Other parts of this series:

Five investment ideas to fuel next year’s results

Today we continue our series on investment ideas for insurance carriers in 2021 with a look at Employee Benefit or Group Benefit carriers. These are the carriers that provide disability, life, and other coverages to employees and their families through their employers.

In 2021, Employee Benefit carriers will be under a premium crunch. The high number of layoffs, furloughs, and bankruptcies caused by the pandemic’s economic impact will reduce the available premium. Carriers with large small commercial or retail and service industry books of business may be particularly hard hit. We also expect increased charged premiums for health insurance, which will put pressure on an employer’s ability to buy these additional coverages.

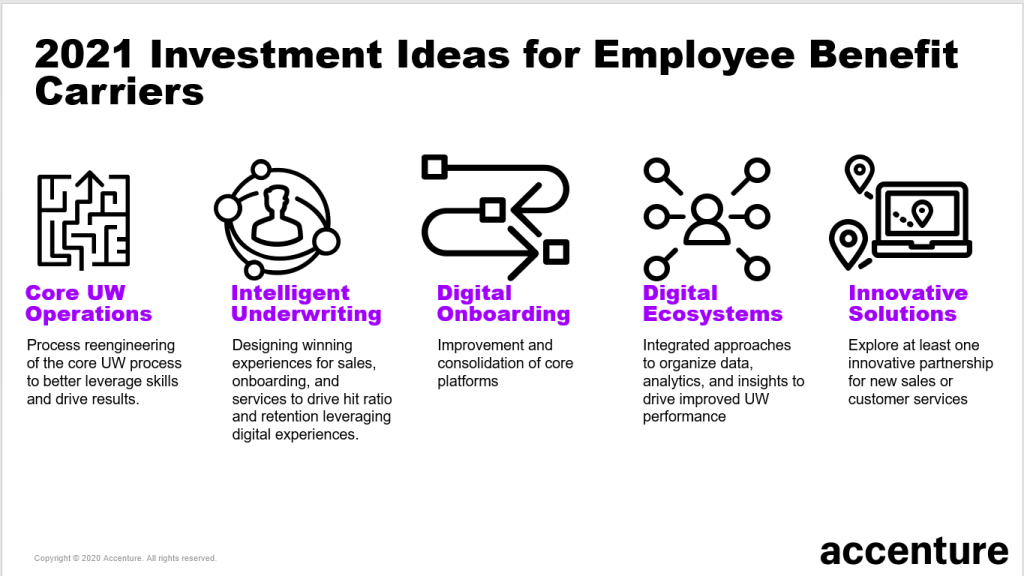

In that environment, the focus for 2021 investments should be on cost-cutting measures that can maintain or ideally improve service capabilities. We see four core areas to consider in this area:

Improve core underwriting operations by reengineering the new business, renewal, and case servicing paths to make sure that the right skilled resource is doing the right task. Benefit carriers, in general, have been less active on this front than some other parts of the industry, so there should be ample room for improvement. A data-driven approach to reengineering often frees up as much as 60% of underwriter time from administrative tasks that could be automated or transitioned to less costly resources and models.

Invest in intelligent underwriting. Intelligent underwriting investments build on process reengineering the underwriting function for improved efficiency. The key to it is to integrate intelligent robotics, machine learning, and data visualization tools into the underwriting process to further improve the efficiency and consistency of underwriting decisions. Advanced robotics can also help with tasks like data collection, census preparation, and preparing comparative analytics to help the underwriter. Intelligent underwriting can also completely automate some simpler coverage types.

Digital onboarding: One of the more difficult parts of the customer journey for group insurance is post-sale. Once the sale is won, the employer needs to be brought onboard and employees need to select optional benefits during enrollment. Developing collaborative digital experiences in which broker, customer, and carrier can gather and validate key data and steps can eliminate rework, errors, and delays that add cost and effort.

Build digital ecosystems to efficiently capture employer data. Consistently getting accurate data from the employer is a critical element of any benefit carrier’s business. With self-administered bills, it can also be a source of significant recurring cost. Carriers often build custom data collection platforms for clients, though this is cost-prohibitive for all but the largest employers. Fortunately, there are now better choices for carriers. Building data collection ecosystems with intermediate providers such as payroll accounting, or benefit administrators who have the employer’s employee information can reduce costs and improve service.

Team up with super bundle providers. This last idea is not a cost-cutting measure. In many industries, we’re seeing the rise of super services or super bundles, which offer everything the customer needs in one easy purchase. The simplest example is some of the emerging high-end car offerings where your car lease, car insurance, and car servicing are rolled together into a single monthly fee. The goal here is to provide complete solutions for customer needs. We see this trend emerging with players like Intuit, Google and Workday offering bundles to small- and medium-sized enterprises super bundles. There is the opportunity in this space to become the employee benefits carrier of their solutions if you can nimbly adapt to their needs.

Cost cutting will be a focus for every benefits carrier in 2021—but opportunities for growth will still come up. Striking the right investment balance between efficiency and expansion will help benefits carriers weather some tough times while building to competitive advantage for the future.

The final post in this series will present some investment ideas for reinsurers.