Other parts of this series:

Opinions about the success of remote work vary across the C-suite. While CIOs have a generally positive outlook, COOs and CHROs are more skeptical.

With the arrival of COVID-19 in North America and social distancing actions to slow the spread of the pandemic, many in the insurance workforce stopped working from the office. In fact, 100 percent of the C-suite executives we surveyed across the insurance industry have implemented remote work from home in some form.

Increases in productivity and efficiency

This sudden shift to remote work has stress-tested business continuity planning. Generally, insurers have hailed it as a resounding success, with most feeling good about how quickly they were able to adapt.

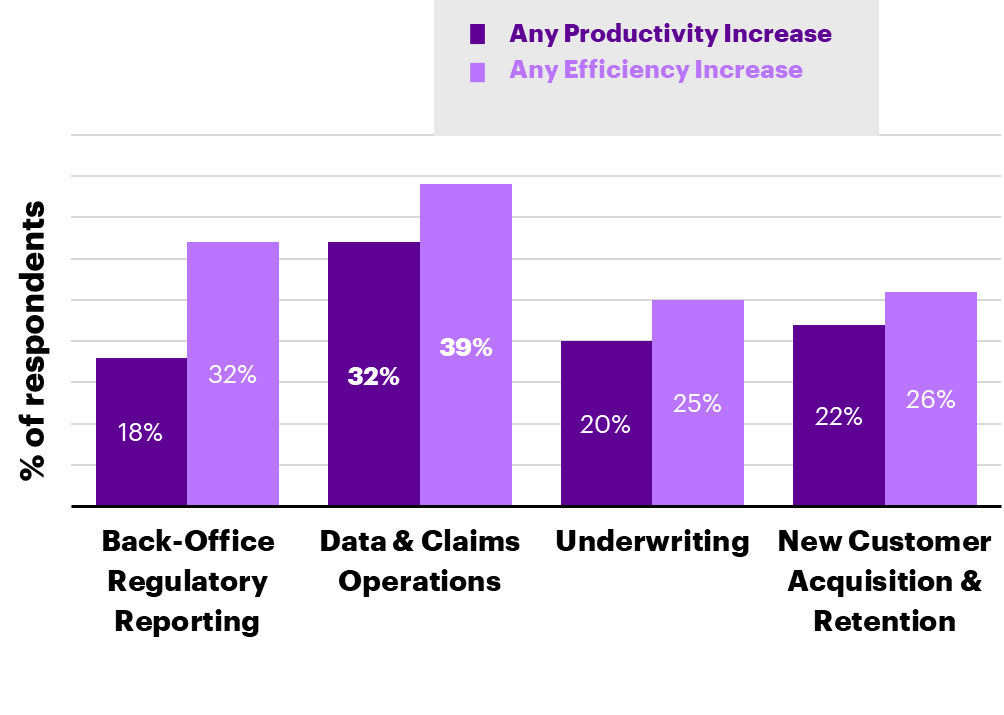

Many are saying that remote work even appears to correlate with better productivity and efficiency. More than 50 percent of chief information officers (CIOs) reported gains in productivity and/or efficiency while about 25 percent of chief operations officers (COOs) reported increases in metrics with the shift to remote work.

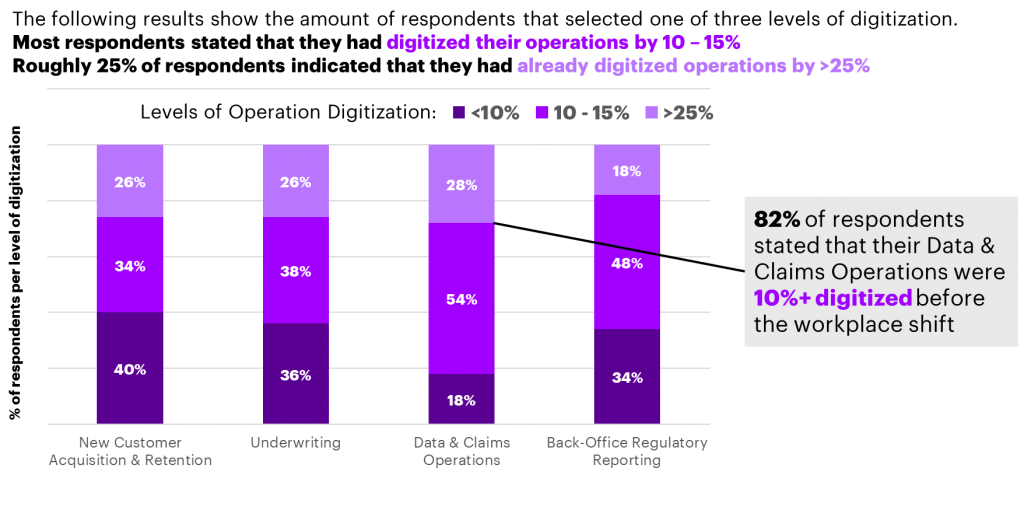

Areas of the insurance operation that were already digitized pre-pandemic experienced the largest gains in productivity and/or efficiency.

Areas of the insurance operation that were already digitized pre-pandemic experienced the largest gains in productivity and/or efficiency.

Differences of opinion across the C-suite

Despite this cheering news, our research found that opinion varied widely across the C-suite over whether organizations and employees were prepared for remote work. Although 82 percent of CIOs thought their firm was prepared when the crisis began and 74 percent of COOs agreed their employees had the necessary tools and technology to work remotely, only 64 percent of chief human resources officers (CHROs) believed their firm was prepared to deploy a remote workforce.

CHROs also revealed other concerns. More than half (55 percent) said that employees were reporting increases in anxiety and depression and 73 percent said their employees are feeling a greater degree of pressure due to the pandemic.

Is remote work sustainable for the insurance workforce in the “never normal” long term?

At our roundtable with insurers this week, participants agreed that they are able to work remotely now, but they questioned whether they are positioned to work well remotely. Further, although productivity and/or efficiency seem to be increasing in the new environment, emerging human capital trends indicate these gains may be coming at a cost.

If you asked us today if remote work is sustainable, we would have to say, “No.” Now is not the time to be complacent. Insurers wanting to boost workforce morale and build a competitive advantage to ensure future success have work to do.

In the following posts, we’ll take a closer look at why CHROs are right to be concerned, how insurers that have already embraced the cloud are coming out ahead and how taking advantage of the cloud to enhance your data and analytics capabilities could be a winning strategy.