Other parts of this series:

Insurers should prepare for a post-pandemic business environment that will be intensely digital and full of uncertainty

The sudden acceleration in the uptake of digital technologies by consumers and businesses during the COVID-19 pandemic is dramatically transforming how we live, work and engage with each other. Insurers need to ready themselves to meet the challenges and opportunities that lie ahead in the post-pandemic, intensely digital, business environment.

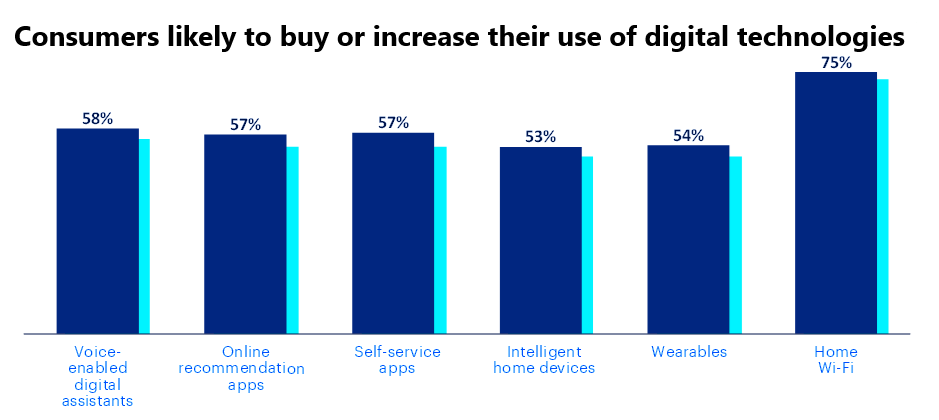

Our research shows that consumers are set to increase their use of digital technologies. They’re also likely to buy more digital products and services. As you can see in the illustration below, consumers are eyeing a wide range of digital offerings.

This accelerated swing to digital technologies will require insurers to adjust their business models. They’ll need to perform this shift while also bolstering the resilience and improving the agility of their businesses to ride out the uncertain times ahead. We don’t yet know the scale of the economic downturn triggered by the COVID-19 pandemic. Nor do we know how long it’s going to last. Potential geopolitical shifts, such as retreating globalization as a result of nations increasing their attention on domestic concerns, are adding to the uncertainty.

My discussions with business leaders at our recent Digital Insurer Network event, and also my talks with clients in the past few weeks, have highlighted some of the priorities that carriers need to address in the wake of the COVID-19 pandemic. Insurers that respond to these challenges successfully will reconfigure their businesses to better meet the shifting needs of their customers while also making their organizations more robust and more nimble. Here are six big priorities:

Digital transformation is no longer an option. Insurers that were well advanced with digital transformation responded to the pandemic with greater speed and agility than their more cautious competitors. Despite likely technology budget constraints, insurance providers should accelerate their digital transformation. They’ll need to take a hard look at their investment priorities. Should they invest more in product development or rather digitize their sales, support or claims handling? They’ll need to conduct similar reviews of their maintenance budgets as well as their planned IT expenditure.

Reinvent the customer experience. Many insurers implemented short-term fixes and “work-arounds” in their organizations’ processes to enable their employees to work from home and continue serving customers. The success of these interim measures has shown that simpler customer journeys can be very effective. Insurers should capitalize on this insight. They might consider overhauling the customer experience they deliver. Greater use of artificial intelligence and smart automation technologies will enable them to provide customers with exceptional experiences.

Transform distribution. Early in the pandemic, many insurers introduced remote video sales solutions. There’s little doubt that face-to-face meetings are still needed when customers want extensive advice and guidance. However, the introduction of remote sales solutions has shown insurers that they can use a highly effective combination of different distribution channels. Video conferencing, for example, can reduce costs while also enabling insurers to provide customers with tailored personalized advice. Carriers could also adopt voice-activated intelligent agents—currently used by telecommunications companies—to sell simple insurance offerings.

Flex operating and IT models. Insurers should prepare for the likely economic slowdown by reviewing their cost structures. They ought to analyze, prioritize and adjust internal and third-party expenditure. This will require them to carefully review their operating models and perhaps introduce zero-based budgeting to identify opportunities to curb costs and increase business agility. Such opportunities could include introducing smart automation technologies, “flexing” workforces, improving IT efficiency and migrating to cloud services. Some insurers may need to revise their sourcing of strategic resources and adopt more flexible approaches to managing in-house and outsourced processes.

Scale protection offerings and address new revenue pools. Many new risk-management needs have emerged as a result of the pandemic. They include business continuity cover for small and medium-sized enterprises, pandemic insurance and event-cancellation policies. The growth in ecommerce and delivery services also offers insurers significant opportunities to extend their protection offerings and establish new sources of revenue. Healthcare needs have come to the fore during the pandemic. This is a sector where insurers are likely to play a greater role. They have already begun to roll out a variety of value-added services that include patient-tracking apps, telemedicine and remote safety alerts for vulnerable people.

Rework workforce. The lockdown imposed by many countries affected by the COVID-19 pandemic forced insurers to manage their workforces remotely. Many employees, especially customer service staff, worked from home. These workers often made substantial contributions to the success of such transitions. They showed the value of shared leadership, support for a common purpose, lifelong learning, adaptability and ingenuity. Insurers have a unique opportunity to build on this experience. They should extend their use of digital tools and intelligent systems to encourage greater workforce collaboration and innovation and to secure closer ties with agents, brokers and intermediaries. Insurance providers can further improve employee productivity and skills development by increasing their use of workforce analytics.

If you’d like to discuss how insurers can transform themselves to meet the demands of the post-pandemic environment send me an email. I’d like to hear from you. The links below provide plenty of useful information. Until next time. Stay safe.

Covid-19: Navigating the human and business impact on insurance carriers

Great information and insight, thanks so much.