It is said that bringing a supertanker traveling at normal speed to a full stop takes at least 20 minutes––and to turn it around and bring it back up to speed, triple that. When we talk about enterprise agility, a lot of the time we are talking about large organizations: the supertankers of the business world. But the speed of change around large organizations is always increasing, with new technology, new workforce expectations and new opportunities. So how does a large, international organization respond effectively to this evolving environment?

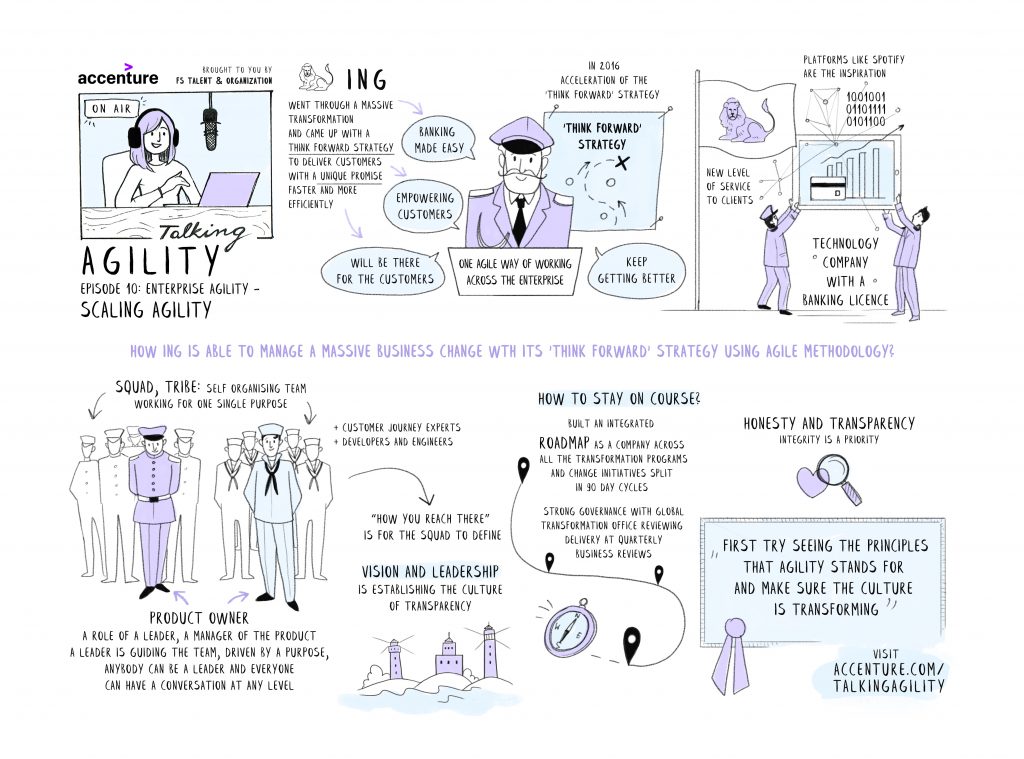

In episode 10 of Talking Agility, I was joined by Subhash Chandra Jose, Head of Change Management for ING Group, to discuss just that. In the past several years, ING has proven to be a leader in the area of agility, moving toward a model that is more reflective of a digital-first company, like Spotify, than that of a traditional bank. It hasn’t always been that way, however.

“In 2014 Ralph Hamers took over as CEO of ING, and he put forward what we call a think-forward strategy,” Subhash explained. “The think-forward strategy means that we wanted to deliver to our customers with a unique promise.”

That promise? To consistently provide banking that is clear and easy, that empowers customers, and is available anytime and anywhere.

Promises like this are great, but transforming a largely decentralized organization that spans the globe, with several different offerings and focuses, is no easy task––yet ING is achieving this. I wanted to know how––what tools and approaches did ING use on its journey toward agility?

“Our agile model is inspired by the Spotify model,” says Subhash. “The basic element of our agile structure is a squad.”

ING’s squads are self-steering, autonomous teams of up to nine people, each responsible end-to-end for its own specific customer-related mission. Each squad is built around different disciplines and different areas of expertise, with different backgrounds.

Subhash explained that with several independent squads working on a single area, such as consumer lending, they are able to respond independently, but collectively as part of a tribe––and those tribes are able to tackle challenges and respond to transformation in a much more fluid way than traditional hierarchical approaches.

An analogy he uses to describe the squads is that of Navy SEALS, who, despite being part of the Navy, are a small team of highly specialized individuals able to fight in the sea, in the air and on the land.

These agile change management squads are all made up of ING employees, “but they are working as special forces units where they can talk business, they can work on technology, they can work on operations and they can deploy these changes.”

A great way to visualize how ING uses its squad approach is captured in this video:

I think you’ll find it interesting and educational, as it brings together a complex approach and makes it easy to understand––which is a nice example of true agility.

Talking with Subhash about ING’s approach and the transformation it has taken under the leadership of CEO Ralph Hamers, and others like Subhash himself, was fascinating. As he explained, in Hamers’ view, “ING is a technology company with a license to do banking”. That is a significant perspective shift from how ING was described only a few short years ago.

As a reminder you can subscribe here, or on iTunes, Soundcloud or Spotify to revisit our previous episodes and be updated when there is a new one live. You can find me on Twitter, LinkedIn, or through the website. I’d love to hear from you—please get in touch!

In the mean time, you can register to read our full report “Enterprise Agility in Financial Services” here.