Other parts of this series:

Three models have emerged to leverage blockchain. Which one(s) will work for your organization?

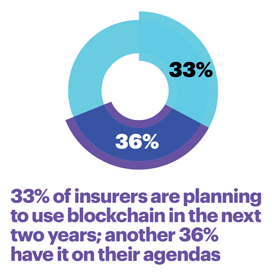

We’ve written about the valuable trend for insurers to create new alliances and ecosystems to compete in a fast-changing insurance space. New alliances also create advantages as insurers explore blockchain technology. Though blockchain in still its early days for this sector, Gartner forecasts a radical second wave of disruption as the business value-add of blockchain ramps up to over $3.1 trillion by 2030. To remain relevant, insurers will need the ability to adopt blockchain rapidly.

And they likely will use the technology in many different ways.

While various use cases for blockchain in insurance have been proposed, no clear lines have been established yet as to what is viable, valuable, and standard among carriers, partners and regulators. As I write this, three models for leveraging distributed-ledger technology are emerging — each with its own merits, potential and level of risk:

1. Intracarrier. This is a tightly controlled blockchain deployment internal to an organization, typically to streamline back-office processing. While it provides control within the enterprise, it misses a main benefit of distributed-ledger technology: the facilitation of transactions between trustless or semitrusted counterparties without an intermediary. Alternative technologies may yield the same benefits.

2. Intercarrier. Carrier-to-carrier transactions can benefit from the speed, traceability, and consensus mechanism that distributed ledgers provide. Reinsurance, for example, is one area ripe for disruption, and the B3i consortium of insurers is developing a prototype smart contract management system to facilitate reinsurance transactions. Investment banks are experimenting with more efficient payments in trade settlements, and insurance companies could reap similar benefits in intercarrier payments.

3. Ecosystems. The ecosystem model would involve a wide range of parties — carriers, brokers, consumers, services providers, and more — on a blockchain to solve a common problem. Some examples: Tokio Marine recently tested a blockchain-based insurance policy for marine cargo insurance certificates, cutting by 85 percent the time it takes a shipper to receive an insurance certificate. Travel insurer InsurETH won a London hackathon with a service that uses publicly available flight data to automatically recognize and pay claims on travel insurance policies using smart contracts. As industries beyond core insurance move to distributed ledgers, carriers will have increased opportunities to engage with partners and vendors in novel ways.

For targeted blockchain engagement, a number of elements must be taken into consideration. These include the growing scale and complexity of blockchain solutions, regulatory requirements, risk and measuring the return on blockchain investments.

Next week, I will take a closer look at these elements and discuss how carriers can prepare for rapid blockchain adoption.

Don’t miss the first blog is this series, Insurers are unblocking blockchain, preparing for the future

And for more on this topic, read Unblocking blockchain: Unlocking the value of distributed ledger technology for insurers.

Unblocking Blockchain: Unlocking the value of distributed ledger technology for insurers.