Other parts of this series:

The post-digital era is upon us and leading insurers are getting ready to experiment with—if they aren’t already piloting—emerging technologies to gain the competitive edge.

Based on a global survey of over 6,600 business and IT executives, Accenture earlier released Technology Vision 2019. With insurers comprising almost 10% of those surveyed, it was confirmed that the industry knows it needs to keep up in order to stay relevant in the post-digital era.

Digital hasn’t disappeared; it’s the new baseline.

What we call the ‘post–digital’ era is not a time when digital has run its course—on the contrary, most of the digital journey still lies ahead. Instead, it signifies that most companies are moving beyond the foundational adoption of digital tools and concepts. Just as people no longer say they live in the ‘age of electricity,’ digital is now a given and no longer carries the meaning and sparkle of being new and innovative.

The digital permeation of the world we live in has granted companies exceptional capabilities to peel back at least 1-2 more layers of the consumer onion. Having more channels than ever to reach customers, and the ability to capture a wealth of data about them, insurers can understand them with new depth of clarity. And with many carriers already running along the digital path, there are more digital ecosystems and potential partners to help create more holistic customer experiences.

This blog will highlight the top five emerging technology trends through noteworthy statistics from Accenture’s survey, and provide insight into the digital path forward.

96% of insurance executives report that the pace of innovation in their organizations has accelerated over the past three years due to emerging technologies.

Regardless of an organization’s view on technology, there is no way to ignore that it has become part of the fabric of consumer and overall reality. Whereas Social, Mobile, Analytics and Cloud (or SMAC) would previously have been adopted within organizational silos, 82% of insurance executives agree that SMAC has leapfrogged to become part of their core technologies—particularly when used together.

With SMAC technology firmly integrated and providing incredible consumer insight for the majority of companies, attention has turned to new digital ecosystems and potential partners that can create rounded and holistic customer experiences.

The top five emerging technologies on the radar of insurers are:

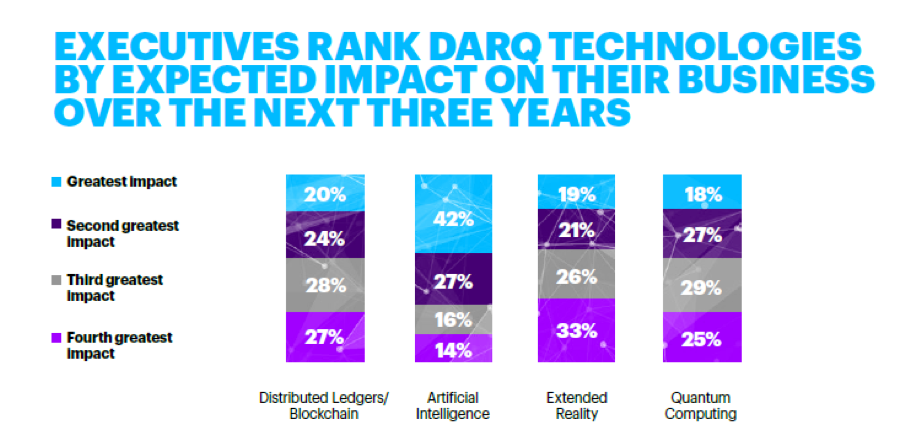

Most insurance leaders believe DARQ technologies will have a significant impact.

When considered catalysts for change, new technologies offer exceptional new business capabilities. SMAC is an example of this, having rapidly brought businesses into the post-digital world. Next in line to ignite a change in rhythm are distributed ledger technology, artificial intelligence (AI), extended reality (XR) and quantum computing—a.k.a. DARQ technologies—with 93% of industry leaders already experimenting with at least one of them.

As with SMAC, the view on DARQ tools is that they will be greater together than when used separately. Seven out of ten insurance executives anticipate that the DARQ combination will transform their organizations over the course of the next three years.

Technology Vision for Insurance 2021: We outline five emerging technology trends that will impact the insurance industry in 2021 and beyond.

LEARN MORE84% of executives believe that digital demographics provide a new way to identify market opportunities in the form of unmet customer needs.

Technology-driven interactions are creating a growing technology identity for every consumer, and insurance executives recognize that a Get to Know Me mindset (and customer permission) is the way forward. With digital demographics providing a living base and understanding of customers’ digital activities and technology identities, companies can have insight into the next generation of customers and how to best deliver expanded post-digital services.

76% of insurance executives agree their employees are more digitally mature than their organization, resulting in a workforce “waiting” for the organization to catch up.

Over three quarters of insurance leaders have acknowledged that their employees and consumers are proving to be more digitally mature than their respective employers and providers. As companies adapt to the post-digital way of the world, they are realizing that they cannot provide customized services without innovating and reimagining the workplace for a Human+ worker.

New capability sets enabled by technology will complement the skills and knowledge of insurance professionals, resulting in an augmented workforce that can perform at a significantly higher level.

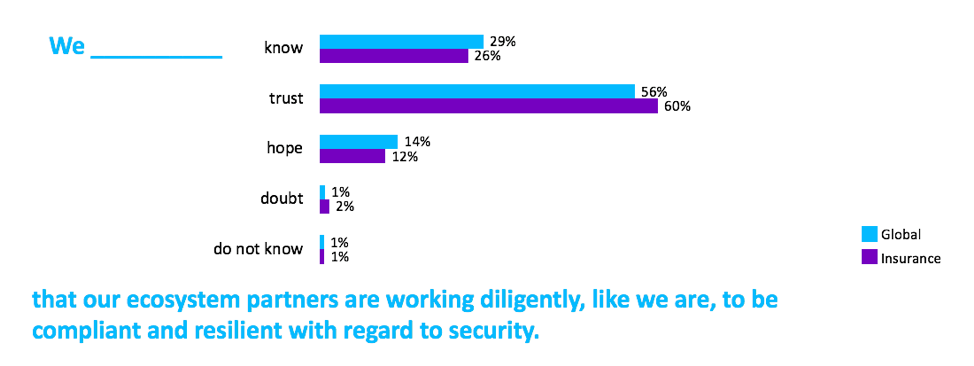

Only 26% of insurers say they know their ecosystem partners are diligent about security compliance and resilience.

When considering their own organization’s security, 85% of insurers believe prospective ecosystem partners perceive them as very good to excellent; but only a quarter feel certain their partners are just as compliant and resilient as they are. Leading providers recognize that trusted partners are needed—a Secure Us to Secure Me mindset—so that the ecosystem is secure for both companies and consumers.

The interconnectedness of an ecosystem-driven business may be key, but the necessary connections increase exposure to risks. While it is all well and good that companies are adapting to the post-digital landscape with new technologies and an ecosystem mindset, security needs to be top of mind in order to best deliver leading products, services, and experiences.

90% of insurance executives agree that the integration of customization and real-time delivery is the next big wave of competitive advantage.

With the potential to gain a better understanding than ever of their current and future markets, and to deliver for those markets more rapidly and with greater personalization than ever before, nine out of ten insurance executives believe that a tailored, MyMarkets approach will give companies the edge over their competitors. The ability to meet consumers’ needs at the ‘speed of now’—treating each opportunity as an individual, momentary market—will be the way to stay ahead at a time when almost everything is attainable via a tap on a 4”x 8” smartphone.

While insurance providers are often seen as more traditional in their approach, this year’s Technology Vision shows that leading businesses are aware of and moving proactively towards emerging technology trends. Our next post will provide further key insights into the insurance industry’s post-digital future through select data and charts.

The full Technology Vision for Insurance is available for download here.