relationships with customers. It also makes it possible for them to engage with a much wider audience of consumers.

APIs are critical to the success of open insurance.

Critical to the success of open insurance are application programming interfaces (APIs). These interfaces enable organizations to open their data, algorithms and processes to others. Ecosystem partners can then build these data resources into their services and experiences. I like to think of APIs as the glue that links ecosystems, service providers and customers. They allow vast volumes of data to flow between everyone connected to the ecosystem.

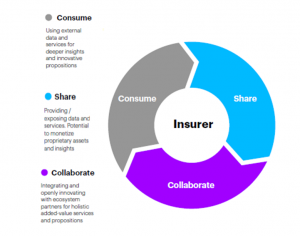

Open insurance business models must address the three essential functions of a data enterprise—consume, share and collaborate.

Major players in the banking industry are already profiting from open platform ecosystems. Open banking in Europe, for example, will generate around €61 billion this year. That’s close to seven percent of the region’s total banking revenues. New banks such as Fidor, Revolut, N26 and banq are using open banking to build innovative platform businesses. They’re creating value by sharing data across an array of ecosystems. Payment specialists, lending companies and service providers are also embracing open banking. What’s more, many traditional banks are following suit. They’re using open banking to reach more customers, deliver new services and connect with additional partners.

What’s triggered this surge of interest in open banking? New data regulations in Europe and the UK. Europe’s PSD2 electronic payment laws and Open Banking Standards in the UK forced banks to open their data resources. Regulators want to encourage innovation and competition. Similar regulations are in place in Australia and are under review in Canada.

Insurers don’t have regulators pushing them to open their businesses and share data. Nonetheless, most carriers I work with recognize that ecosystems are already disrupting their businesses. And they believe this disruption will intensify. About 67 percent of insurers expect to overhaul their business models in the next five years. They point to the rise of ecosystems as one of the biggest, if not the biggest, causes of this disruption.

In today’s post-digital era, digital technology pervades almost every facet of life. It’s everywhere. Consumers expect constant access to their personalized digital services. Insurers such as Zurich, AXA, Groupama, Lemonade and Anorak are already meeting this demand. They’re using ecosystems to combine their offerings with services from key business partners. This makes their products much more appealing to customers. Some insurers, for example Ping An and Allianz, are opening up their platforms. They’re allowing other service providers to use their platforms to build ecosystem businesses.

Open insurance offers carriers many benefits

Why is open insurance important? The benefits of open insurance are extensive. Here are some of the most promising open insurance applications:

Innovative customer propositions. Carriers can tap the huge flows of real-time data that open insurance unleashes to boost their product offerings. They can deliver on-demand, personalized services and experiences with variable pricing. Closer ties with customers will allow insurers to introduce new ecosystem services that combine their offerings with those of business partners outside the insurance industry. Customers can also gain from these alliances. They can share their data in return for extra services or better prices.

New partnership and distribution models. Open insurance gives carriers a bigger market for their products and services. It allows them to extend their distribution channels through strategic partnerships. The more customers and service providers they connect with, the greater the number of new partners they’ll attract. That’s the power of the network effect. It enables insurers to discover a host of new business opportunities.

Extra revenue sources. By adopting open insurance carriers can monetize their proprietary information and data services. They can also position themselves earlier in their customers’ buying processes. What’s more, open insurance will enable insurers to release value that’s trapped in their businesses. They can create additional value by pulling in services from partners that delight, and thereby retain, their current customers.

Operations improvements. The expansive ecosystems that underpin open insurance allow insurers to fast-track product innovation. They can design, develop and distribute products at speed. And reach a big audience. These operating improvements will push down costs. The whole of the insurer’s value chain will benefit. Greater collaboration and sharing of resources will deliver further savings.

In my next blog post, I’ll discuss the capabilities insurers need to become successful ecosystem businesses. Until then, take some time to look at the links below. They provide plenty of useful insights into open insurance and ecosystem businesses. Otherwise, send me an email. I’d like to hear from you.

Tomorrow’s open insurance opportunities.

TechVision 2020: We, the Post-Digital People.

Insurers: Go all-in on ecosystems.