Other parts of this series:

In my previous post, I discussed how four of the five emerging technology trends in Accenture’s Technology Vision for Insurance 2019 will impact talent and organization in insurance. In this post, I will focus on the third trend in the Tech Vision: the Human+ Worker.

Rise of the Human+ Worker

Insurance executives must realize they are not going through their digital transformation alone. In a post-digital world, their employees and agents are using technology to perform their roles in new ways and, in some cases, to adapt to roles that did not exist in a pre-digital era.

What our 2019 Technology Vision reveals is that there is a growing digital divide between insurers and their workforces. Employees exist in a world where technology is woven into the fabric of reality, yet most insurance firms are unable to keep up with their changing needs and expectations.

In our survey of 577 business and IT executives in the insurance industry, 76 percent agreed that their employees are more digitally mature than the organization itself, resulting in a workforce ‘waiting’ for the organization to catch up. Most insurance enterprises are optimized for the workforce of the past, even as the workforce evolves into the future at a rapid pace.

Technology has given workers a wider range of potential career paths to explore. Workers expect their employers to help them identify, manage and support these paths. However, companies in most industries fail to do so.

What’s plaguing insurers today?

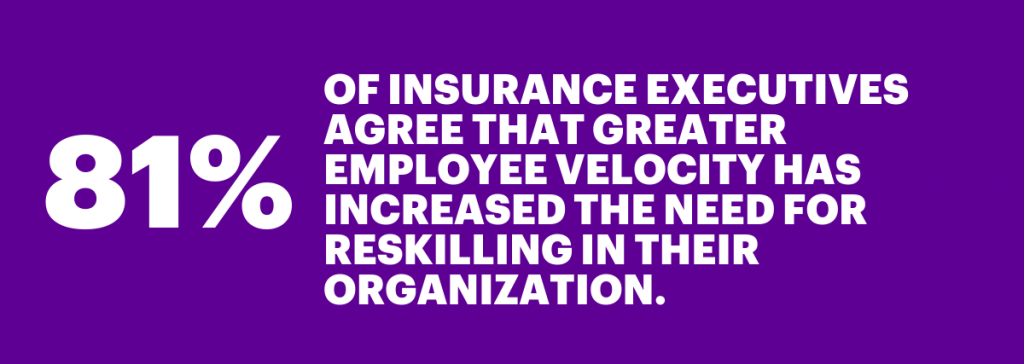

Insurance firms, faced with an ageing workforce, are struggling to attract top young talent. Their talent-finding strategies are out of sync with the capabilities of human+ workers; furthermore, their investments in learning and reskilling are insufficient to help employees transition to different roles and companies. Knowledge management and access strategies haven’t kept pace either.

How can employers overcome these problems? Organizations must adopt technology strategies that will empower a next-generation workforce. Through artificial intelligence (AI), extended reality (XR), people analytics and modern collaboration platforms, insurers will be able to propel their workforce forward.

The future is here

We have entered a future where employees need to rely more heavily on technology—for example AI, automation, machine learning, data and analytics—to do their work. We live in a world where people interact more with technology every day. And it can be extremely liberating for your workforce. For example, AXA XL is piloting AI and natural language processing software to help populate and process information on commercial business properties in an effort to free underwriters from a tedious, manual chore.

As I mentioned in my previous post, change is a slow process and adopting new technologies takes time. To help your employees adapt to the new normal, you need to empower them with tools that will make their work easier, not harder.

Too often, companies invest in technology without thinking how it will affect or disrupt their workers’ roles and lives. Before you buy into new tech, consider: will it enhance my employees’ capabilities or am I adding yet another step to their work process? Am I providing adequate training to ensure that they become confident with and empowered by the new tools?

If you don’t make an effort to change the workplace, you’ll risk hindering the workforce.

In my next post, I will take a deeper look at the winning talent management strategies that are driving leading insurers into the post-digital era. For more insight, read the Accenture Technology Vision for Insurance 2019 or get in touch with me here.