Other parts of this series:

The COVID-19 pandemic has brought about a recession unlike any we have seen before. While the severity of this recession is still yet to be determined, we know that the events of the global economy will have an impact on the insurance industry. However, leading insurers across the world are reacting with innovative responses that show that smart strategic plays are still possible in this environment.

The current insurance context

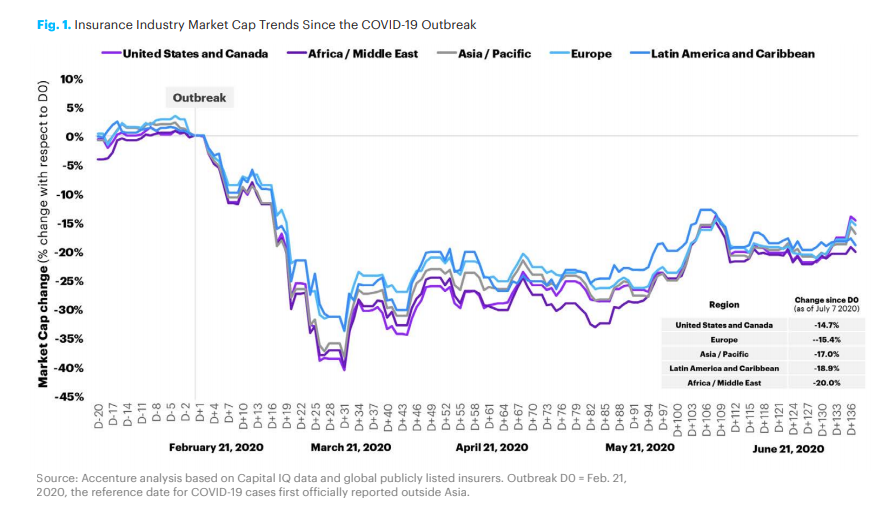

While we may not know the full depth of the global recession yet, it is clear that the COVID-19 pandemic has had a significant impact on the market capitalization of insurers that has gained momentum much faster than previous financial crises. Specific lines, such as trade credit, inland marine, and workers’ compensation are at particular risk, as are segments such as the small- and medium-sized business market.

Accenture’s latest report, Strategic Plays for Recession Recovery, looks at the delicate mix of actions that previous outperformers have taken to remain stable duringand come out stronger afterrecessionary times. The evidence shows that insurers outperformed their peers in previous recessions through structural cost reduction and strategic reinvestment of those savings in core sources of competitive advantage to drive growth. However, in current times, insurers need to apply unique, nuanced strategies.

Post-COVID-19 cost reduction strategies

Current examples of cost reduction we are seeing across Europe include:

- A UK based company is optimizing services and increasing its operational efficiency by moving to an intelligent operating model that combined data analytics, applied intelligence and human ingenuity

- An Italian insurance company optimized procurement, radically changing how source-to-pay services were delivered. This insurer is now able to more effectively manage to spend, drive compliance and strengthen risk management.

We are also seeing multiple examples to underpin insurers growth across Europe through new initiatives:

- In Finland, there are thousands of uninsured vehicles, resulting in millions in unpaid insurance premiums. Using blockchain technology, Finland’s State Treasury created a vehicle identity platform that could potentially eliminate this problem

- New partnerships such as Generali Global Corporate & Commercial (GC&C) partnering with insurtech firm Descartes Underwriting to offer parametric insurance products

Insurers are also focusing on customer service to further fuel their growth. For example:

- A Finish insurance company uses human-centric research to better meet customer needs.

- A large Spanish insurer reduces response times to client communications by using Artificial Intelligence.

Deciding your next play is complex. Many leading insurance companies are working with consulting companies to developed impact analysis around the COVID-19 pandemic in the insurance industry to identify opportunities in these uncertain new times. In the next post, we will show how strategic partnerships are helping insurers recover from the recession.

Contact me to discuss how to build your business’s recession response.

Read the full insurance report: Strategic Plays for Recession Recovery Report