Other parts of this series:

Breaking down insights from Accenture Technology Vision for 2019. Insurance leaders are aware of and ready for the post-digital future.

In a sustained period of industry disruption, Accenture’s recent release of Technology Vision for Insurance 2019 gives timely global insight into the post-digital future—a time when digital is less novel and innovative, and more accepted as the conventional way of running a business. Insurance leaders comprised 577 of the 6,672 survey respondents, and results show that they have a keen understanding of how emerging technologies combined with current digital capabilities can enhance the consumer experience—and create a competitive market advantage.

Our previous post took a look at key statistics from our recent survey, and today’s blog will explore further important insurance industry and global insights through charts created from the findings of the Technology Vision.

SMAC has moved to the technology core of businesses.

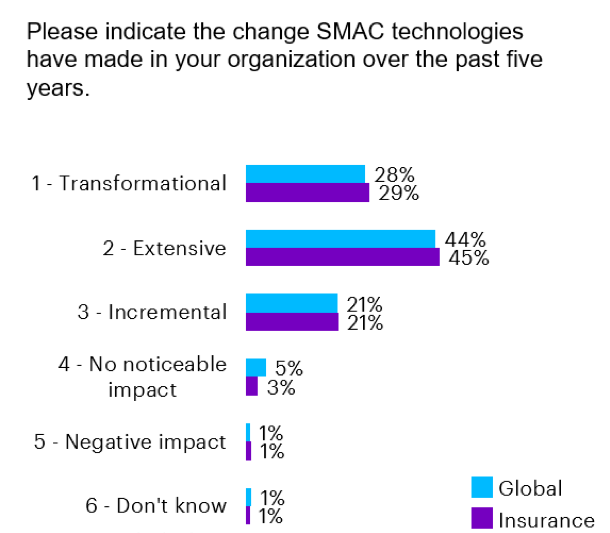

When asked to indicate the change social, mobile, analytics and cloud (SMAC) technologies have made in their organizations in the past five years, 74% of insurance leaders indicated that the impact has been significant. And as previously highlighted, 82% agreed that these technologies have moved beyond adoption silos to become part of the core technology foundation for their organizations. With these digital tools having moved from being trends to being part of most companies’ and consumers’ everyday lives, we are officially in the post-digital era.

42% of insurers view AI as having the greatest future impact for their organizations.

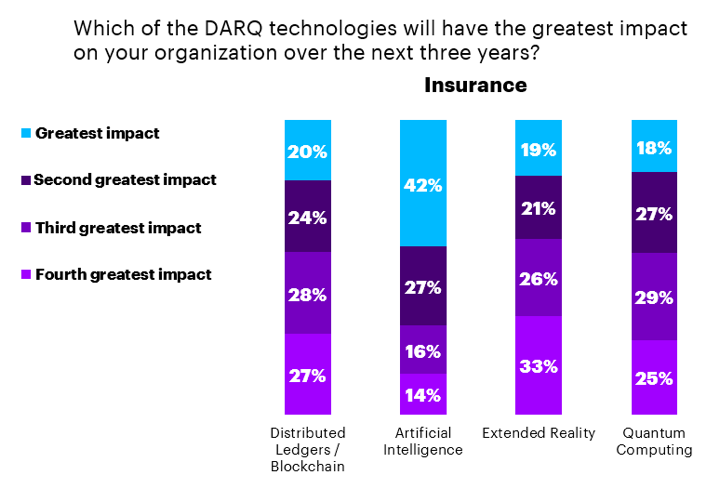

Amongst the emerging technology trends, distributed ledger technology / blockchain, artificial intelligence (AI), extended reality (XR) and quantum computing—known together as DARQ technologies—are at the forefront. And when surveyed, 42% of executives ranked AI number one as likely to have the greatest future impact on their organization over the next three years.

Though AI is in the lead for enabling future transformation, the saying “teamwork makes the dream work” is very applicable to DARQ—exploring this quartet of technologies as a team will be crucial for insurers to gain the competitive edge.

Digital demographic information is expanding the number of ways for services and products to be delivered to consumers.

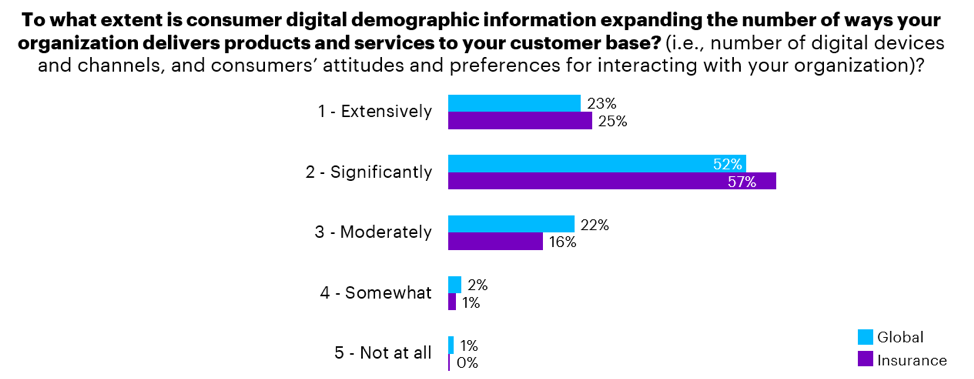

82% of executives report that digital demographics are allowing for a major expansion of how products and services are delivered. Digital demographics include data relating to:

- Digital devices

- Channels

- Consumers’ attitudes and preferences for interaction

These demographics are a new source of data that aid in better understanding the wants and needs of current and potential customers; and with the mindset and implementation of the Get to Know Me trend, 8 out of 10 executives see the amount of data their company will have to manage increasing considerably in the next two years.

Almost half of all executives believe their HR organization will routinely use AI HR functions within the next two years.

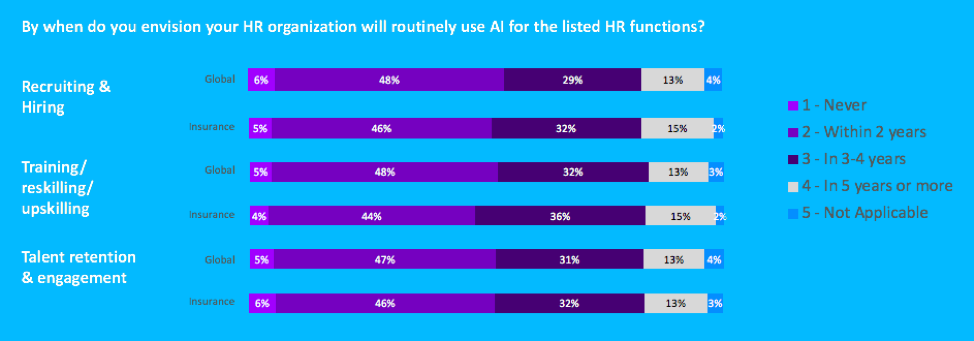

Workforces are becoming Human+, with each individual worker being empowered as their skillsets and knowledge are augmented by a new, constantly growing set of capabilities made possible through technology. As indicated earlier in this post, almost half of executives believe AI will create the most future impact. In tandem, 45% envision that—within two years—AI will routinely be used for HR functions such as:

- Recruiting and hiring

- Training / reskilling / upskilling

- Talent retention and engagement

Adopting AI as a technology strategy within HR has the potential to enable a new way of working within the post-digital age.

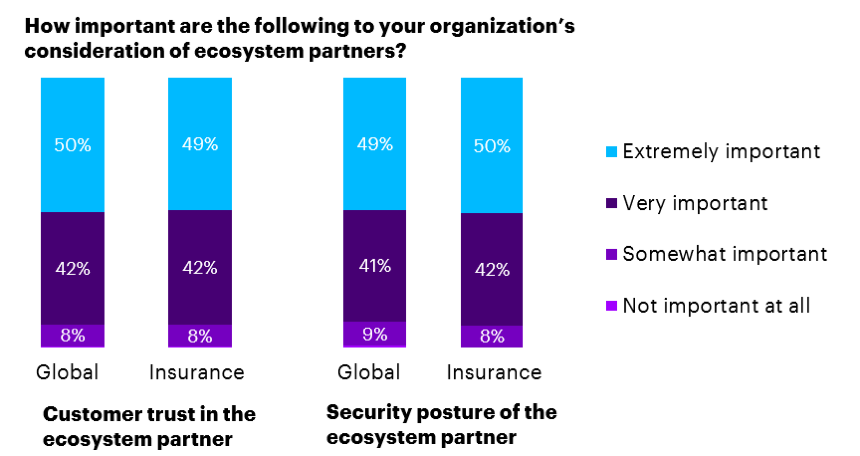

Security is the main point of concern when choosing an ecosystem partner.

Though the interconnectedness of an ecosystem-driven business may increase exposure to risk, 88% of insurance executives agree that to be truly resilient, organizations must rethink their approach to security in a way that defends not just themselves, but their ecosystems—Accenture coins this view on security as Secure Us to Secure Me.

With this, 91% of insurance executives rank customer trust in an ecosystem partner as a key component of choosing a partner, and over 90% feel the same about the security posture of the potential partner.

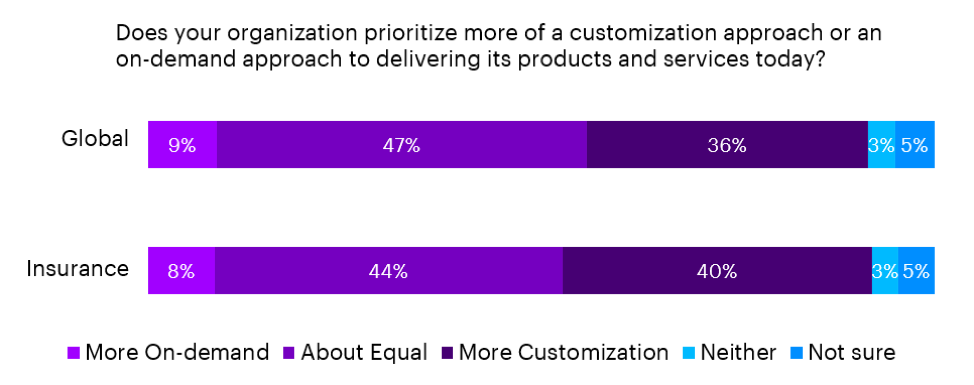

Five times as many companies prioritize a customization approach over on-demand.

Though 44% of insurers are using equal approaches of customization and on-demand to deliver their products and services, another 40% lean towards customization over on-demand. Regardless of approach, eight out of ten businesses believe 5G will revolutionize their industry by offering innovative ways to provide products and services (e.g. drone delivery, driverless vehicles, faster video transmission) through intensely customized and on-demand experiences—a MyMarket method.

The full Technology Vision for Insurance is available for download here.