Other parts of this series:

From its earliest days, life insurance has been fueled by data. Today, the industry is more data-driven than ever. Life insurers rely on data to make better operational, risk and pricing decisions. They use data to develop new products and business models. Increasingly, they leverage data to incentivize customers to reduce their exposure to risks and help them avoid incurring losses.

For instance, many life insurers use fitness data from wearables like Fitbit and the Apple Watch to encourage customers to lead healthier lives. AIA Vitality, a program run by AIA Singapore, tracks customer health and incentivizes healthier choices with discounts on life insurance, cash back, and deals on consumer goods like 50 percent off on flights and cruises.

Programs like this one have helped life insurers realize real gains in recent years. Customers are better treated, operations are more efficient, and profits are more reliable thanks to modern life insurance data practices.

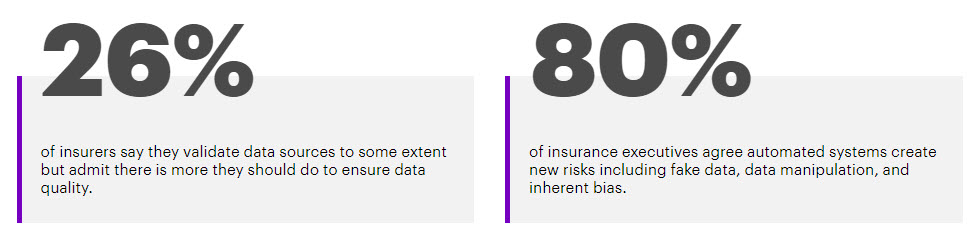

Yet as data unlocks these new possibilities, it exposes carriers to a new vulnerability: inaccurate, unverified, or manipulated data. A recent study estimates that 97 percent of business decisions are made using data that the company’s own managers consider to be of unacceptable quality.

Despite this, 80 percent of the insurance executives surveyed for the Technology Vision for Insurance 2018 report that their organizations are increasingly using data to drive critical and automated decision-making at scale.

The crucial role that data plays in modern life insurance also makes it a target for bad actors. Thirty-four percent of survey respondents report that they’ve been the target of malicious digital actors seeking to falsify or manipulate insurance data through bot fraud and other techniques. Another 32 percent said they most likely were the target of such an attack but could not verify it.

Life insurers don’t need to resign themselves to using unreliable data, however. They can address this vulnerability by building confidence in three key areas identified in the Tech Vision 2018 report:

- Provenance, or verifying the history of data from its origin throughout its lifecycle.

- Context, or considering the circumstances around data’s use.

- Integrity, or securing and maintaining data.

Each life insurer will need to chart their own course to develop these principles across all lines of business. However, proper oversight of data is unlikely to occur without making it the dedicated function of a specialized business unit. Every life insurer should develop a “data intelligence” practice or function to grade the truth within the data it uses. This function will incentivize sound data practices and help the insurer reap the rewards of data veracity.

A life insurer building a data intelligence practice will need to answer four key questions.

- Are we able to attract, train and retain the talent needed for a culture of strong data practices? Cybersecurity, data science, and AI are all related but distinct fields of expertise. All three must coordinate closely to maintain data veracity. Consider implementing a rotational program to expose more employees to these disciplines.

- How does our enterprise grade data? Document the data flowing into and out of your organization. For each stream, ask the responsible teams to grade their confidence in the truthfulness of data under their care. Ask the same of any data provided by third parties. Develop a rubric to ensure consistent grading.

- How important is digital hygiene in our culture? How important should it be? One way to begin this digital hygiene journey is to have employees compete in building security-based, future-focused scenarios. Use the most prevalent scenarios to prioritize security measures and training programs.

- Are we incentivizing users to ‘game’ our systems? Information asymmetries tend to incentivize data manipulation and gaming of autonomous systems, such as faking the frequency or intensity of exercise routines. List the information asymmetries throughout your data supply chain. Establish a culture that minimizes these asymmetries to protect against data manipulation.

Come back next week for a look at how the age of frictionless business will influence how life insurers form partnerships and find competitive advantage.

In the meantime, the full Tech Vision for Insurance 2018 report is available here.