Improving the core of underwriting will play a key role for carriers looking to succeed in the future of small commercial insurance. The three basics to strengthening underwriting, while enhancing the quality of data, include third-party data, evolving straight-through processing, and enabling underwriters with artificial intelligence and machine learning.

In my first post of this series, I talked about how increased competition in small commercial insurance will continue to drive price and margin pressures on carriers, and the two strategies they can use to find ways to survive and thrive.

Let’s take a closer look at the first part of the winning strategy in small commercial: Brilliant Basics: Improving the Core of Underwriting.

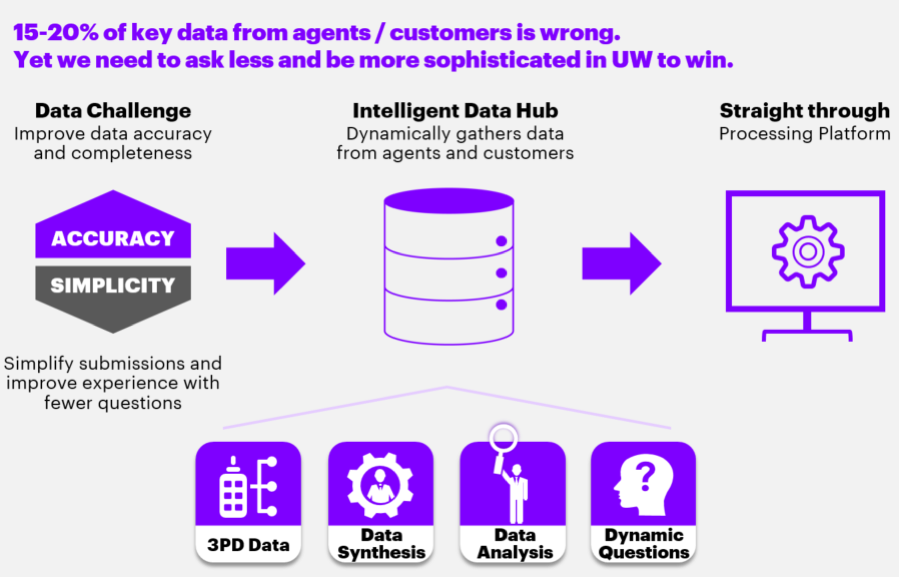

The elephant in the room is obvious to most insurers: the data challenge. All carriers want as much data as they can get, yet around 15 to 20 percent of the critical data we collect from agents and customers is wrong. In the competitive market of small commercial, carriers need to ask fewer questions and be more sophisticated in underwriting to win.

So, how do we simplify what we need to ask and improve data accuracy at the same time? The Brilliant Basics strategy has three major components: 1. Third-party Data, 2. Intelligent / evolving straight-through processing (STP), 3. Enabling underwriters.

Third-party Data

In this new world of small commercial, legacy carriers recognize the need to improve their customer and agent experiences as well as their underwriting efficiency, while enhancing data quality and pricing accuracy. Being able to quote faster with less data is an advantage, but it comes with its challenges. Just like agent-collected information, third-party data can be incomplete, out-of-date, or just plain incorrect. Intelligent data hubs can help insurers synthesize third-party data. In order to make the most of third-party data, carriers will need a combination of solutions including multiple data vendors and the use of artificial intelligence (AI) to supplement the incoming third-party data. Continuous data evaluation will be critical to ensure underwriting quality.

Intelligent / Evolving Straight-Through Processing

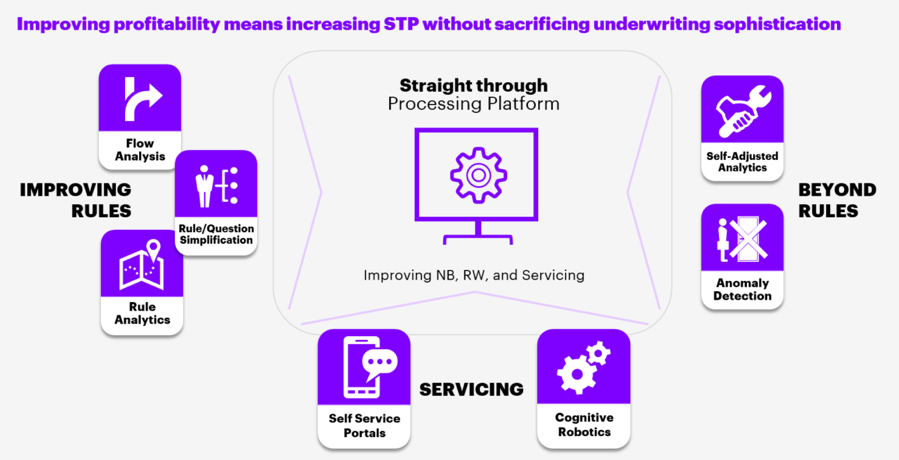

Improving profitability means increasing STP rates without sacrificing underwriting sophistication. Historically, carriers have relied on a myriad of complex rules, yet STP rates remain at 50 to 60 percent, at best. The ideal STP rate would be closer to 90 percent, and in order to reach that, we need to think of rules in a couple of ways. The first is to simplify, adjust and change some of the rules. But some rules may no longer be needed at all. In small commercial underwriting there is life beyond rules, and it’s called self-adjusted analytics.

Enabling Underwriters

Underwriters in small commercial have to make good decisions fast. AI can help with underwriting enablement in three ways: Enhanced automation, enhanced judgment and enhanced interaction. AI and machine learning can bring sophistication to the underwriting process by not only collecting data automatically from thousands of online sources, but also by directing underwriters to important data points to make immediate, insightful decisions on the curated content. Underwriters would also receive real-time updates to pricing analysis and increase the scope of the analysis when needed. Access to the latest data would also enable underwriters to improve their risk appetite and pricing.

In my next post, I will examine the small commercial strategy for Pivoting to the New.

Please feel free to contact me with your comments, questions and feedback.