Other parts of this series:

In this blog series Accenture’s Max Richter examines how collaboration and innovation will play a critical role in tackling an ever-changing cyber risk landscape; and why London combines all the elements needed for a world-class cyber security ecosystem.

Cyber Insurance: Huge growth opportunities for forward-thinking insurers

Cyber risks pose some of the biggest threats facing companies today. The frequency, severity and sophistication of cyber attacks continue their rapid upward trajectory. At the same time, recent privacy-related regulations such as GDPR increase the stakes for companies failing to adequately protect themselves and their customer data.

Advances in technology will only serve to fuel new cyber exposures in future. Blockchain, AI, and autonomous vehicles all present significant new opportunities for cyber criminals.

Yet despite rising exposure, cyber risks remain profoundly uninsured; globally, premiums are calculated to account for less than 1% of the estimated $600 billion annual cost of cyber-crime.

As awareness and demand continue to rise, it’s clear that cyber insurance represents an enormous potential market, with huge growth opportunities for forward-thinking insurers.

Moving from risk indemnification to holistic protection

For large corporates and SMEs alike, protecting themselves against an ever-changing risk landscape requires robust and continually evolving cyber resilience strategies.

In our view, insurers now have an opportunity to develop new and unique propositions that take a holistic view of their customers’ cyber protection needs. By expanding services and mindsets beyond risk indemnification, insurers can increase the value of their cyber protection offerings; reducing the threat of cyber attacks and increasing the speed of recovery.

In doing so, they also have a critical opportunity to differentiate, gain competitive advantage and grow their business, while at the same time increasing connection and engagement with their customers.

End-to-end cyber protection

So, what do holistic cyber risk protection services look like? We see four critical elements that are integral to end-to-end cyber protection:

- Complete and transparent cyber risk assessments – with insurers and brokers working together to improve client education on cyber risks. Services may cover areas such as industry-specific risk frameworks, client training and threat intelligence.

- Targeted pre-breach services to reduce risk exposure – including near- or real-time threat monitoring; industry and company-specific risk management; contingency planning; and incident simulation.

- Tailored insurance coverage and other products – including risk-aligned premiums and terms.

- Breach response services and incident management – with flexible and globally accessible incident response teams, designed to speedily restore companies to their pre-incident state.

For more information on what we feel is required, please see our latest report, co-authored with AXA XL and the City of London Corporation, The Global Future of Cyber Insurance— and the London Market’s Pivotal Role.

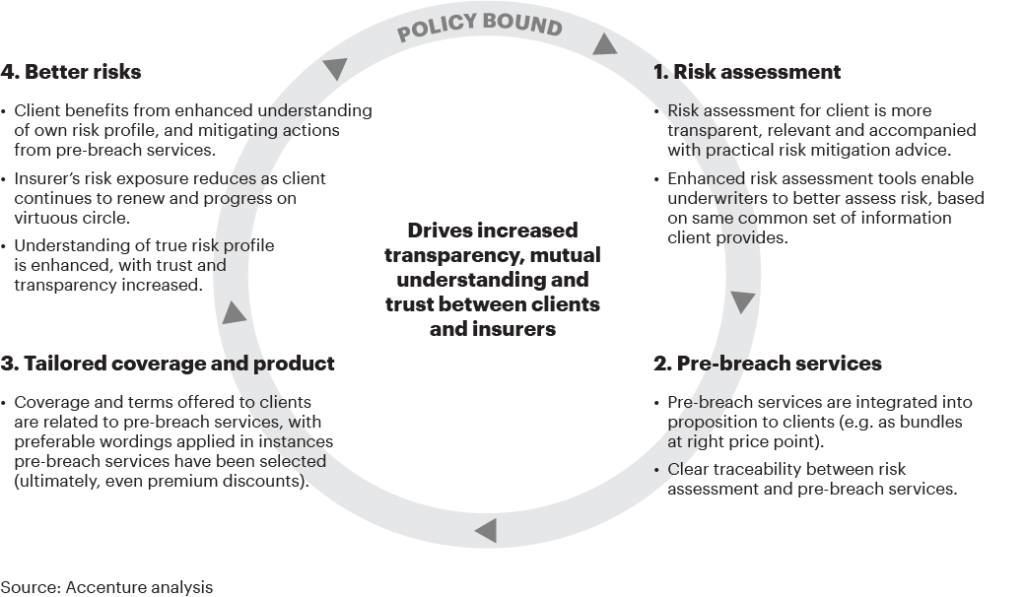

It’s also important to note that more holistic cyber insurance propositions create a virtuous circle for clients and insurers. Reducing the likelihood and severity of a successful cyber attack turns clients into more attractive risks to insure. It also goes a long way to increasing the understanding and trust between clients and insurers.

Cyber security ecosystems will be key to developing market-leading propositions

To provide cyber propositions that incorporate all four of these elements, cross-industry innovation and collaboration will be vital. Insurers need to leverage a wider cyber security ecosystem, with partners across the value chain. These may include brokers, legal firms, cyber security vendors, threat intelligence specialists, IT forensics firms, and PR firms, for example.

In developing such services and acting as the end-to-end glue binding these components and partners together, insurers can gain cutting edge market leadership in one of the biggest growth opportunities currently on offer in the global insurance market. At the same time, by being part of the first response team, they have the opportunity to truly deliver for their clients in their moment of peril.

To stay ahead in this fast-moving risk landscape, the time to act is now.

In my next blog I will outline why the London Market has such a pivotal role to play in the future of cyber insurance.