“Zhong An is different because of you.”

When you visit the Chinese online-only insurance company’s website, the first thing that strikes you is the company tagline. So simple, it translates easily to English. In one sentence, it embodies everything that Zhong An stands for: personal, digital, immediate insurance offerings that put the customer at the center of its operations.

What is Zhong An Online P&C Insurance Company?

The Shanghai-based company was co-founded in 2013 by China’s most prominent businessmen: Jack Ma (Alibaba), Pony Ma (Tencent) and Mingzhe Ma (Ping An). The idea was enormous in its simplicity—to create China’s first insurance company to sell its products over the internet. In 2017, when it was time for its debut on the Hong Kong Stock Exchange—the first public offering of its kind for an internet-only insurer and the largest IPO in Hong Kong that year—the company raised an initial public offering (IPO) of $1.5 billion on the first day. Japanese tech giant SoftBank bought 5 percent of its shares for $550 million on the spot.

The company today boasts more than 400 million customers with over 10 billion policies sold. It’s part of five major ecosystems—with more than 307 ecosystem partners. There’s also talk of an overseas expansion into Tokyo.

Impressively, the company is capturing the attention of millennials:

- The average age of Zhong An employees is 29.5.

- Customers aged 18-39 account for 57.8 percent of its policyholders.

What is the secret behind Zhong An’s success and, critically, what can insurers learn from the insurtech giant?

For me, there are three standout lessons for traditional insurers:

- The customer is king—always (and what that really means in a digital age).

- Digital powers everything—and creates solutions to customers’ problems.

- Your strength lies in your ecosystem and the partnerships you create.

Customer-centricity

Pedro Matthynssens, CEO at Vanbreda Risk & Benefits, writes in an article in De Tijd that insurers must get ready for Zhong An. There’s a reason why young people in China are buying their first insurance policies directly online—the company makes buying insurance easy and convenient and constantly innovates to put their needs first.

Matthynssens says there’s a big difference in how traditional insurance companies and insurtechs approach the concept of customer-centricity. Traditional insurers, he writes, focus on offering additional services to better serve customers. Insurtech go beyond that—they look at how society is evolving to identify customer needs and develop products and services to meet those changing needs. And they’re doing it by using the latest intelligent technologies.

Digital innovation

In 2016, Zhong An partnered with Ethereum to establish Zhong An Technology—an incubator to research artificial intelligence, blockchain and cloud computing.

“With the creation of Zhong An Technology, we are developing a new fintech ecosystem, integrating technological research with financial innovation. We aim to be an accelerator for both the finance and healthcare sectors.”—Zhong An CTO Xing Jiang

Matthynssens writes that 97 percent of Zhong An’s customers communicate via chatbots only—making communication fast, immediate and accessible. Its powerful digital capabilities allow the company to settle claims immediately—if a flight has been delayed, it will settle your claim while you’re still waiting for the flight.

Zhong An is also embracing blockchain to enable smart contracts, mitigate security risks and facilitate growth in the insurance industry.

“Not only will we develop technology, but our aim is to make technology become a commercial driving force, to put it at the core of our business ecosystem.”—Zhong An CEO Jin Chen.

Ecosystem power play

In an interview with the founders of the Digital Insurance Agenda, COO of Zhong An Technologies International Group Bill Song ascribes the company’s success to its “ecosystem thinking”.

Zhong An uses behavioral data from more than 300 partnerships to identify moments in which the customer can use an insurance product. These digital ecosystems create channels through which the carrier can sell its insurance products.

“Insurance is a data game. In the future, IoT, everything within telematics and even wearables generate huge piles of data. The question is if you use this data to really generate tailor-made solutions for your new customers. The second time your customer buys the same policy, maybe you could consider different scenarios for pricing. To understand and use your customer’s latest data for recent purchases; that would be the preferred direction.”—Bill Song

A little over a year ago, I wrote a blog series on how ecosystem power plays are transforming insurance and I presented Ping An as a case study of an insurer that’s paving the way to the future.

Today, Zhong An sees early investor Ping An as a rival it can learn from. In an article in the South China Morning Post, Laura He writes that China’s insurtech market is expected to hit 1.4 trillion yuan (US$211.7 billion) by 2021 with five technologies set to reshape the industry—blockchain, artificial intelligence, the Internet of Things (IoT), big data and cloud computing.

He writes that China’s insurtech market consists of three segments:

- Traditional products on the internet

- Upgrading existing products via new technologies

- Creating innovative products with big data analytics to tap unmet needs

Sheng says that Ping An’s insurtech business focuses on the first and second segments, while Zhong An operates in the third.

The 5 Cs of the platform economy

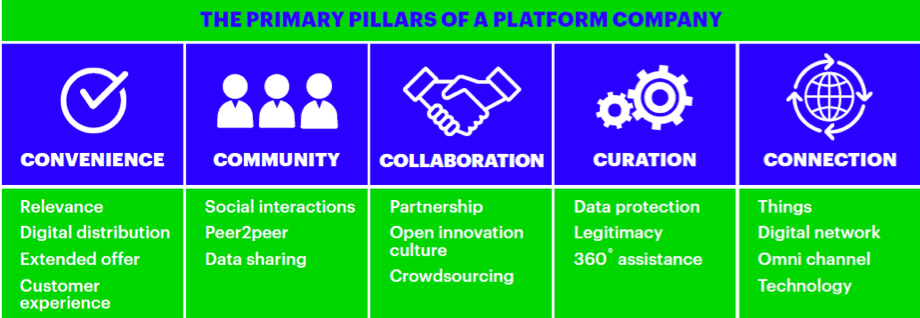

Zhong An addresses all the primary pillars of a platform company—convenience, community, collaboration, curation and connection. I anticipate that the carrier, in the future, will redefine even what we currently know about platform economies and ecosystems.

To learn more about ecosystems and how they are transforming the insurance industry, have a look at the following resources:

- Evolve to thrive in the emerging insurance ecosystem

- How ecosystem power plays are transforming insurance

- Case study: Ping An

- Another case study: Tune Protect and AirAsia

- How to unleash the power of us