Other parts of this series:

- Insurers: Start Boosting your “AIQ”

- How to use AI throughout the insurance value chain, starting with sales and distribution

- How to use AI throughout the insurance value chain with a focus on underwriting and service management

- How to use AI in the insurance value chain: claims management

- How to use AI in the insurance value chain: customer service and policy administration

How do you increase quality in claims assessment, management and administration? We share insights into an end-to-end AI-powered claims automation approach to increase quality, processing efficiency and reduce cost.

In this blog series, I’ve spoken about how AI increases process efficiency, reduces costs and helps business solve problems. I also showed how it enables smart business transformation by creating intelligent processes at every step along the value chain and intelligent products and services in the market.

In my previous post, I illustrated how insurers can use AI-related technologies in underwriting and service management. Now, I’ll explain how AI helps insurers to manage claims more effectively and efficiently.

How can insurers use AI in claims management?

AI technologies make information systems more adaptive to humans and improve the interaction between humans and computer systems. By doing this, AI gives insurers an edge on how they manage claims—faster, better, and with fewer errors. Insurers can achieve better claims management by using the intelligent technologies in some of the following ways:

- To enable a real-time question-and-answer service for first notice of loss;

- To pre-assess claims and for automated damage evaluation;

- To enable automated claims fraud detection using enriched data analytics;

- To predict claim volume patterns;

- To augment loss analysis

What are the benefits of using AI for claims management?

In our 2017 Technology Vision for Insurance , we highlighted how Fukoku Mutual Life Insurance in Japan is using the IBM Watson Explorer AI platform to classify diseases, injuries and surgical procedures as well as to calculate claims pay-outs.

Our research has shown automated machine classification can be 30 percent more accurate than manual classification by humans and has the potential to increase productivity by 80 percent. AI-related technologies can enable a higher quality in claims assessment, management and administration. It also supports improving the predictability of reserves and fraud.

Smart machines can pre-assess claims and automate damage evaluation. Machine learning enables insurers to classify claims via email in the case of an accident or if medical care is required. It’s fast, accurate, efficient and simple to use.

Case Study 1: Cognitive health insurance claims process management

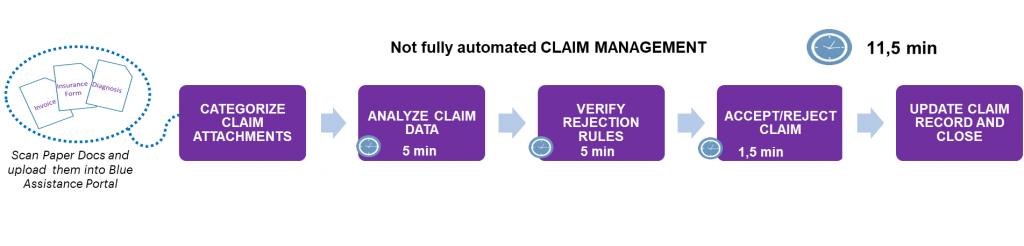

We have conducted a pilot with one of our insurance clients on the application of AI to their health insurance claims processes. This insurer’s health claims management process took about 11.5 minutes from receipt of the claim to updating it and closing the record. In this instance, scanning the paper documents and uploading them into the portal where they were categorized were the first manual steps. It took roughly five minutes to analyze the data, another five to verify rejection rules, and one and a half minutes to accept or reject the claim.

With our machine learning solution in place, a fully automated process was enabled and it took only three minutes to do the same amount of work. This represents a 74 percent reduction in the claims settlement time.

Furthermore, the machine learning technology applied was able to process health claims with 80 percent accuracy. The other 20 percent of claims are incorrectly processed owing to spelling errors or database limitations. However, machine learning technologies are able to store and recall those errors for more accurate claims processing in the future.

Case study 2: AI-powered automation of automobile claims processing

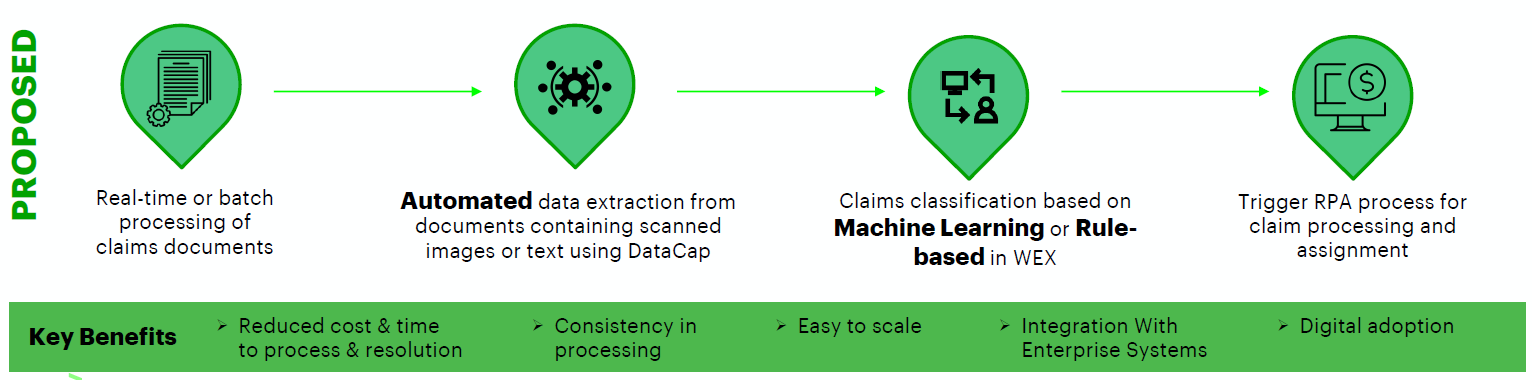

Accenture was recently part of a major client initiative to identify technologies and partner for an AI-driven automation journey. We proposed and built a solution to automate their processes to extract and classify data from commercial automobile claims PDF documents.

The client faced many challenges, including having fewer than 400 records to classify 55 unique cases, and these records were mismatched and labeled inconsistently. It also received scanned images containing text, owing to the redaction process followed to ensure data privacy.

We developed an on-premise solution using a combination of IBM offerings and open-source technologies that enabled a detailed analysis of training data. It also helped the client to identify quality and sparse/skew data and to test various approaches to maximize the performance of the solution.

In the end, a blind data set of 207 claims documents was processed within a four hour assessment window and we were able to process claims PDF documents with scanned images as well as text, including several formats and layouts not part of training data.

We identified several pain points in the current claims management process, which were:

- Error-prone manual data extraction;

- Inconsistent claim classification;

- The need for additional downstream validation;

- Increased time and cost for processing and resolution.

Solution proposed:

In the next post, I’ll look at how AI-related technology can be used to improve customer services and policy administration. Get in touch to find out how you can use AI in the entire insurance value chain, or download the How to boost your AIQ report.